CATEGORY

Gelatin

Gelatine is a translucent, colorless, flavorless food ingredient, derived from collagen taken from animal body parts. It is commonly used as a gelling agent in food, medications, drug and vitamin capsules, photographic films and papers, and cosmetics.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Gelatin.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoGelatin Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoGelatin Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Gelatin category is 20.10%

Payment Terms

(in days)

The industry average payment terms in Gelatin category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Gelatin Market Intelligence

global market outlook

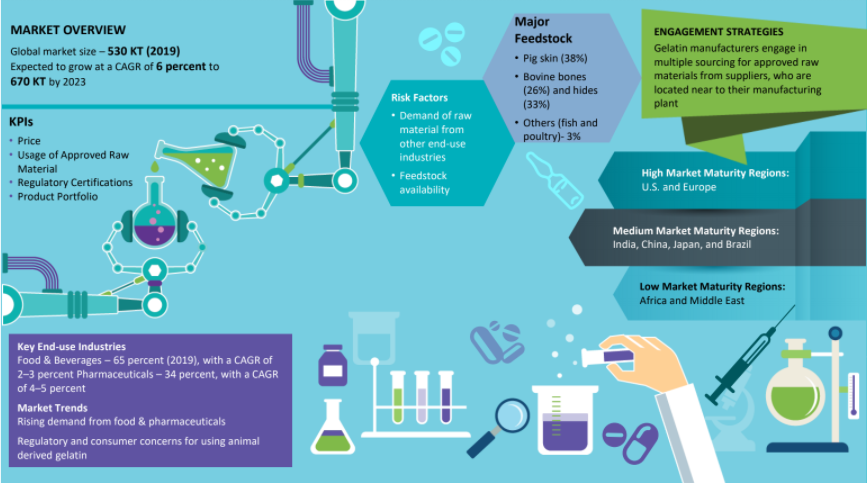

- The global market size is around 595 KT in 2021 and is expected to grow at a CAGR of 6%

- The U.S. is a net importer of gelatin, and it majorly imports from Brazil, Canada, and China. Its major export destinations are Canada and Mexico. Europe majorly exports to the U.S., Japan, and other developing nations.

- Brazil is a major producing nation in LATAM and exports globally. In Europe, Belgium, Netherlands, France and Germany are the major countries of production. In Asia, China is the major exporter, followed by Turkey and India

- Rousselot , Gelita AG, PB Gelatins , Weishardt, Nitta Gelatin, Sterling Biotech and Narmada Gelatines are the key players in the market

- Gelatin prices are volatile, due to fluctuating raw material prices. Since the gelatin market is not the major raw material buyer for bovine hide and bone, variations in allied industries impact the raw material prices

Use the Gelatin market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoGelatin market frequently asked questions

From the global gelatin market forecast report by Beroe, the market size is expected to grow at a CAGR of 2.3 percent to reach 420 KT by 2020.

According to Beroe's gelatin market report, the major demand for gelatin comes from the food industry (64 percent) and the pharmaceutical industry (34 percent). As all the players in the industry operate at 90-95 percent of their installed capacities, supply and demand go hand-in-hand without any gaps.

The gelatin market is impacted by the consolidated nature and complexity involved in sourcing raw materials along with regulatory concerns.

The gelatin industry is a highly consolidated one with the top seven suppliers holding about 65-70 percent of the total gelatin market share. They are Rousselot, Gelita AG, PB Gelatins, Weishardt, Nitta Gelatin, Sterling Biotech, and Narmada Gelatines.

The demand from food, drug development and manufacturing industries, substantial growth in Asia, and the lack of availability of potential substitutes are driving the growth of the gelatin market. On the other hand, the market faces constraints from fluctuations in the supply and demand for raw materials and consumer concerns related to safety and social aspects of animal sources excipient.

The cost of raw materials contributes to about 50-60 percent of the total cost of gelatin production. Therefore, it is an important factor that impacts the overall cost of gelatin. The cost can vary according to the raw material and the region from where it is sourced.

Gelatin market report transcript

Global Gelatin Market Outlook

-

The global market size 586 KT (2022), and it is expected to grow at a steady rate of 7–8 percent, due to increased demand from food and pharmaceutical industries

-

The food industry (66 percent) is the major end-use industry of gelatin, followed by the pharmaceutical industry (34 percent). The increasing demand from these two industries is likely to be met by the decreasing gelatin usage in the photographic industry

-

Supply and demand go hand-in-hand in this industry, with no significant gap, with all suppliers operating at ~90–95 percent of their installed capacities to meet the demand

Market Drivers and Constraints

-

Drivers: Demand from end-use industries, substantial growth in Asia, and lack of availability of potential substitute (plant-derived HPMC)

-

Constraints: Fluctuations in the supply and demand of raw materials and consumer concerns related to safety and social aspects of animal-derived gelatin

Global Gelatin Suppliers

-

The gelatin industry is highly consolidated (the top seven suppliers hold 65–70 percent market share). Hence, buyers do not have much bargaining power

-

However, the global food and pharma industries buy large volume of gelatin, allowing them a slight negotiating bandwidth

Global Demand by Application

-

Pharmaceutical-grade gelatin is expected to show a growth rate of 6–7 percent between 2023 and 2027. The food & beverage industry is expected to lose its share marginally to the pharmaceutical & nutraceutical industries by 2027.

Key Applications and its Downstream Growth Projections

Food & beverage Industry

- Drivers: Increased demand for processed food

- CAGR: 2–3%

Pharmaceutical (mainly Rx, OTC, health & nutrition capsule) Industry

- Drivers: Growth in the global pharmaceutical & nutraceutical markets

- Pharmaceutical gelatin is considered more lucrative, since its price is higher than that of the food grade gelatin (by 5 percent)

- CAGR: 6–7%

Technical/Photography

- Drivers: Demand from fertilizers, detergents, ink-jet paper, etc

- CAGR: 0–1%

Demand from Alternative industries

-

Gelatin demand in the pharmaceutical industry is expected to grow with the highest CAGR. The usage of gelatin in pharmaceutical industry, including capsules manufacturing, nutraceuticals manufacturing, sports nutrition manufacturing, medical and biomedical application, are the major demand drivers

-

Increased demand from pharma, the food industry would only be marginally affected, due to the advantage of high procurement volume

-

However, the pharmaceutical industry would have to shell out more, in case of a sudden surge in demand from the food industry, on account of low volume purchase, compared to the food industry

Gelatin Cost Structure

Cost of raw material contributes to ~50–60 percent of the total cost of gelatin production, thus having a direct impact on the cost of gelatin, however, it varies with the type of raw material and regions.

-

Raw material is the major contributor to the cost of gelatin. It typically accounts for ~45–55 percent of the production cost. In addition to the animal bone or hide, hydrochloric acid and lime are also necessary for manufacturing bovine gelatin

-

The manufacturing process is labor intensive, requiring ~90 man-hours for producing a ton of gelatin

-

The typical profit margin in the gelatin industry is ~10 percent

Gelatin Sourcing Strategy

Raw materials sourcing strategy by gelatin manufacturers

-

The production cycle of bovine bone gelatin is ~3–6 months compared to one month for hide and porcine hide-derived gelatin

-

Hence, during the raw material shortage, the production of hide-derived gelatin can only be affected. Bone-based gelatin production would have an impact only during prolonged shortage of raw material

Gelatin sourcing by pharmaceutical companies

-

The top global pharma companies purchase gelatin in less quantity, which is used for tableting and stabilizing vaccines

-

Leading food/pharma suppliers engage with 2–3 global gelatin majors, while preferring to source locally to cater regional demand

Gelatin sourcing strategy by capsule manufacturers

-

Every top capsule manufacturer partners with all the top bovine gelatin manufacturers, thereby ensuring robust and high quality supply of bovine gelatin

-

The demand of gelatin in the photographic industry is expected to come down, so some volume can be transferred from its photographic usage to manufacture hard capsule in pharmaceuticals. The bovine bone gelatin production is expected to increase by 5–10 percent in the near future, due to its increasing consumption in food & pharmaceutical industries. Hence, the market has adequate capacity of gelatin to meet the demand

-

During cases where there has been a shortage of raw material, gelatin suppliers manufacture customized blends of various gelatin sources (like bovine hides with bones)

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.