CATEGORY

Fleet Management

Fleet category is defined as mobility solution for sales personnel and executives. Organizations across the globe either provide a company car or cash allowance/reimbursement for their employees. There is a shift towards alternate mobility models like ride sharing. Company cars can be acquired in three ways - buying, leasing or renting. After the fleet is acquired, it needs to be managed, which includes various activities starting from vehicle purchase to vehicle disposal.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Fleet Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

DLA Piper poaches a Second Hong Kong Banking Lawyer from Linklaters

December 15, 2022Uptick in Q1 2023 European Car Registrations

April 20, 2023Entry of Chinese EV Manufacturer in Europe

April 19, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Fleet Management

Schedule a DemoFleet Management Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoFleet Management Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Fleet Management category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Fleet Management category for the current quarter is 53.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Fleet Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFleet Management market frequently asked questions

Fleet leasing is most preferred in regions like Europe and North America, while in APAC and LATAM, purchase is the preferred model. Several large companies in these areas are shifting towards the leasing model, but the purchase model remains unaffected.

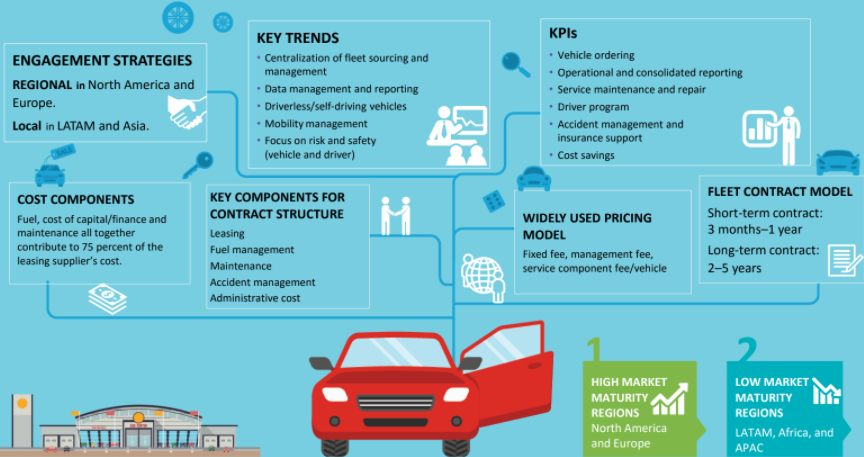

The factors driving the growth of the global fleet management market are as follows. ' Centralization of fleet sourcing and management ' Decrease in the sale of diesel vehicles ' Risk and safety factors ' Driverless/self-driving vehicles ' Increase in mobility budget ' Shift towards alternative fuel vehicles ' Increased focus on mobility management

From Beroe's fleet analysis market reports, the global passenger car sales were expected to grow at 2.5 percent to reach 85 million units from the past sales of 83 million units in 2016.

The major KPIs in the fleet management industry are vehicle ordering, operational and consolidated reporting, service maintenance and repair, driver program, accident management, and insurance support and cost savings.

Leasing, fuel management, maintenance, accident management, and administrative costs are the key components for contract structure in the current fleet management industry trends.

As per the fleet management cost analysis, fuel, cost of capital/finance and maintenance are the key cost components that contribute to 75 percent of the leasing supplier's cost.

North America and Europe have high market maturity regions, while LATAM, Africa, and APAC are the regions with low market maturity.

Global Fleet Services, Volkswagen Financial Services, ALD Automotive, Arval, LeasePlan are the key service providers in the global fleet management market.

The increase in the fleet leasing price is dependent on the MSRP of the vehicle and residual value. After the BREXIT in 2016, the exchange rate of the Pound was expected to remain low in 2017. Consequently, the MSRP was expected to witness a rise along with the lease price.

Due to the fall in the exchange rate of the Pound, the fuel prices went up leading to higher fleet management costs. Companies can use this opportunity to explore techniques for fuel reduction, review fuel reimbursement rates, and adopt high mileage vehicles in the fleet.

Fleet Management market report transcript

Fleet Management Market Analysis and Global Outlook

MARKET OVERVIEW

Global Vehicle Sales: ~80 million units (2022)

Automotive sales is expected to reach ~84 million units in 2023, an increase by 2.5 percent.

-

Global light vehicle sales are expected to grow by 2–3 percent in 2023 to reach ~84 million units. Recovery of passenger car sales in 2023, owing to ease in supply chain. However, the economic recession is expected to restrict forecasted new vehicles in 2023.

KEY TRENDS

-

Centralization of fleet sourcing and management

-

Data management and reporting

-

Driverless/self-driving vehicles

-

Mobility management

-

Focus on risk and safety (vehicle and driver)

Fleet Management Global Market Maturity

-

Fleet leasing is high among the companies in North America and Europe. Though purchase is the preferred model in LATAM and APAC, large companies in these regions are moving towards leasing.

Fleet Management Global Drivers and Constraints

-

Increased interest for automation of fleet management, high maturity of the leasing industry, benefits of outsourcing non-core functions, and road safety are driving the fleet leasing industry. However, alternatives to travel, like video conferencing, and alternate mobility solutions, like ride sharing and car sharing, are some of the constraints.

Drivers

-

Outsourcing benefits cost control: The buyers outsource the car leasing and fleet management services to reduce the administrative overhead and to achieve cost benefits.

-

Global presence and scalability: Buyers with global presence and higher mobility of their employees prefer outsourcing fleet management services to manage the increasing fleet size.

-

Change in consumer behavior: The pandemic has changed the consumer behavior; employees prefer private vehicles for commute to maintain social distancing.

Constraints

-

Video conferencing and webinars: Increased adoption of video conferencing to conduct online meetings and sales presentations has reduced direct interaction and need for travel.

-

Economic constraints: The pandemic has impacted the cash flow of most organizations, resulting in reduced demand for fleet vehicles.

-

Alternate strategies: Mobility solutions, like ride hailing, car sharing, etc., have started gaining prominence. Currently, these are used as secondary transportation model.

Supply Trends and Insights : Fleet Management

Global/regional supplier

Increase in M&As and partnerships

-

Global suppliers are expanding their reach and enhancing their service capabilities through M&A

-

E.g., Daimler Financial Services acquired Athlon Car Lease, Volkswagen Financial Services acquired Fleet Logistics

-

Many suppliers are entering into alliances with other suppliers (e.g., Element and Arval entered into a global alliance; Wheels and ALD entered a partnership)

-

ALD Automotive has acquired LeasePlan for of €4.9billion and the deal is expected to complete by end of 2022 to form a new entity “New ALD”

-

This acquisition makes ALD Automotive to be the largest FLMC with 3.5 million vehicles under management

-

Athene holdings is the lead investor in Wheels Inc, LeasePlan and Donlen merger, a new entity will be formed to manage the combined fleets

Comprehensive fleet management services

-

Most of the leasing suppliers are providing comprehensive solutions for their buyers.

-

Many suppliers are entering into alliances with fuel card companies, telematics providers, etc., to provide comprehensive solutions

Alternatives to company cars

-

Suppliers are adding mobility solutions (e.g., car sharing, long-term and short-term rental, e-mobility solutions) to their portfolio of services.

Tier-2/local supplier

-

Entering new markets: Tier-2 companies are building the capability to provide a wide range of services to the emerging markets, such as the Middle East and APAC

-

Partnership with global suppliers: Tier-2 suppliers are entering into partnerships with global suppliers to expand their reach

Engagement trends

-

Most adopted model globally: Regional sourcing strategy

-

Why: There exists no leasing company which has direct capabilities throughout the globe. To achieve better implementation and better negotiation on price, a regional strategy is adopted

-

Pricing strategy: Fixed fee + management fee + service component fee/vehicle is widely adopted

Why You Should Buy This Report

The report provides information on major fleet management industry trends, drivers and constraints, the regional market outlook of APAC, Europe and North America, and Porter’s five force analysis of the global fleet management market share in each region. It provides insight into the supply trends and presents a SWOT analysis of major suppliers such as Arval, LeasePlan, and Wheels Inc, to name a few. Further, the fleet management market report breaks down the cost structure for different fleet management models and compares the best sourcing, pricing and contract models.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.