CATEGORY

Glycerin

Glycerine is the by-product of biodiesel production and are used majorly in FMCG sector. They are used as sweetners, humectants in food and as a bonding agent in making cigarettes and are also widely used in comestics and personal care products.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Glycerin.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoGlycerin Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoGlycerin Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Glycerin category is 1.00%

Payment Terms

(in days)

The industry average payment terms in Glycerin category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Glycerin market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGlycerin market frequently asked questions

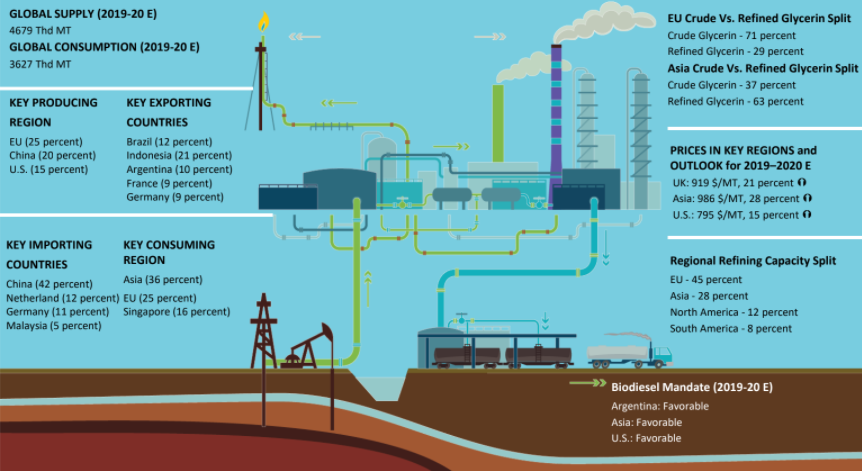

The largest industrial source for glycerin is biodiesel, which contributes to more than 60 percent share of the total glycerin supply in the world. The next largest source is fatty acids accounting for a 24 percent share of the global supply.

Due to the higher biodiesel blending mandates in Europe and blenders' tax credit in the US, these regions have gained the top position among the global biodiesel producers. Europe and the U.S. together account for more than 50 percent of the global share of biodiesel production.

According to Beroe's market research data, the global glycerin market is expected to reach $3.12 billion by 2021. Presently, the market is tight with uncertain trends and policy changes regarding anti-dumping duties for the biodiesel market in the US and the EU.

IOI, KL, Kepong, Oleon, Wilmar, ADM, P&G, and Emery are the key players in the global glycerin suppliers market. From the 2014 market reports from Beroe, the top five to six players accounted for over 65 percent of the total demand for glycerin.

In the U.K., the glycerin price stood at $613/ MT, '72.3/ Kg in Asia, and $609/MT in the U.S. during the period 2016/17.

The key glycerine supplier countries include the E.U. accounting for about 25 percent of the market, China at 20 percent, and the US at 15 percent.

The key exporting countries include Brazil, accounting for 12 percent of the total glycerin exports, Indonesia at 21 percent, Argentina at 10 percent, France and Germany at 9 percent each.

China is the largest importer of glycerin accounting for 42 percent of the total market followed by the Netherlands (12%), Germany (11%), and Malaysia (5%).

The growing crude glycerin usage in the disposal applications and the growth in demand from the personal care industry have led to the high consumption of glycerin in the E.U. and the U.S.

Due to the increasing consumer preference for shower gels in developed countries and the predominant usage of fatty acids in the production of soaps, the global production and price of glycerin reduced.

Glycerin is widely used in pharmaceuticals and personal care, which accounts for about 35 percent of the total global application. Other areas in which glycerin is used are epichlorohydrin (13 percent), food and beverage (12 percent), tobacco and humectants (12 percent), and alkyd resin (11 percent).

Glycerin market report transcript

Glycerin is one of the oleochemicals also known as glycerol. It is extensively used in the pharmaceutical and chemical industries. The glycerin market is categorized based on different segments. These include the grade of glycerin, which could be crude or refined. Based on the source, it is classified as biodiesel, soybean oil, rapeseed oil, and fatty alcohols.

It is also classified based on its application. The glycerol market is growing thanks to its multiple applications, like in pharmaceuticals, food and beverages, cosmetics and personal care, resins, industrial Chemicals, tobacco humectants, automotive, and others.

When we compare crude and refined glycerol, we find that refined glycerol has a share of nearly 65%. Its application in cosmetics, pharmaceuticals, and food sectors makes it the preferred choice. Crude glycerol is used in applications like the preparation of animal feed, where it is being used as a replacement for corn.

When we look at the applications for which glycerin is used, we find that the maximum usage is from the cosmetics and personal care sector. It accounts for around 36% of the total market share. Glycerin is used in a variety of products like shampoos, moisturizers, hair conditioners, and even toothpaste. It is also used in eye drops.In the food industry, it is used as an additive and is considered safe to use.

Biodiesel is the largest industrial source for glycerin, contributing more than 60 percent share to the global glycerin supply, followed by fatty acids that account for 24 percent share. Higher biodiesel blending mandates in Europe and blenders' tax credit in the U.S have led to their leading positions among the global biodiesel producers. Europe is the largest biodiesel supplier and along with the U.S., it accounts for more than 50 percent of the global share of biodiesel production. With a production capacity of 26 billion liters and production of around 10.8 billion liters, Europe is the largest producer of glycerin as well. However, since 2012, Brazil and Argentina have been increasing their production of biodiesel due to an increase in mandates imposed by the government. With the current market, glycerin is oversupplied globally. And with many fragmented suppliers, buyers have endless options to change suppliers and bargain for the most effective procurement option.

Glycerin Global Market Outlook

-

The global glycerin market is expected to reach $3.21 billion by 2023, with a CAGR of 3.12 percent

-

Currently, it is a tight market, and the trend is uncertain with changes in policies of anti-dumping duties for biodiesel market in the US and the EU. The US domestic production has increased, and the EU imports are witnessed to increase this year

-

The market is highly concentrated, as top 5–6 participants accounted for over 65 percent of the total demand in 2022E. Key market suppliers include IOI, KL Kepong, Oleon, Wilmar, ADM, P&G, and Emery

Glycerin Demand Cycle

Glycerin is derived as a by-product from various production process, such as biodiesel, soap, fatty acid, and alcohol. Hence, glycerin supply is largely determined by the global demand of biodiesel and fatty acids/alcohols

Global Supply–Demand Analysis

-

Biodiesel is the largest industry source for glycerin, with more than 60 percent share to the global glycerin supply, followed by fatty acids (24 percent). Higher biodiesel blending mandates in the EU and blenders’ tax credit in the U.S. have led to their leading positions among the global biodiesel producers

Market Overview (2021–2022 E)

-

In 2022, there is a shortages following the war in Ukraine continues to keep rapeseed based non-GMO glycerin availability low across Europe

-

In the last ten years, production of biodiesel has expanded as a result of regulatory support. Consequently, the production of biodiesel became the main source of the world's glycerin supply. Biodiesel production displayed a tremendous annual growth rate of approx. 28-30 percent during 2012–2022F

-

In 2022, Biodiesel production was reduced by several producers in response to significantly poor margins brought on by the increases in energy and feedstock costs.

Glycerin Global Demand by Application (2021/22 E)

-

Glycerin production is a by-product of saponification process, which has decreased in the recent days. This is because of the increasing consumer preference for shower gels in developed countries and predominant usage of fatty acids to produce soaps in the developing countries

-

Synthetic production of glycerin is negligible, and Dow Chemical is the only manufacturer of synthetic glycerin, shut down its £140 million plants, when the prices dropped to unprofitable levels

Global Glycerin Trade Dynamics

The global trade volume of glycerin has been increased at a CAGR of 6 percent since 2016. In 2022, Biodiesel production was reduced by several producers in response to significantly poor margins brought on by the increases in energy and feedstock costs. Glycerin availability was dented further because of upstream biodiesel supply issues due to Russia-Ukraine war.

-

Higher percentage of biodiesel mandates in Brazil had made it one of leading contributor of glycerin at a global scale

-

Brazil will keep the 10 percent biodiesel blend in diesel mandate through March 31, 2023

-

Indonesia surpassed Brazil in 2016, due to the abundance of palm plantations, which are processed to fatty acids and alcohols, which yield out glycerin as a byproduct. Moreover, impact of weather in Brazil has impacted its soybean production.

-

China imports glycerin from Southeast Asia and Brazil to meet its demand for glycerin

Methodology for writing this Report

Beroe gathers intelligence through primary sources that include industry experts, researchers, and consultants, as well as current suppliers, producers, and distributors. Secondary sources can include business journals, newsletters, magazines, market research data, company sources, and industry associations. Following data collation, analysis, and strategic review, the Final Research Report is published on Beroe LiVE.

Why should you buy this report?

The report provides an extensive analysis of the key price drivers, supply-demand trends, and trade dynamics of global glycerin manufacturers such as Europe, the U.S., and Asia.

The report provides a detailed analysis of Porter's Five Forces for glycerin along with a detailed understanding of the glycerin supplier landscape. It also discusses the supply share of major commercial suppliers of refined glycerin brands including Archer Daniels Midland (ADM), Kuala Lumpur Kepong Berhad (KLK), Musim Mas, Twin Rivers Technologies, IOI Group, and BioMCN.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.