CATEGORY

Ethanolamine

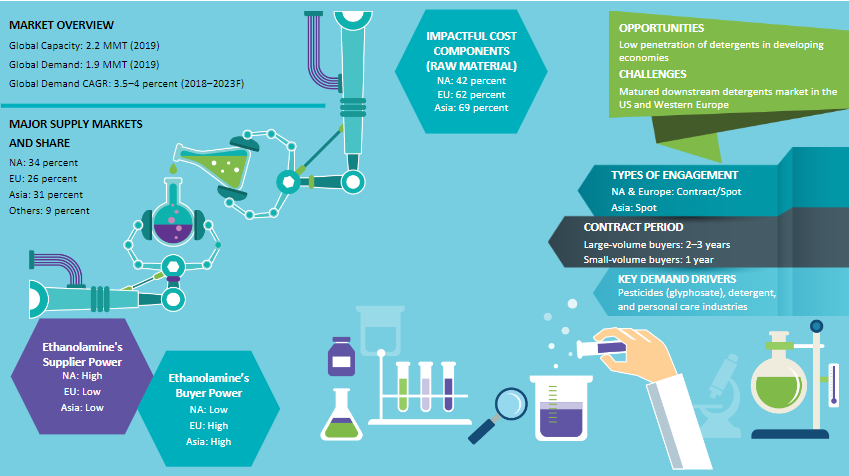

Ethanolamine has enough capacity to cater to demand until 2022, which is expected grow at 3.5 - 4 percent. Sadara has added a new capacity of 20,000 MT per annum of ethanolamine in Jubail, Saudi Arabia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Ethanolamine.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoEthanolamine Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoEthanolamine Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Ethanolamine category is 6.50%

Payment Terms

(in days)

The industry average payment terms in Ethanolamine category for the current quarter is 70.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Ethanolamine market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEthanolamine market report transcript

Ethanolamine Market Analysis and Global Outlook

-

Pesticide is expected to be the major demand driver of ethanolamine due to an increase in agrochemicals production in China and India

-

Rising disposable income in Asia and other developing economics is expected to spur the demand for detergents and personal care products, the major downstream industries for ethanolamine

Ethanolamine Demand Market Outlook

-

Ethanolamine demand is expected to grow at 3.5-4 percent until 2022. Asia Pacific will be the major demand driving region for ethanolamine due to high growth rates in herbicides production and home and personal care products demand

-

Ethanolamine growth rate in Europe and North America will be low due to mature downstream markets

Industry Best Practices : Ethanolamine

-

Large volume buyers usually prefer buying through contracts across all major regions. Whereas, small volume buyers, opt for spot

-

Buyers in Europe and Asia can prefer sourcing from the US due to economical cost

-

Mix of contract/spot pricing is preferred in NA to excess capacity and Asia prefer more of spot buying

Global Market Size–Ethanolamine

-

The global market size is expected to grow at a CAGR of 5 percent Y-o-Y, mainly driven by the demand from the detergent and herbicides industries

-

A steady increase in detergent consumption and glyphosate consumption across the globe will attribute to the sales of ethanolamine in the future

Global Capacity–Demand Analysis

-

Ethanolamine has enough capacity to cater to demand until 2023, which is expected grow at 3–5 percent. Sadara has added a new capacity of 20,000 MT per annum of ethanolamine in Jubail, Saudi Arabia

Market Outlook

Sufficient Capacity until 2023

-

The current installed capacity will be enough to meet the global demand until 2023

-

The average operating rate of suppliers is anticipated to be around 75–80 percent, which is highly sufficient to meet the demand levels

Detergent and Herbicide Industries to Drive the Demand

-

Ethanolamine global demand was mainly driven by the demand from the detergent and herbicide industries, which is expected to grow by 5 percent and 6.2 percent, respectively, until 2025

Increasing Demand from Other Applications

-

Other downstream industries of ethanolamine, like gas treatment and cement production, are expected to have less impact on ethanolamine prices, as their market size is about 20 percent of the total end-use market

Global Demand by Application : Ethanolamine

-

Glyphosate, which uses ethanolamine as its raw material, is expected to be the major demand driver for ethanolamine because of increase in crops production in Asia and NA

-

Increasing disposable income in developing economies like Asia is expected to drive the demand for detergent, which in turn drives ethanolamine demand

Downstream Demand Outlook

Detergent and Personal Care:

-

Ethanolamine is used as an intermediate in the production of surfactants, which goes into the production of detergents.The consumption of detergents is expected to grow at a CAGR of 5 percent until 2025, which is expected to increase ethanolamine demand

Herbicides:

-

Ethanolamine is used in the production of glyphosate, a herbicides used as a weed killer in agriculture. Glyphosate is expected to grow at a CAGR of 5 percent until 2022 due to an increaese in growth of agriculture, mainly genetic modified crops in the Asian and NA region

Cements:

-

The cement industry uses ethanolamine to produce cement grinding aids and performance enhancers. The global construction industry is expected to grow at 4 percent until 2025 due to an increase in construction activities in Asia, which inturn increases the demand for ethanolamine

Gas purification:

-

Ethanolamine is used in gas treatment application to remove acidic impurites, such as hydrogen sulfide and carbondioxide. This market is expected to grow by more than 3 percent, which is expected to increase the ethanolamine demand

Global Trade Dynamics : Ethanolamine

-

North America: Net exporter of ethanolamine and the export had decreased by 15 percent from Y-o-Y

-

Europe: Net importer of ethanolamine, due to high cost of production, which is attracting low-cost imports from other regions, especially from Asia

-

Asia: The imports of DEA and MEA decreased slightly, as China imposed ADD on the US, Thailand, Saudi Arabia, and Malaysia

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.