CATEGORY

ERP Software

ERP is a business process management software which integrates several enterprise functional modules or applications into a unified system.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like ERP Software.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoERP Software Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoERP Software Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in ERP Software category is 11.00%

Payment Terms

(in days)

The industry average payment terms in ERP Software category for the current quarter is 57.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the ERP Software market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoERP Software market frequently asked questions

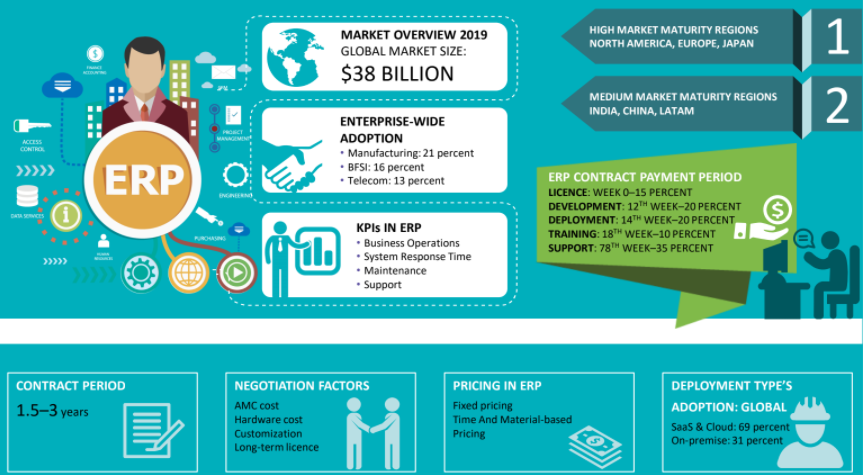

As per Beroe's industry reports, in 2016, the global ERP software market was worth $31.9 billion. The market will continue to follow an upward trajectory to reach a valuation of $42 billion at a CAGR of 7-7.3 percent by 2020.

The APAC and Latin American regions are expected to be driving the ERP software market growth in the near future.

The pricing models followed in the ERP software market are fixed pricing, time, and material-based pricing.

Business operations, system response time, maintenance, and support are the KPIs in the ERP software market.

As per the ERP software market report by Beroe, North America leads the market with a 58% market share, followed by Europe at 20%, APAC at 16%, LATAM at 4%, and MEA at 2%.

The ERP software market share according to its adoption by enterprises are manufacturing (21%), BFSI (16%), Telecom (13%), Government (12%), Healthcare (11%), Retail (11%), Aerospace, and Defense (9%), Others (7%).

ERP Software market report transcript

Global ERP Software Market Outlook

-

The global ERP market is valued at $49.2 billion in 2023. The ERP market is estimated to grow at a CAGR of 9.1 percent until 2029

-

APAC is expected to be the growth driving markets in the future. Supply is more consolidated, with the top five suppliers holding over 50 percent of the market share globally

Demand Market Outlook

-

ERP penetration for large organizations is medium outside Europe and North America

-

SMBs in APAC and Latin America are witnessing increasing adoption due to the efforts of large global buyers to consolidate the supply base

ERP Supply Trends and Insights

Global/Regional Supplier

-

The big data industry is expanding quickly, which highlights how crucial data is to practically every aspect of business operations

-

ERP systems' access to a wealth of data allows them to create better analytics relating to operations and market demands

-

For the majority of the functionality that firms will need when installing ERP in 2022, data and data analytics are necessary

-

Global suppliers are developing user-friendly interfaces and functionalities, moving away from the existing high degree of complexity in software

-

Enabling flexibility in deployment options. Hybrid cloud model in which an organization combines on-premise applications with cloud applications in its broader ERP package

-

End of Legacy System: Products such as Oracle EBS, Microsoft Great Plains, and Epicor Prelude are less likely to introduce new capabilities or provide long-term support. This will force enterprises to migrate towards a cloud-based ERP solution or the latest ERP suite from the above suppliers

Tier-II/Local Supplier

-

Suppliers are highly fragmented in the mid-market segment

-

Tier-II market players follow a vertical strategy, in which they limit their expertise to focus only on a few specific industries.

-

Increased trend towards globalization, where suppliers are building a greater amount of international presence, either directly or through channel partners

-

The mid-market segment has seen growth in increasing the number of SaaS ERP, due to reduced implementation and operational costs

-

Open-source ERP suppliers are evolving with a focus to reduce TCO and also enable customization without access to source code

Engagement Trends

Most adopted model (globally): Multi-supplier engagement is being practiced to achieve spend visibility, cost savings and risk minimization.

Contract length: 1.5–3 years

-

Preferred Phase (Support and Maintenance)

-

Pricing strategy (Fixed pricing)

-

Preferred Phase (Implementation)

-

Benefit (High knowledge retention)

-

Pricing strategy (Time and Material)

-

Benefit (Achieve greater spend visibility)

Global ERP Market Maturity

-

ERP penetration for large organizations is medium outside Europe and North America

-

SMBs in APAC and Latin America are witnessing increasing adoption due to the efforts of large global buyers to consolidate the supply base

Global ERP Drivers and Constraints

Drivers

Hybrid ERP

-

A hybrid ERP system is a perfect combination of in-house ERP supplemented by cloud-based ERP application. It is popular among organizations who want to improve ERP functionality but do not want to change or add an in-house legacy system

-

Hybrid ERP allows organizations to have a smaller section of functionalities of on-premise solutions, such as financial and manufacturing, and the rest of the applications on the cloud.

SaaS adoption in ERP

-

SaaS-based ERP solutions are gaining popularity in the mid-market segment, where it proves to be cost effective in terms of implementation, reduced operational cost, increased business agility and the ease of start-up and maintenance

-

Large enterprises are slower in adopting SaaS-based ERP, since they have already made high investment in on-premise deployments. Incumbent on-premise ERP suppliers offer migration path to SaaS, buyers decide on the transition, based on costs and benefits, in terms of architecture, flexibility, interface, etc.

IoT and ERP

- The ERP system will be integrated with the real-time unstructured data (produced from machines) to the structured data from business operations. Legacy ERP, compounded with its business intelligence skills, will be empowered with real-time data through IoT, to enable organizations to make actionable decisions

Intelligent ERP Application

-

Business & IT leaders are expecting intelligent ERP systems, which include features, like machine learning, artificial intelligence, and automation

Constraints

-

Lack of feature and function fits between the customers and ERP providers is the predominant constraint faced by ERP buyers. In several cases, customers do not find the ERP packages that will solve their business requirements

-

Availability of alternatives for increasing the level of systems integration

-

High switching cost and process integration involved, making it tough for the organizations to switch suppliers

-

Enterprises that follow decentralized decision-making find it difficult to implement, as ERP systems are not easy to change once they are configured and installed

-

Lower ROI and high ERP failure rates

-

Large enterprises’ resistance to OCM

Why You Should Buy This Report

The report gives you, insight into the supply trends, core modules and functionalities, global ERP market industry drivers and constraints and Porter’s five force analysis of the global ERP software market.

It gives you ranking and information of key supplier along with SWOT analysis of SAP, Oracle, Microsoft, etc. The report gives the best pricing and delivery models and cost-effective opportunities in the ERP market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.