CATEGORY

Emulsifiers

Emulsifiers can be derived from plant, animal and synthetic sources. Their common applications is in processed foods such as mayonnaise, ice cream and baked goods to create a smooth texture, prevent separation and extend shelf life

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Emulsifiers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoEmulsifiers Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoEmulsifiers Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Emulsifiers category is 3.00%

Payment Terms

(in days)

The industry average payment terms in Emulsifiers category for the current quarter is 65.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Emulsifiers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEmulsifiers market frequently asked questions

The global food emulsifiers market is evaluated at USD 3.5 billion at a CAGR of about 5.5 percent between 2017-2022.

The key factors driving the global food emulsifiers market growth are as follows. ' Application in bakery and confectionery as a substitute for enzymes ' Health awareness ' Preference for convenience foods by consumers

Yes, the demand from Asian regions like China, India, Indonesia, Malaysia, and Vietnam will continue to rise at a CAGR of 6.9 percent through 2020.

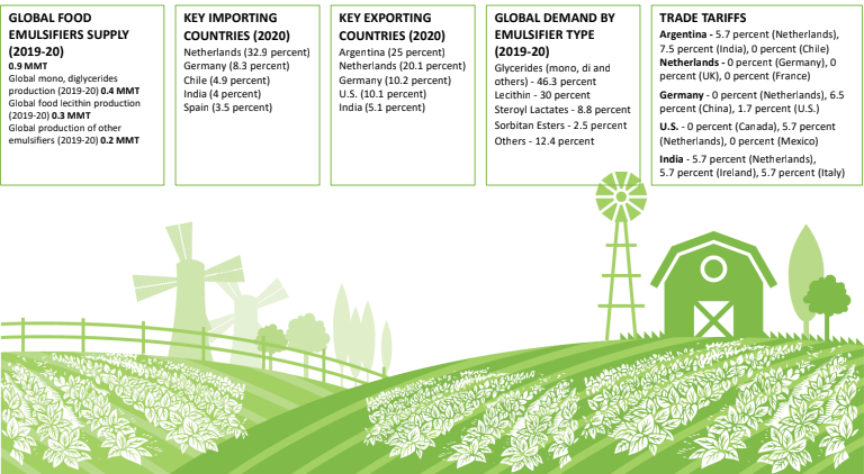

As per Beroe's emulsifier market outlook reports for the 2016-2017 period, the global food emulsifiers market size stood at 0.816 MMT, while the global mono, diglycerides production was at 0.378 MMT. Additionally, the global food lecithin production during the period was at 0.245 MMT and for other emulsifiers, it was at 0.193 MMT.

The highest demand in the food emulsifiers market is for glycerides (mono, di, and others) at 46.3 percent followed by lecithin at 30 percent, stearoyl lactates at 8.8 percent, sorbitan esters at 2.5 percent, and others at 12.4 percent.

From Beroe's emulsifier market analysis and intelligence report, approximately 60 percent of the supplier market share is consolidated by four companies, which are DuPont-Danisco, Cargill Inc., Riken Vitamin Co., and Palsgaard. Among these top players, Danisco leads the emulsifier supply market and holds the maximum share.

The major price driver for the food emulsifiers market was the increase in the production of Malaysian palm oil by 7.7 percent to 21 MMT and Indonesian palm oil by 4.7 percent to 33.5 MMT. Besides, there was an increase in the production of Argentina soybeans as well.

The demand for the PGPR emulsifier has risen because it can be suitably substituted for cocoa butter in the chocolate manufacturing process. Major companies like Hershey and Nestle have adopted PGPR to replace cocoa butter in their manufacturing process. The demand seems to increase further as more companies are expected to adopt PGPR in the near future.

The food emulsifiers market is mainly driven by innovations. The top trends in innovations that are driving the market forward are ' ' the ongoing efforts that are being targeted at phasing out PHO and GMO emulsifiers ' developing emulsifiers to replace expensive ingredients to help end-users cut down the production costs

Emulsifiers market report transcript

Global Market Outlook on Emulsifiers

-

The global food emulsifiers market is estimated to be valued at about $3.4 billion 2021, at a CAGR of about 7 percent, between 2022 and 2029

-

The key factors driving the growth include application in bakery and confectionery as a substitute for enzymes, health awareness, and preference for convenience foods by consumers

-

Demand from Asian regions, such as China, India, Indonesia, Malaysia, and Vietnam, is expected to rise by a CAGR of 6.9 percent from 2019 to 2025

Global Demand Analysis: Class and Type of Food Emulsifiers

-

Synthetic emulsifiers account for approx. 70 percent of the market share. Mono, diglycerides, and derivatives constitute the largest segment, possessing approx. 46.3 percent of the market share, with lecithin accounting for the second largest share at approx. 30 percent

-

Mono, di-glycerides, and their derivatives continue to account for largest market share, owing to its wide range of applications in the food and beverage sectors, especially in the baking industry

Est. Global Demand by Type of Food Emulsifier (2022)

-

The mono, di glycerides, and derivatives constitute the largest segment and possess qualities, such as stabilization, increase softness, and enhance the shelf life of the products

-

Sorbitan esters are expected to witness a lucrative growth at a CAGR of 4.9 percent in the food emulsifiers market. Sorbitan esters are extensively used in the dairy industry for manufacturing of cream

-

Lecithin is mainly used in chocolate. Demand for this emulsifier could rise, due to improvement in handling and processing

-

Consumption of FDA-approved Stearoyl Lactate is expected to grow, due to its application in bread, sugar confectionery, and ice cream

Est. Global Demand by Class of Food Emulsifier (2022)

-

Synthetic emulsifiers comprise more than two third of the emulsifier market, with di-glycerides and derivatives constituting the largest share

-

Others include Sucrose esters, Polyglycerol esters, and PGPR

-

Natural emulsifiers include egg yolk containing lecithin, mustard, honey and soy-beans, guar gum

-

Di-glycerides and lecithin have the highest share among synthetic and natural food emulsifiers segments, respectively

-

Lecithin is expected to grow at the highest CAGR of 5.6 percent in the food emulsifiers market

Global Demand Analysis: Food Emulsifiers by Region and Segment

-

Europe accounts for approx. 25 percent of the global demand for emulsifiers as a region, while APAC is exhibiting rapid growth in demand at a projected CAGR of 7.5 percent, due to factors, like economic growth, population increase, and high disposable income

-

The food emulsifiers market, by source, is estimated to be dominated by the plant segment, driven by the claims that plant-based emulsifiers are less harmful to humans as compared to animal-based emulsifiers

Global Demand of Food Emulsifiers by Region (2022)

-

The APAC food emulsifiers market is expected to grow at the highest CAGR of 5.9 percent and is expected to reach a value of over $1.1 billion by 2025. Rising demand for healthy food products, along with technological advancements in regions, such as China and India, have led to higher adoption of emulsifiers

-

Europe is the single largest region for demand, with a market share of approx. 25 percent. Demand is growing in regions, like Brazil and the Middle East (Saudi Arabia, Egypt and Israel)

-

The major demand drivers are consumer awareness of the benefits of food emulsifiers and the growth of the food processing industry

-

Roundtable on Sustainable Palm Oil (RSPO)-certified sustainable food emulsifiers from a mass balanced source is also an emerging market

Food Emulsifier Consumption by Segment (2022)

-

Bakery and confectionery segment applications include cakes, chocolates, sugar confectionery, and gum

-

Food emulsifiers account for 32.8 percent of the global emulsifier market share and are used in functional foods, bakery and confectionery, dairy, convenience foods, and meat products

-

Major demand driver is convenience. Recently, consumers have given more importance to low-fat content, while demanding sensory characteristics, like texture, flavor, and taste of convenience foods

-

Among food emulsifiers, di-glycerides have a maximum share among synthetic emulsifiers, while lecithin dominates in the natural segment

Why You Should Buy This Report

- The report gives information on the global food emulsifiers market size, supply-demand trends, trade dynamics, emulsifiers procurement intelligence, etc.

- It gives the Porter’s five force analysis of the global food emulsifiers market, the latest innovations and trends, and the market drivers for them.

- It provides an overview of the food emulsifiers supplier market and gives key profiles of major suppliers like Danisco, Palsgaard, Riken Vitamin Co. Ltd. etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.