CATEGORY

Explosives

Explosives are used in mining site to break through rock formation for excavation.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Explosives.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Omnia secures JV with Indonesian mining explosives business

March 31, 2023Orica introduces 4D? bulk explosives system for underground operations

March 31, 2023Digital Terrain completes acquisition of explosives magazine management software specialist Magman

March 31, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Explosives

Schedule a DemoExplosives Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoExplosives Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Explosives category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Explosives category for the current quarter is 56.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Explosives market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoExplosives market report transcript

Global Market Outlook on Explosives

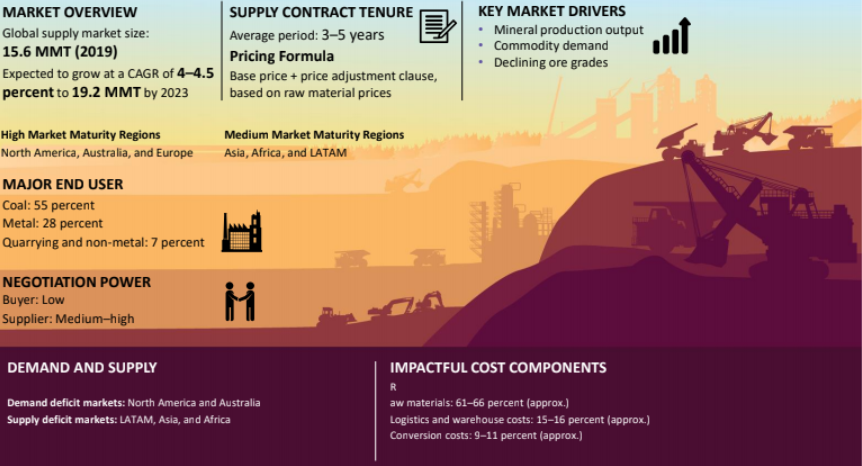

MARKET OVERVIEW

Global Supply: 14.65 MMT (2022E)

Global Demand: 13.59 MMT (2022E)

Global Demand CAGR: Approx. 3.5–4 percent (2021–2024)

-

The demand for explosives is driven by rising commodity consumption levels from China, India, and other Asian countries. This scenario is expected to continue in 2022 with higher demand from countries, like India and China

-

A constant rise in commodity demand, coupled with increasing mineral output, and declining ore heads are the key drivers for explosives

Global Explosives - Drivers and Constraints

Drivers

Increase in Commodity Demand

-

The mining industry is expected to witness a 22 percent increase in capital expenditure in 2022, as overall prices and demand for metals and minerals are expected to improve in 2022

-

Commodities, such as copper, gold, iron ore, etc., have a positive impact on demand for explosives, due to the expansion of mining activity

Rise in Commodity Prices

-

It results in high-profit margins for mining companies, which triggers Greenfield and Brownfield mine project expansion

Technology Changes

-

Major explosive manufacturers invest significantly in R&D in order to develop innovative products, which improves the efficiency of blasting as well as result in lower GHG emissions. This helps the mining industry meet the emission targets

Constraints

Decrease in Mineral Output Growth Rate

-

It will result in a reduction in mineral output from mines, adversely impacting explosives demand

Regulations and Complexity in Transportation and Logistics

-

Increasing security and safety regulations have had a negative impact on the sales and supply of explosive products, especially in mining destinations, such as Africa, LATAM, etc.

-

Such stringent regulations affect the supply security and have impacted blasting services cost significantly

Decarbonizing

-

The global shift toward phasing out the use of coal for energy needs would significantly impact the demand for explosives, as coal mining industry is the largest end-user of explosives at present

Market Driver - Commodity Price

-

Prices of key commodities are the best indicators of mining activities, which, in turn, evinces the demand for explosives

-

Iron ore prices have increased by 19.5 percent and averaged at $111/MT, due to improved demand from the end users

-

LME Nickel prices averaged at $13.17/lb. in December 2022, a monthly rise of around 12.2 percent compared to $11.56/lb. in Nov 2022

Cost Structure Analysis : Explosives

-

Feedstock raw materials are the key cost drivers for explosives, as they constitute to ~60–70 percent of the total production cost across all regions.

-

The profit margin for explosives in a particular region is set up by the supplier, based on demand from the customers in that region and competition among the suppliers

-

Other costs are inclusive of logistics, warehouse cost, and other direct and indirect expenses

-

Utilities mainly include storing of AN prill at the appropriate temperature, as it should not be subjected to extreme external conditions of rain, high humidity, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.