CATEGORY

Ethyl Acetate

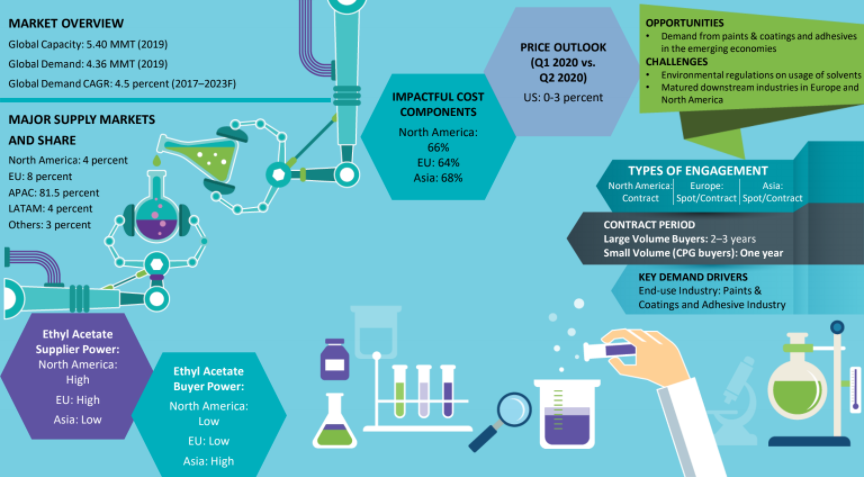

The global demand of ethyl acetate is estimated at ~4.0 MMT in 2019, expected to grow at a CAGR of 4.5 percent until 2023.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Ethyl Acetate.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoEthyl Acetate Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoEthyl Acetate Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Ethyl Acetate category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Ethyl Acetate category for the current quarter is 90.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Ethyl Acetate market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEthyl Acetate market frequently asked questions

As per Beroe's Inc. report, the global demand for ethyl acetate products is expected to grow at a CAGR of 4.5 percent by 2022. Asia holds the largest ethyl acetate market size/share with around 81.5 percent, followed by EU at 6.9 percent, and North America with 1.7 percent.

The key trends to watch out for in the ethyl acetate market are: The capacity-demand gap is expected to narrow down as the capacity additions may not cater to the expected increase in demand The rise in the construction sector and increase in auto sales is increasing the demand for paints, coatings, and adhesives in developing regions, like China, India, LATAM, etc. which will further drive the demand for ethyl acetate. India and China would remain the maximum demand-generating countries until 2021 due to a considerable increase in auto sales and growth in the construction sector.

Ethyl Acetate market report transcript

Ethyl Acetate Global Market Outlook

-

The global demand of ETAC is estimated at approx. 4.76 MMT in 2022, which is expected to grow at a CAGR of 4.5 percent until 2025

-

Asia has excess capacity, whereas North America and Europe are dependent on imports from Asia to cater to domestic demand

-

Capacity–demand gap during 2022–2023 is expected to narrow down, as the capacity additions announced may not cater to the expected increase in demand

Ethyl Acetate Demand Market Outlook

-

Increasing demand for paints & coatings and adhesives in the developing regions, like China, India, LATAM, etc., due to the rising construction sector and increasing auto sales, is expected to drive the demand for ETAC

-

Capacity–demand gap in the ETAC market is expected to reduce during 2022–2023, due to lesser capacity additions compared to the demand growth, reducing the buyer power

Impact on CPG

-

CPG buyers are small-volume buyers for ETAC manufacturers compared with paints & coatings and adhesive buyers

-

CPG suppliers in North America and Europe have less options, due to the presence of only few suppliers

-

The buyers have less leverage during contract negotiations and have to contend with high prices and supply unavailability during tight supply situations

Global Market Size: ETAC

-

Major demand drivers are the increasing downstream demand from paints & coatings, printing inks, adhesive segments in Asia, and other developing economies

-

China and India would be the maximum demand-generating region until 2025, due to high growth rates in construction and automobile industries, which consume paints & coatings and adhesives

Global Capacity - Demand Analysis

-

About 79 percent of global ETAC capacity is concentrated in Asia

-

Excess supply in Asia is exported to North America and Europe

-

More capacity additions/expansions are required than the current announcements to avoid the reduction in capacity–demand gap

Market Outlook

-

Current capacity–demand scenario: At a global level, there is excess capacity; however, this excess capacity is concentrated in Asia

-

Europe and North America are currently relying on imports from Asia, due to insufficient domestic capacity

-

Huge capacity additions in China and India, over the past decade led to excess capacity in the APAC. Saudi Arabia's Saudi International Petrochemical (Sipchem) capacity addition further increased capacity in the APAC

-

Future capacity–demand scenario: Nearly, 0.39 MTPA of capacity is expected to come online by 2023, concentrated mainly in China and India. The timelines of the plant startup is yet to confirmed

Engagement Outlook

-

Low-volume buyers in North America and Europe are recommended to have long-term contracts, with ETAC manufacturers for supply security

-

In Asia, with surplus capacity in the market, buyers can opt for a spot/contract mix, with more preference to the spot

Ethyl Acetate Cost Structure Analysis

-

Availability of feedstock is the key determining factor for the choice of raw material used by suppliers in the respective region

-

Ethanol is the preferred feedstock in North America and Asia, due to its abundant availability

-

In other regions, especially Europe, ethylene is used majorly in place of ethanol

-

In Asia and the US, ethanol is the preferred feedstock, due to its high availability from corn via bio-based fermentation and sugar molasses, respectively, thus making it a cheaper source of feedstock

-

In Europe, ethylene and acetic acid are majorly used as feedstock

-

The European electricity and labor costs are higher compared to other regions, owing to shift toward renewable source of energy

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.