CATEGORY

Digital Payment Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Digital Payment Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Visa partners PayPal for interoperable P2P payments

April 12, 2023UPI would be accepted in India as a form of payment for tourists from Australia and other G20 nations instead of cash.

February 14, 2023Standard Chartered and Allinpay partnership enables cross-border QR payments

February 14, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Digital Payment Services

Schedule a DemoDigital Payment Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Digital Payment Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Digital Payment Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

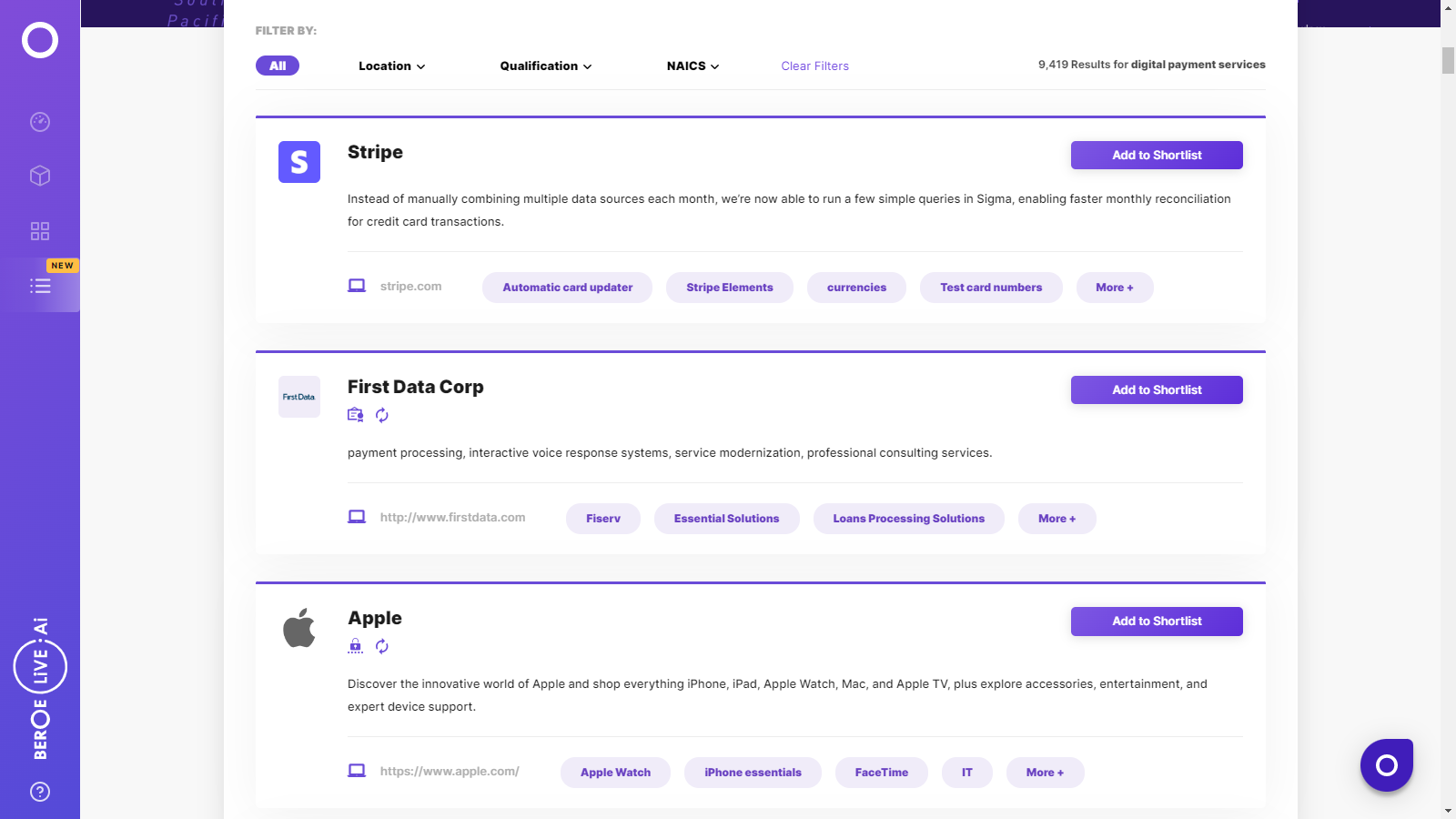

Digital Payment Services Suppliers

Find the right-fit digital payment services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Digital Payment Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDigital Payment Services market report transcript

Digital Payment Services Global Market Outlook:

-

It has been observed that 82 percent of the banking executives expect to increase their fintech partnerships in the next 3–4 years

-

It is expected that fintech will offer banks a speedy way to test and launch innovative services without having to complete their costly IT systems, while banks offer financial capital, an expanded customer base, and an imprimatur of greater legitimacy

-

The Global Digital Payments Market is estimated to reach USD 19.89 trillion by 2026 with a Compound Annual Growth Rate (CAGR) of 24.4%.

-

The demand for cashless payments over cash is being driven by greater convenience, favorable government policies, and evolving customer behavior

Digital Payment Services Pricing Structure

-

It has been observed that 82 percent of the banking executives expect to increase their fintech partnerships in the next 3-4 years. The commission rates charged for the transactions Is expected to increase as the demand for digital payments is higher during the pandemic

-

It is expected that fintech will offer banks a speedy way to test and launch innovative services without having to completely their costly IT systems, while banks offer financial capital, an expanded customer base and an imprimatur of greater legitimacy

Digital Payment Services Key Market Trends

The North American region is projected to be dominant regional market due to the availability of highly advanced infrastructure presence and presence of established market players.

Electronic & Contactless Payments

- Two years into the pandemic, there was an increase in the use of electronic and contactless payments, along with the launch of numerous new digital wallets. According to NMA, this widespread adoption will last through 2023.

Biometric authentication

- Biometric authentication has been rapidly emerging in 2022. It may develop into a dependable and secure solution for all digital payments made in 2022 as identity theft and fraud issues are on the rise.

Increasing Demand for Point of Sale

- The demand for POS has been increasing and around 1.6 billion global consumers are expected to pay with digital wallets at the point of sale (POS) in 2023, accounting for 30 percent of POS payments.

Adoption of AI and Blockchain

- AI can be used to improve the speed and efficiency of the payment process A new system of international settlements can be developed using the technology behind digital currencies and blockchains that will be far more practical and completely safe for its users.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now