CATEGORY

Drilling Equipment and Consumables

Drilling equipment and consumables are used in mining sites to drill holes and consumables are used for uninterrupted drilling activity.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Drilling Equipment and Consumables.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Sandvik delivers next-gen drill rig to Finish diamond mine

February 07, 2023BHP to trial Epiroc Boomer M2 battery-electric jumbo

November 29, 2022Bolting head upgrade gives Sandvik DS300 drills new life

November 23, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Drilling Equipment and Consumables

Schedule a DemoDrilling Equipment and Consumables Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDrilling Equipment and Consumables Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Drilling Equipment and Consumables category is 6.30%

Payment Terms

(in days)

The industry average payment terms in Drilling Equipment and Consumables category for the current quarter is 52.5 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Drilling Equipment and Consumables market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDrilling Equipment and Consumables market report transcript

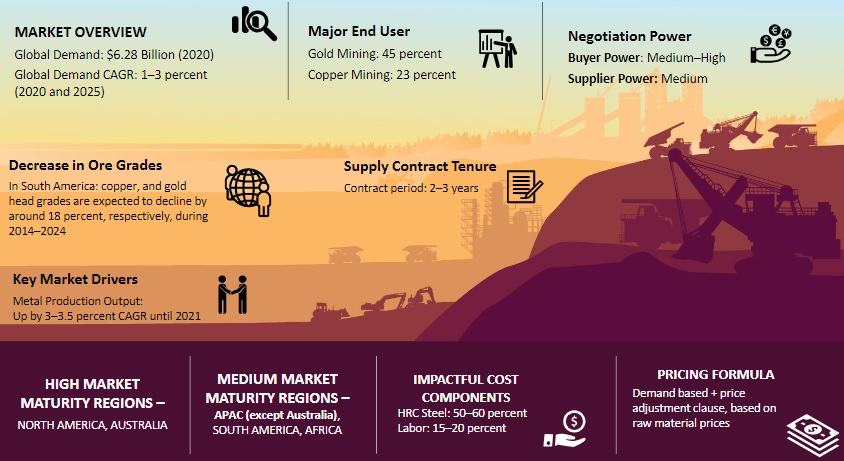

Global Market Outlook on Drilling Equipment and Consumables

- Commodity price increase coupled with declining ore heads are the key market drivers

- Shift of market focus in consumers preference in partnering equipped with best technology suppliers have been witnessed as an emerging trend in major regions such as Australia, Canada to optimize the buyer’s total cost of ownership

Global Drilling Equipment - Market Drivers and Constraints

Drivers

Increase in Commodity Demand/Price:

- Commodity demand is a result of the global economic situation. The average commodity price is expected to grow between 5 percent and 6 percent until 2017. Increase in commodity demand will drive up the market for production and exploration drilling equipment.

Decrease in ore grades at mine (surface and underground mining):

- Falling in ore grades results in increased exploration activity, which in turn, acts as a driver for the rise in demand from the drilling equipment segment. In South America, a key mining region, copper and gold head grades are expected to decline by 21 percent and 18 percent, respectively, during 2014–2024

Constraints

Mining Slowdown:

- Reduction in mineral output from mines and closure of high cost mining operations due to the current mining industry slow down is adversely impacting drilling equipment and mining consumables demand

Reducing Exploration Spend:

- Reduction is exploration spend in new mining activities across all major mining regions has severely impacted the demand for exploration drilling equipment. The spend in mineral exploration has decreased by 19 percent in Asia and around 12 percent in Australia in 2016

Drilling Tools Market Overview and Trend

-

Demand for drilling equipment is expected to improve, due to an increase in metal production, construction activities, and an upsurge in new mines and restarting of existing mines. The drilling equipment and consumables market is expected to increase at a CAGR of about 6–7 percent during the forecast years

-

Asia Pacific accounts for approximately 45-50 percent of the drill equipment market, in terms of revenue, and is expected to grow at a CAGR of around 4-5 percent during the forecasted period

-

The global drill equipment market is consolidated with major OEMs, capturing 80 percent of the market share

-

Demand for drill bits is expected to grow at a CAGR of about 5.1–6 percent during the forecast years. The market size is anticipated to reach $1647.16 million, primarily driven by the increasing demand for commodities, like iron ore, gold, copper and coal, etc.

-

One of the major constraints that affect the global mining drill bit market is expensive pricing or cost of ownership

-

The most common type of drill bit used in the market are the rotary drill bits, which account for about 70–75 percent of the drill bit market. The two types of rotary drill bits used in mining are fixed cutter bits and roller cone bits. Fixed cutter bits account for more than 60 percent of the rotary drill bit market

Why Should You Buy This Report

- Information about mining drilling equipment market size and trends, regional overview, outlook, drivers and constraints, market driver analysis, etc.

- Porter’s five force analysis of the global mining consumables and drilling tools market.

- Supply trends, market share and SWOT analysis of major players like Atlas Copco, Sandvik, Caterpillar, etc.

- Cost structure analysis, cost and price drivers analysis.

- Best procurement models, sourcing channels best practices in the mining drilling equipment industry and risk analysis.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.