CATEGORY

Fluff Pulp

Fluff pulp is the primary raw material in the absorbent core of personal hygiene products such as baby and adult diapers and other feminine hygiene products

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fluff Pulp.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Rayonier Advanced Materials increases fluff pulp prices by $50-80/tonne for July

July 14, 2022Rayonier Advanced Materials increases fluff pulp prices by $50-80/tonne for July

July 14, 2022Rayonier Advanced Materials increases fluff pulp prices by $50-80/tonne for July

July 14, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Fluff Pulp

Schedule a DemoFluff Pulp Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoFluff Pulp Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Fluff Pulp category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Fluff Pulp category for the current quarter is 84.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Fluff Pulp market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFluff Pulp market frequently asked questions

As per Beroe's study, the global capacity of the fluff pulp market is 6.8 MMT while the global demand stands at a valuation of 5.8 MMT.

According to the insights, the top three producers of fluff pulp control nearly 80 percent of global production.

The primary factors that majorly contribute to the expansion of fluff pulp market size include: Increasing aging population Female population Considerable growth in the baby diaper market Increased production of air-laid products Expanding patient population of adult incontinence Rising disposable income

According to the fluff pulp market report generated by Beroe, APAC region would continue to be the net importer of fluff pulp from North America. The net demand from the Asia-Pacific will grow at a CAGR of about 5-6 percent. The factors that influence this CAGR growth include: Increasing consumption of personal hygiene products Increasing working women population Low penetration rate of diapers

There are four suppliers that rank at the top positions. The names include: Georgia Pacific International Paper Domtar Stora Enso

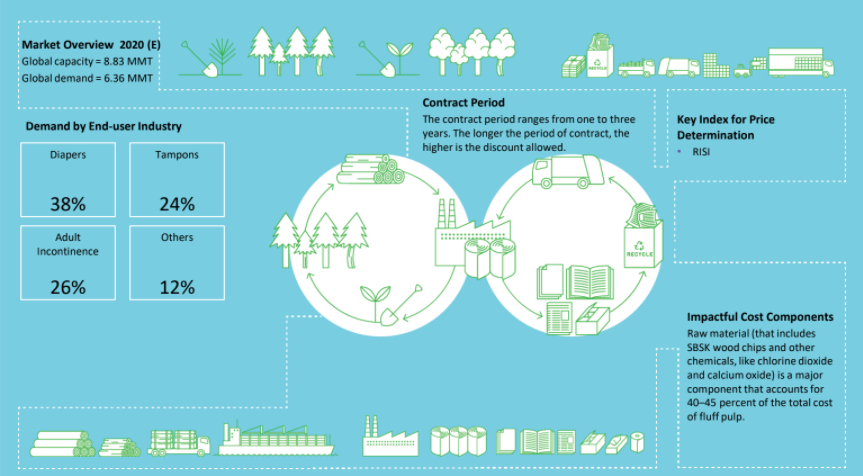

Usually, within the fluff pulp industry, the ideal contract period ranges from one to three years. The longer the period of the contract, the higher is the discount allowed.

According to Beroe's insights, raw materials majorly influences the total cost of fluff pulp nearly by 40 ' 45 percent. The raw material includes SBSK wood chips and other chemicals (like chlorine dioxide and calcium oxide)

According to Beroe's report, diapers hold nearly 38% of the market demand, while tampons, adult continence, and other products hold 24%, 26%, and 12% share of the demand by the end-user industry.

Fluff Pulp market report transcript

Global Fluff Pulp Market Outlook

-

The top three producers of fluff pulp control approx. 80 percent of global production

-

Asia and the Middle Eastern markets are expected to drive demand for fluff pulp in the coming years

-

NA is a well-matured region, showcasing lower growth rates, characterized by no increase in demand and end-uses demand already ripe

Fluff Pulp Regional Market Overview

The availability of fluff pulp has started to increase globally during the past 1–2 months, and is expected to remain high along with dip in demand levels in the coming months.

-

Asia is the largest demand market for fluff pulp and is expected to remain the largest buyer. It is a net importer of fluff pulp. China is one of the leading countries with the highest demand for fluff pulp in the region. The demand for Asia-Pacific is anticipated to grow at a CAGR of about 3–4 percent until 2027 owing to the increasing consumption of personal hygiene products. The increasing working women population coupled with low penetration rate of diapers will drive the demand of fluff pulp until 2027

-

Since the outbreak of the pandemic, the demand for hygiene products has increased. Also, the demand for sanitary napkins and diapers has increased, which led to more demand for fluff pulp in the global market

-

The demand is expected to be low in most of the months of 2023, since it is expected that buyers will be reducing their order volumes to pressure the suppliers

Fluff Pulp Global Demand by Application

-

Fluff pulp is a niche category with limited end uses. These end uses have high growth prospects, which is making fluff pulp sought after by the US producers

-

Expected increase in the usage of these end-use products, post the outbreak of pandemic, the greater demand for hygiene products will be triggering the demand growth of fluff pulp globally

Downstream Demand Outlook

-

Adult incontinence is the largest end-user segment for fluff pulp and the demand from the segment is expected to grow further in the coming years, due to an increasing need and demand for hygiene products

-

The annual growth rate of fluff pulp usage in feminine hygiene products is expected to grow continuously in the coming years. The demand from Asia is expected to rise more compared to other regions

-

By 2022, these end uses are foreseen to consume only 89.5 percent of the world’s fluff pulp; a small drop in market share, but an indicator of long-term trends that have been in place for several years

Reasons for Grade Shift to Fluff Pulp Production –US

-

Less technical knowledge and process understanding required, as the commodity is a “one size fits all” category

-

As the manufacturers can swing to producing BHK or BSK or fluff pulp as per the market dynamics, enabling the manufacturers to diversify

-

Due to steady growth of 4-5 percent from 2014 through 2019, driven by Asia and Middle East

-

Due to premium pricing compared to other market pulp grades, resulting in higher returns (>15 percent ROI)

Steady Growth

-

Growing demand globally with expected 2-3 percent CAGR from 2020 to 2025

-

U.S. manufacturers capitalizing on the availability of raw material (slash and loblolly pine), with 83 percent of the production concentrated in the U.S.

-

Growing disposable income and ease of use, urging emerging middle class population to switch to disposable products

-

Innovation and increased penetration by disposable product manufacturers’ drives the consumption of their products, and thereby the consumption of fluff pulp

Uncomplicated Production

-

Fluff pulp production does not require technical knowledge and process understanding, unlike cellulose specialty grades

-

It is considered an uncomplicated pulp grade, which can be produced by market pulp manufacturers, with addition of some equipment like drying unit, reel, and winder rebuilds

-

The “one size fits all” attribute, enables manufacturers to swing between market and fluff pulp, helping them to leverage on the supply-demand imbalance

-

Fluff pulp requires an ISO brightness of 84-87, lesser than the paper grade’s ISO brightness of 89-90. This results in a significant reduction of chlorine dioxide required for the bleaching process and hence less chemical cost

Premium Pricing and Swing Capacity

-

Fluff pulp is priced at premium to market pulp, enabling manufacturers to lock in extra profits (>15 percent ROI), than producing market pulp

-

Among 5.5 MMT of U.S. fluff pulp capacity, ~2 MMT are swing capacities

-

With a decline in paper consumption, due to advent of digital technologies, many manufacturers are converting their market pulp lines to swing production, to produce both fluff pulp or market pulp, depending on the market dynamics

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.