CATEGORY

Fraud Prevention Systems

Fraud prevention systems are software or tools used in the financial industry to prevent fraudulent activities.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fraud Prevention Systems.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoFraud Prevention Systems Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Fraud Prevention Systems category is 5.90%

Payment Terms

(in days)

The industry average payment terms in Fraud Prevention Systems category for the current quarter is 68.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Fraud Prevention Systems market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFraud Prevention Systems market frequently asked questions

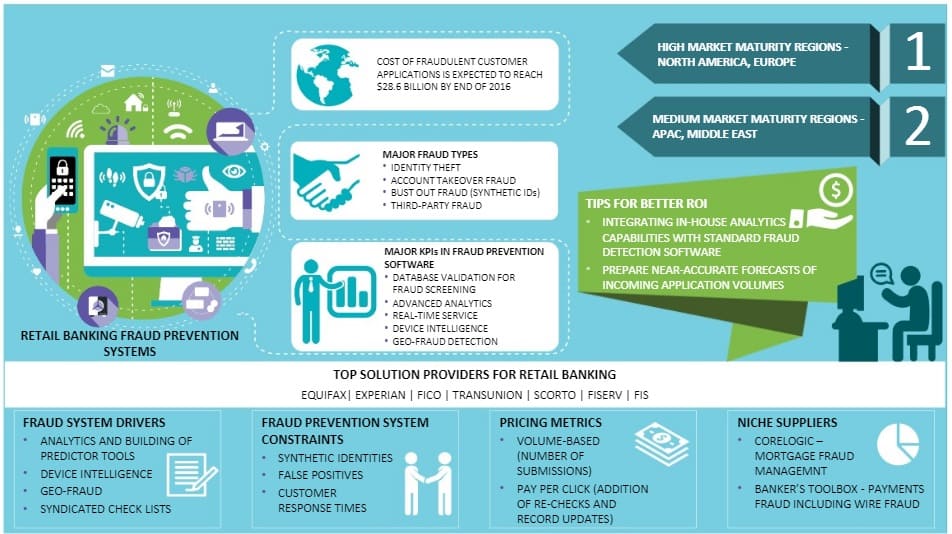

According to Beroe's global fraud detection and prevention market analysis, the cost of fraudulent customer applications was estimated at $28.6 billion by the end of 2016.

The major fraud types can be categorized as identity theft, account takeover fraud, bust out fraud (synthetic IDs), and third-party fraud. What are the major KPIs in fraud prevention software' The major KPIs in fraud prevention software are mentioned as follows. ' Database validation for fraud screening ' Advanced analytics ' Real-time service ' Device Intelligence ' Geo-fraud detection

North America and Europe are the high market maturity regions, while APAC and the Middle East are medium market maturity regions.

The top fraud prevention solution providers for retail banking are Equifax, Experian, FICO, TransUnion, Scorto, Fiserv, and FIS.

Analytics and building of predictor tools, device intelligence, geo-fraud, and syndicated checklists are the key factors driving the global fraud detection and prevention market.

The fraud prevention system market faces constraints from synthetic identities, false positives, and customer response times.

As per Beroe's fraud detection and prevention market analysis, the niche suppliers are CoreLogic ' Mortgage Fraud Management and Banker's Toolbox ' Payments Fraud including Wire Fraud.

Due to the regional and national regulations, only a few players are catering to the retail banking space although many players are offering analytics-based financial fraud detection software. This explains why global market maturity is closely tied to the banking landscape.

Emerging economies lagging in terms of fraud technology adoption have the opportunity to leapfrog into adopting advanced fraud detection software across enterprises.

Here are the key takeaways from the global financial fraud detection and prevention market trends. ' 2017 saw a 70 percent increase in the new-account fraud reaching a total loss of $55.1 billion. ' In 2014, there were about 500,000 fraud victims from social security number breaches. ' Identity Fraud victims reached 16.7 million in the US in 2017. ' Fraudsters netted a total value of $16.8 billion in the US.

Fraud Prevention Systems market report transcript

Fraud Prevention Systems Global market outlook

-

The global fraud detection and prevention market is estimated to be $30.73 billion in 2023 and is forecasted to reach $60.74 billion by 2027. The market is predicted to grow at a CAGR of 14.6 percent.

Demand Market Outlook

-

While there are many players offering analytics based financial fraud detection software, there are only few players catering to the retail banking space. This is a direct consequence of regional/national regulations. Hence, the maturity is closely tied to the banking landscape.

-

While emerging economies still lag behind developed countries in terms of fraud technology adoption, they have the opportunity of leapfrogging into adopting advanced fraud detection software across the enterprise. (Its peers in the developed world face challenges integrating its legacy systems).

Market Analysis

-

The global fraud detection and prevention market is estimated to be USD 30.73 billion in 2022 and is forecasted to reach USD 60.74 billion by 2027. The market is predicted to grow at a CAGR of 14.6 percent.

Key Impact Factors

-

High volume of digital payment transactions globally

-

Increased demand for payment applications

-

Increasing Adoption for IoT

-

Exponential increase in cyber crimes and security threats

-

Loss of data / data theft

MAJOR END-USERS

-

Major end-user for fraud detection and prevention is the BFSI industry. Other industries that contribute to the market include telecommunication, retail, government, manufacturing, media, entertainment.

KEY TRENDS

Major trends which drive the growth:

-

Significant increase in application-based payments and digital payment technologies, has led to high volume of non-cash transactions.

-

Industries have started adopting IoT to reduce costs. IoT devices gather, transmit and store different consumer data which creates multiple privacy risks

-

The current hybrid working industry model, has led to increased investments by enterprises and suppliers to mitigate any potential security threats and frauds.

Retail Banking Fraud: Market Overview

-

Retail banking fraud encompasses application level fraud and transactional level fraud

-

Application fraud comprises fraud committed at the application stage across account opening, and secured and unsecured credit product applications whereas transactional fraud refers to that occurring during transactions such as account takeover and payments

-

While technologies in POS, like EMV (chip, tokenization and encryption), have helped to decrease transactional fraud losses, application fraud is still a major issue in the banking space

Global Fraud Prevention Systems Market - Drivers and Constraints

Drivers

Artificial Intelligence in Fraud Prevention

-

Data science and artificial intelligence assisted fraud prevention solutions are driving higher efficiency and improved security. Adoption of AI-based fraud prevention tools is gaining market maturity.

Need for analytics in building predictor tools

-

With an exponential growth in data from different channels such as mobile, email, ATM, etc., there is a need to develop effective early warning system using analytical predictor solutions that take a holistic approach towards identifying suspicious customer applications beforehand

Device intelligence and geo-fraud

-

With multiple application channels buoyed by increasing preference for digital channels, it is essential for banks to monitor for identity not only at the application level but also throughout the customer lifecycle. Hence, the need for device intelligence systems that track web, e-mail and digital interaction behavior to derive abnormal patterns

Constraints

Volume of data / data sources

-

The exponential increase in digital channels for payments and banking, has led to high vulnerability due to large number of data sources. Managing digital payment channels effectively is key to real-time fraud prevention.

Managing customer response times and false positives

-

Customers’ expectations on turnaround times for credit products are high owing to progress in digital banking and flagging of accounts as suspicious, causes delays for false positives

Regulatory directives

-

New regulatory directives, like PSD2, in Europe, which are concerned with banks opening their APIs to fintech firms like Amazon Pay and Apple Pay, to provide better self-service capabilities, like wallets, bill payments, account management, etc., are expected to drive costs toward establishing better control, while sharing of APIs

Supply Trends and Insights : Fraud Prevention Systems

Global/Regional Supplier

-

Reactive to predictive analytics: Advanced analytics techniques based on machine learning such as neural networks and self organizing maps are being used to identify fraud patterns and vulnerable customer applications. This in turn provide fraud scores for customer applications indicating proximity to a benchmark fraud characteristic

-

Big data: With the explosion in volume, variety and velocity of data, fraud prevention systems are gearing towards capabilities that enable digestion and monitoring of customer information across his/her entire lifecycle. E.g., Looking at buying patterns to discern any unlikely/deviant purchase behavior in comparison with historic purchase behavior. These services are mostly provided as a bespoke managed service post license purchase

-

Device intelligence to digital footprint: Apart from device intelligence services encompassing channels such as mobile, e-mail, IP, etc., there is also a need to look at synthetic identities where there are sudden spikes in credit requests from a seemingly authenticated source

Vertical/Local Supplier

-

Vertical focused solutions: While there are few suppliers focussed on the retail banking vertical due to the need for dynamic regulatory systems, there are information sharing agreements through databases at the national level that contain cross-member (financial institutions and insurance) application data that help in screening for fraud at the application stage E.g., CIFAS, Hunter, SIRA in the UK, IFI in the Netherlands, FPN in Germany

-

These fraud databases are also sometimes combined with data from other industries such as telecom data E.g., Fraud prevention pool in Germany

Engagement Trends

-

Most adopted engagement model globally: Single supplier with a bespoke service

-

Licensing metrics: The most widely used metric is volume of applications/number of submissions into the system. Some suppliers also use ‘pay per click’ where in the initial submission and any updates or re-checks are counted separately

-

Additional services such as integration to external consortium data through adaptors or APIs are charged as a separate fee. E.g., FICO Falcon Fraud Manager integrating with Hunter database

Why You Should Buy This Report

- The report provides insights into the fraud prevention systems market size, fraud prevention trends, and drivers and constraints.

- It offers Porter's five forces analysis of the global fraud prevention system market, region-wise and country-wise.

- It provides insight into supply trends and gives profiles and SWOT analysis of major players like Experian, TransUnion, and Equifax.

- Furthermore, this report on fraud management trends provides the pricing metrics analysis.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.