CATEGORY

Epoxy Resins

In depth analysis of the epoxy resins market across NA, EMEA and APAC with a focus on capcity-demand analysis, industry analysis, cost structure, historic/ forecast price trends and preferred sourcing strategy

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Epoxy Resins.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoEpoxy Resins Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoEpoxy Resins Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Epoxy Resins category is 10.00%

Payment Terms

(in days)

The industry average payment terms in Epoxy Resins category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Epoxy Resins market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEpoxy Resins market frequently asked questions

According to Beroe's analysis report, the top suppliers in the market include the names of ' Kukdo, Nan Ya, Sanmu Group, Hexion, and Chang Chun.

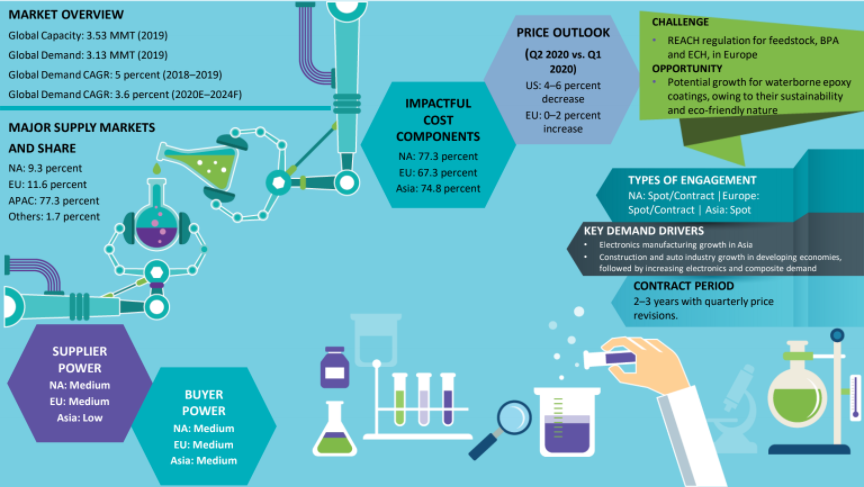

As per epoxy resin market analysis, the global market has a surplus capacity with more than 75 percent concentrated in Asia. The demand is anticipated to show a growth rate of nearly 0.5 percent CAGR to reach 3.45 MMT by 2021. As per the report, the APAC region holds the major epoxy resin market share (~77.3 percent), followed by the EU at 11.6 percent, and the NA region at just 9.3 percent.

Analyzing Beroe's report, we understand that the epoxy resin market revenue increased owing to a considerable increase in the price of BPA. The Asian countries are expected to witness a high demand growth rate by 2022 mostly driven by electronics, construction, and automobile sector, while in the NA and Europe regions, the demand growth is expected from windmill installations. If we look at the global capacity-demand market, the operating rates are expected to increase from 70 ' 75 percent to 95 percent by 2022, given that no further capacity additions are announced. The global demand is likely to show a growth of about 5 percent by 2022, driven by Asia.

The global economic slowdown and challenges can majorly impact the epoxy resin market outlook for the rest of the year as a recovery in the demand will be trickier. Firmly maintaining the price of epoxy resins would be a major challenge in the long-term, however, it will also depend on the level of feedstock and demand volatility. As per trends and modified epoxy resins market analysis report, epoxy resin price drivers BPA and ECH prices have shown an increase, while the supply and downstream demand took a downslide leading to an oversupply thus forcing the suppliers to reduce their operating rates in the U.S. and Europe.

Epoxy Resins market report transcript

Epoxy Resins Market Analysis and Global

-

The global epoxy resin market will continue to have sufficient supply until 2023. More than 75 percent of the capacity is concentrated in Asia. The overall demand, which was growing at a CAGR of 5.0 percent until 2019, has declined steeply to 3.3 percent in 2021, owing to the outbreak of COVID-19 pandemic globally

-

The demand from the wind energy and packaging sectors remains buoyant and unscathed by the COVID-19 impact and will drive the demand for epoxy resins until 2025

Epoxy Resins Demand Market Outlook

-

Demand from the coatings sector is typically seasonally healthy in H1 2021 and is anticipated to continue throughout the year

-

Metal coatings packaging for food/beverages, wind energy and residential construction sectors are expected to be robust in 2021

-

In Q1 2022, the demand for epoxy resins from downstream auto sector continues to show signs of recovery, as a result of recovery in manufacturing. However, co-raw materials, such as diluents and hardeners are difficult to procure, thereby impacting the consumption

-

Demand from the architectural coatings continues to remains strong, especially into exterior projects

Global Market Size: Epoxy Resin

-

The global market for epoxy resins is expected to grow at a CAGR of 5.1 percent Y-o-Y in the forecast period between 2022 and 2025 to reach $6.6 billion by 2025. The overall growth has lowered from 6.4 percent in 2018 to 3.8 percent between 2019 and 2021

-

The epoxy resins market predominantly driven by a steady growth in demand from the coatings sector for use in construction and automobile industries

Global Capacity–Demand Analysis

-

H1 2021 witnessed persistent tight supply conditions globally amidst robust demand from the coatings sector. Continued strong buying momentum and feedstock supply constraints continue to deplete inventories. Any likely stability or drop in global volatility is likely to take place in Q4 2021 after the conclusion of feedstock and epoxy outages.

-

Demand for epoxy resins continues to remain strong, with little-to-no impact so far, despite a spate of record high prices.

Market Outlook

-

The current installed capacity will be sufficient to meet the global demand until 2023

-

The average operating rate of the suppliers is anticipated to be approximately 70-75 percent to meet the current demand

-

The APAC represents more than 75 percent of the global consumption of epoxy resin, with China being the largest consumer

-

In H1 2021, the epoxy resin market witnessed severely constrained market as a result of planned/ unplanned maintenance turnarounds across all the three regions

-

The tight supply conditions was further compounded by low imports from Asia as a result of higher freight charges and extended lead times

Engagement Outlook

-

Buyers in Asia could engage on spot pricing mechanism for a maximum period of 1–2 years, owing to excess supply in the market

-

If no further capacity additions are announced, buyers are advised to enter into contracts, as the market is anticipated to become tight

Industry Drivers and Constraints : Epoxy Resins

Drivers

Demand from the Construction Sector

-

Increasing construction spending in China among other Asia has been driving the demand for paints, coatings, and varnishes

-

This is further expected to propel the demand for epoxy resins in this region

R&D Initiatives

-

Expected increase in R&D initiatives, coupled with technology and innovation in the category of cured epoxy resins, would open new applications to boost the otherwise sluggish demand of aerospace and marine coatings sector in Europe

Renewable Energy Demand

-

Epoxy demand is expected to increase with expanding wind energy capacities, on account of a shift toward the development of renewable energy in the US

-

This progress is expected to drive the epoxy demand in the long term

Constraints

Regulations

-

Prevailing ban proposals against feedstock, BPA, would restrict the production of traditional epoxy

Lack of Capacity Additions

-

There are no more capacity additions planned in the coming years, which is a big restraint in the industry

Freight Charges

-

Freight charges are seven times more expensive than the prices in 2020 owing to low container availability. Asian imports are currently more expensive than the regional material available in the US and European countries

Cost Structure Analysis : Epoxy Resins

-

Epoxy resin cost will continue to depend majorly upon the price movements of feedstock bisphenol-A (BPA) and Epichlorohydrin (ECH) across all the three regions – US, Europe & APAC. Owing to high labor cost in Europe and limited imports from Asian countries, epoxy resin suppliers will continue to face margin pressure for the next 6–12 months

-

Easy availability of raw material and lower labor costs in Asia leads to a lower cost of epoxy resin production in that region

-

However, H1 2021 witnessed higher freight charges amid low container availability making Asian imports to US and Europe more expensive

-

CPG buyers in NA and Europe can look out for the arbitrage windows for Asian imports. Otherwise, buyers will have to contend with high prices fixed by the domestic suppliers, who are already facing margin pressures

Why You Should Buy This Report

Find information about epoxy resins market size, export-import, and trade dynamics. Get Porter’s five forces analysis of NA, Europe, and Asia, as well as the lists of the important industry drivers and constraints. Know about epoxy resin price trend analysis and cost structure analysis. Get details of key suppliers and SWOT analysis of key players like Kukdo Chemical (Kunshan) Co., Nan Ya Plastics, etc. Also, learn about the best industry practices and contract models. This report packs rich resources with in-depth insights.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.