CATEGORY

DNA Sequencing

Use of equipments to decode the genetic seuence employed in drug discovery.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like DNA Sequencing.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoDNA Sequencing Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in DNA Sequencing category is 5.40%

Payment Terms

(in days)

The industry average payment terms in DNA Sequencing category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the DNA Sequencing market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDNA Sequencing market report transcript

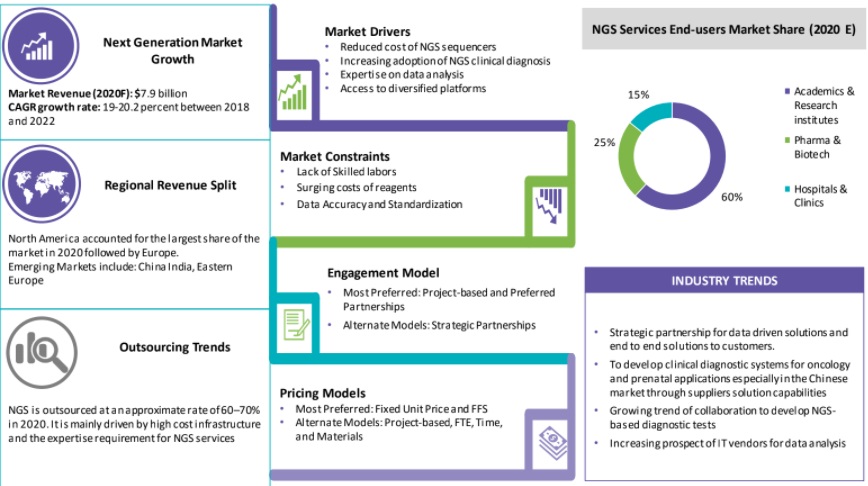

DNA Sequencing Global Market Outlook

-

The global demand for DNA sequencing services is expected to grow at approx. 19–20 percent CAGR through 2021–2025F. The current market size is $9.1 billion

-

Pharmaceutical companies are outsourcing DNA sequencing services as it requires dedicated bioinformatics team to handle the data analysis service. It is mainly driven by high cost infrastructure and the expertise requirement for DNA sequencing services

-

North America is the preferred region, followed by Asia Pacific, mainly due to the low cost of operations and continuous evolving nature of regulations

DNA sequencing Services Spend by End-users and Applications

-

Even though clinical application is growing, the usage of sequencing for research purposes is still dominating the market making academics and research institutions a major end user

-

DNA sequencing services is used along the entire chain from early discovery to clinical trials through predictive biomarkers and patient stratification studies

-

Hospitals and clinics are the fastest growing end-user segment as clinical DNA sequencing shows a great promise to develop in the future

-

Non clinical segment is also poised to grow with pharmaceutical companies encouraging strategic partnerships with DNA sequencing service providers for bringing in patient-specific treatment regimes

Growth Drivers and Constraints : DNA Sequencing

Drivers

Increasing Demand for Clinical DNA sequencing

-

DNA sequencing application spectrum is broadening to hospitals and clinics with DNA sequencing being performed for diagnosis, treatment and even prevention of diseases. The demand for DNA sequencing-based companion diagnostics tool for cancer and infectious diseases is driving services segment.

Preference for Outsourcing

-

Not every firm performing sequencing services can offer DNA sequencing data analysis, as it is a niche area and requires dedicated bioinformatics team to handle the data analysis service. The niche area of DNA sequencing data analysis is driving the DNA sequencing services segment as buyers are looking for integrated service providers.

Diversified DNA sequencing Platforms

-

Need for different sequencing platforms for different experiments, as there is no single sequencing platform to perform all set of experiments. The output of each platform is different, which brings sequencing in the need for different platforms. Also, the cost of sequencers had drastically reduced in the past few years across major players.

Constraints

Lack of Skilled Labor

- The crucial steps of sequencing, such as for sample and library preparation as well as analysis needs expertise. Also, library preparation rely on experience, as it is relatively a manual process and data analysis that involves huge volumes of complex raw data to interpret.

Surging Cost of DNA sequencing Reagents

- Even though, the DNA sequencing platforms rates have reduced considerably, the cost of reagents is surging up Y-o-Y, which increases the overall cost of DNA sequencing sequencing.

Data Accuracy and Standardization

-

Even after the introduction of sophisticated sequencers and better consumables, standardization of DNA sequencing data is still a bottleneck to the market growth of DNA sequencing platforms.

COVID-19 Impact on DNA Sequencing Market

-

DNA sequencing services were in more demand during the pandemic, due to the ongoing clinical trials, as well as more focus on COVID trials and diagnostic testing. Supply–demand gap was felt, due to the shortage of experienced personnel and increased turnaround time.

-

As businesses are faced with unexpected closures and demand uncertainties, the supply–demand gap would eventually increase hampering the ongoing clinical researches

-

Technology advancements like Nano pore technology can provide efficient sequencing in drug development: target identification and genetically stratified clinical trials

Outsourcing Adoption Rate : DNA Sequencing

-

DNA sequencing is outsourced at an approximate rate of 60-65 percent in 2020. It is mainly driven by high cost infrastructure and the expertise requirement for DNA sequencing services

-

Downsizing by pharma/biotech firms, decreasing research and development funding, and focus on core competencies are the key factors driving outsourcing

-

Though the supplier fee for an outsourced service is high, reduction in fixed costs over the long term is far beneficial

-

Drug discovery and development is still one of the prime areas to be outsourced among the non-clinical application segments. However, clinical application would see a vast increase in outsourcing rate in the upcoming years

-

Pharma and biotech companies are the largest end user segment that outsource the DNA sequencing services to reduce the overall fixed cost and improve the operational efficiency for DNA sequencing services

-

Outsourcing enables access to best-in-class technologies through the latest array of sequencers and also integrated services along with data interpretation and storage

Outsourcing the DNA sequencing services would help the buyer to overcome the challenge of increasing cost to drug discovery and development and access to diversified DNA sequencing platforms. Buyer may improve efficiency through project specific engagements and end to end customer solutions through the suppliers.

DNA Sequencing Market Trends

-

Even though FDA had not approved any DNA sequencing panels, the launch of these specialized diagnostic companion tools are not far. However many PCR-based companion diagnostic kits are available in the market

-

Changing regulatory scenario, CRO dynamics, risk sharing models, technologies are the key areas impacting early phase trial conduct. Buyers have to ensure suppliers have regional regulatory expertise, therapeutic, operational capability and innovative technologies to handle the complex trials. Upon assurance, a full service strategic partnership could be formed.

DNA Sequencing Key Outsourcing Trends

-

DNA sequencing is outsourced at an approximate rate of 60-65 percent in 2020. It is mainly driven by high cost infrastructure and the expertise requirement for DNA sequencing services

-

Downsizing by pharma/biotech firms, decreasing research and development funding, and focus on core competencies are the key factors driving outsourcing

-

Though the supplier fee for an outsourced service is high, reduction in fixed costs over the long term is far beneficial

-

Drug discovery and development is still one of the prime areas to be outsourced among the non-clinical application segments. However, clinical application would see a vast increase in outsourcing rate in the upcoming years

-

Pharma and biotech companies are the largest end user segment that outsource the DNA sequencing services to reduce the overall fixed cost and improve the operational efficiency for DNA sequencing services

-

Outsourcing enables access to best-in-class technologies through the latest array of sequencers and also integrated services along with data interpretation and storage

Why You Should Buy This Report

- The report gives details on the next generation sequencing market size, trends, growth drivers and constraints and the Porter’s five force analysis.

- It gives information on the NGS platforms, top suppliers and sourcing, pricing and engagement models in the next-generation sequencing market.

- It provides a competitive intelligence report on the major industry cases and important deals between suppliers and buyers in the next generation sequencers market.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.