CATEGORY

Finance Accounting and Outsourcing

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Finance Accounting and Outsourcing.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoFinance Accounting and Outsourcing Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoFinance Accounting and Outsourcing Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Finance Accounting and Outsourcing category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Finance Accounting and Outsourcing category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

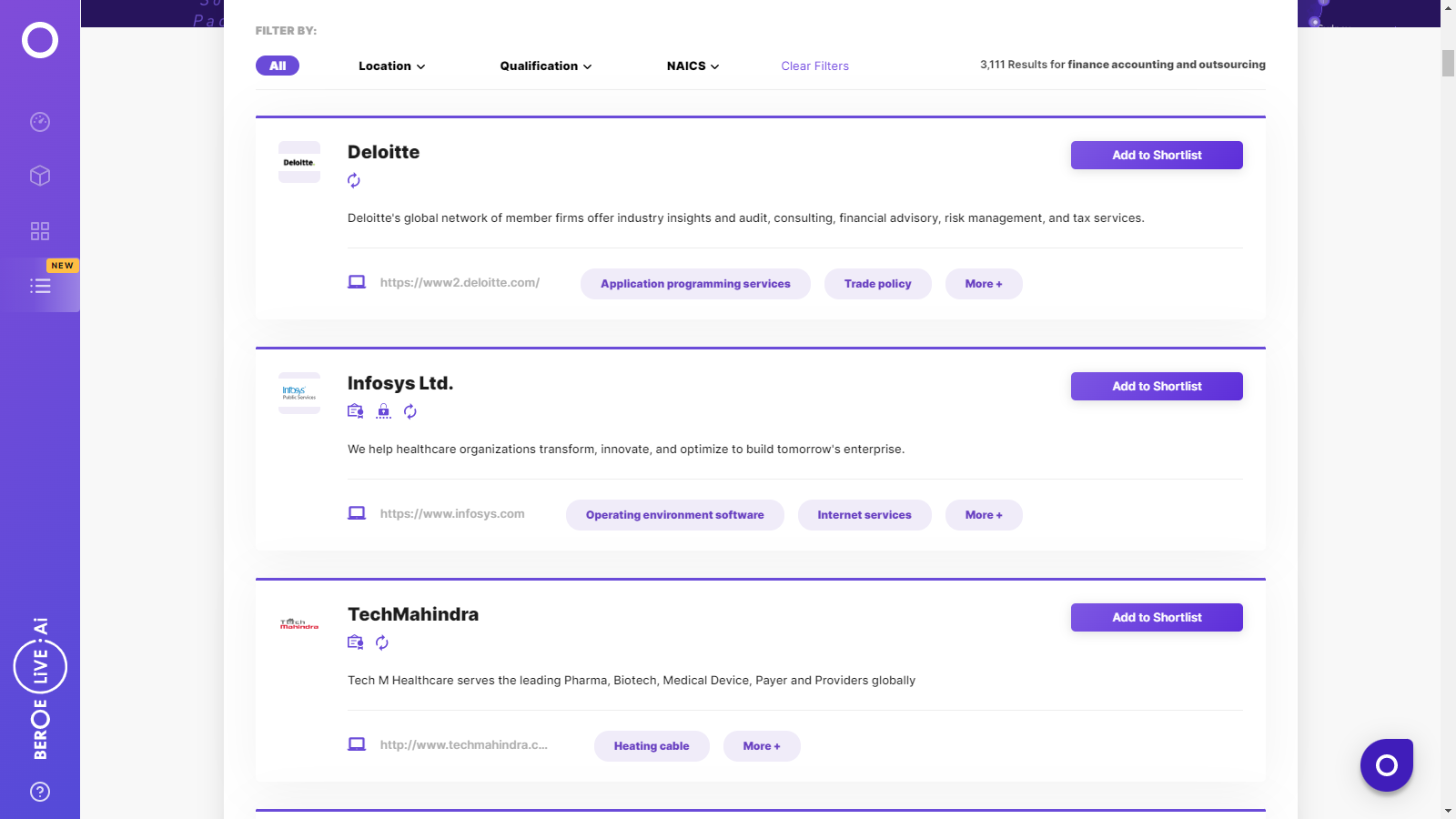

Finance Accounting and Outsourcing Suppliers

Find the right-fit finance accounting and outsourcing supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Finance Accounting and Outsourcing market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoFinance Accounting and Outsourcing market report transcript

Finance Accounting and Outsourcing Global Market Outlook

Market Size (2023 Estimate) - $13.3 billion

As per Global Multi-Process F&A Outsourcing Deal over $1 million Annualized Contract Value (ACVs)

Annual Growth Rate (2023 Estimate) - 9–10 percent

-

The Asian locations are still ahead of others, when it comes to low-cost off-shore delivery. Manila, in Philippines, recently overtook Mumbai, based on various criteria, indicating the attractiveness of a location

-

The high adoption locations of Latin America support the operations for the whole of Americas, while the European locations support near-shore requirements for the European-based buyers

-

Latin America supports all the European languages currently, as the service providers have invested heavily into strengthening this capability

Demand Market Outlook

-

North America has the highest market share in FAO spent globally, close to 45.7 per cent, followed closely by EMEA at 40 per cent

-

Japan and the APAC regions are expected to have the fastest growth rate

-

South Africa is also expected to witness a growth

-

Latin America remains small, in terms of the FAO market, due to the availability of cheap labour and lower costs compared to other regions. This is not expected to change in the next 2–3 years

Porter’s Five Forces Analysis: FAO Industry

Global

-

The barriers to new entrants is high in the FAO market since established players have a higher strength in terms of capability and reach

-

Supplier Power, the intensity of rivalry, and the buyer power are only medium since the market is fragmented and most of the leading service providers have similar technologies and service offerings

Supplier Power:

-

The FAO industry is currently dominated by market leaders, like Accenture and IBM. The industry is fragmented, in terms of service providers and their industries, with only a few being category-specific to FAO

-

As a result, it limits the service provider power to medium

Barriers to New Entrants

-

Increasing process complexity, high investments required and established presence of industry leaders are high barriers for new entrants

-

Currently, buyers prefer working with preferred service providers, having strong domain expertise and able to cater to a wide range of requirements

-

It requires high initial investments and skilled labor to cater to the needs of mature buyers

Intensity of Rivalry

-

Top players, including Accenture, IBM, Capgemini, and Genpact, account for more than 60 percent of the overall market. The latest trend is that medium-sized players combine with niche players to provide integrated services

-

All players compete on the similar platforms, such as technology and service delivery capabilities, and not pricing exclusively. Hence, the intensity of rivalry is medium

Threat of Substitutes

-

The cost of carrying out finance services in-house is high and its process efficiency is lesser compared to outsourcing

-

The access to the world-class delivery, a trained workforce, increase in spend visibility, and most importantly, the focus the buyer gets on core activities because of outsourcing makes sourcing in FAO less susceptible to the threat of substitutes

-

Many F500 clients from Pharma, Financial services, Retail, Consulting, Agro, Biotech and FBT industries observed reducing their F&A service outsourcing by moving processes in house or Shared Service Centre(SSC) in low cost countries

Buyer Power

-

For global/regional engagements, and/or end-to-end services with market leaders, like Accenture, IBM, Capgemini, and Genpact, the buyers have relatively medium bargaining power, as there are no service providers that match them in end-to-end service delivery capabilities and geographic reach

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now