CATEGORY

Discovery Services

Design of chemicals based on targeted action on a specifiic disease

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Discovery Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoDiscovery Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDiscovery Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Discovery Services category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Discovery Services category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Discovery Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDiscovery Services market report transcript

Global Market Outlook on Discovery Services

-

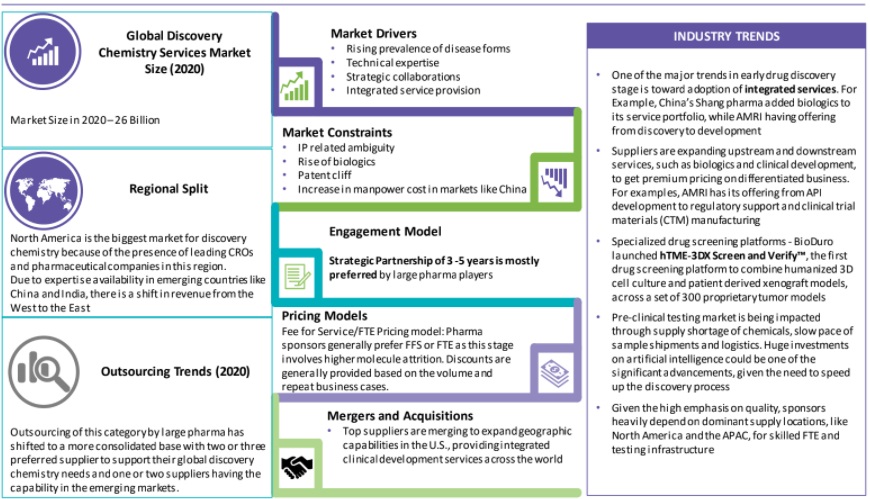

One of the major trends in early drug discovery stage is toward the adoption of integrated services. For example, suppliers are expanding upstream and downstream services, such as biologics and clinical development, to get premium pricing on differentiated business

-

Large CROs have been continuously expanding their supply base through acquisitions and partnerships to provide integrated services

-

The pre-clinical testing market is being impacted through supply shortage of chemicals, slow pace of sample shipments and logistics. Huge investments on artificial intelligence could be one of the significant advancements, given the need to speed up the discovery process

Global Market Size: Discovery Chemistry Services

Discovery chemistry services are highly fragmented and is a heavily outsourced function for small molecule discovery and with the rising numbers of biologics in pharma pipeline, the demand for discover chemistry is being affected adversely.

-

The market dynamics of research chemistry can be understood from the demand-supply perspective

-

From the demand side, pharmaceutical companies are facing pipeline issues and outsourcing additional activities. This trend has led to the emergence of integrated chemistry services, with emerging nations like India and China becoming favorable destinations

-

The discovery chemistry function is highly outsourced to leverage technical expertise and specific therapeutic area skill set at CROs

Discovery Services Regional Market Share

-

It is easier to offshore more routine services like medicinal chemistry and HTS to emerging regions like India and China. However, services like radiochemistry that require strict regulatory guidelines are mostly near shored to the developed markets

-

This is expected to change in the future with suppliers like WuxiAppTec building capabilities in technologies like computer aided drug discovery, improvements in fragment based drug discovery and sponsor’s willingness to outsource core functions

Key Supply Market Trends : Discovery Services

Adoption of Integrated Services

One of the major trends in early drug discovery stage is toward adoption of integrated services

- Service expansion to address increased demand in certain regions like China

Service Expansion and Consolidation

-

Suppliers are expanding upstream and downstream services, such as biologics and clinical development, to get premium pricing on differentiated business.

-

Consolidation in supplier base is also occurring, wherein two or more suppliers collaborate to take advantage of complementary capabilities

Movement to Low-cost Destinations

-

With rising costs and added pressure to invest in new services, it is becoming difficult for suppliers in emerging countries to provide cost leverage and also maintain its margins

Insourcing Services

- As a new service opportunity, suppliers hire chemists and place them in the client’s facilities. These chemists are on the suppliers' payrolls and the supplier is responsible for all the benefits to be given to the chemists

Launch of Research Institutes

-

Research institutes are being set up by governments to facilitate innovative drug discovery

-

For example: The UK government has set up institutes with integrated cloud and AI features. This would lead to an automated chemistry lab, which would speed up the discovery process

Cost Drivers and Cost Structure : Discovery Services

- FTE rates (staff) contribute to 40 percent of cost and can be negotiated through assurance of long-term contracts. Data management and instrumentations, which contribute to 24 percent, can be negotiated through bundled outsourcing and consolidation of supply base. Clinical unit and facility contributing to 16 percent could be negotiated by increasing partnership with academia and hospital networks.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.