CATEGORY

Debt Sales

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Debt Sales.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoDebt Sales Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Debt Sales category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Debt Sales category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

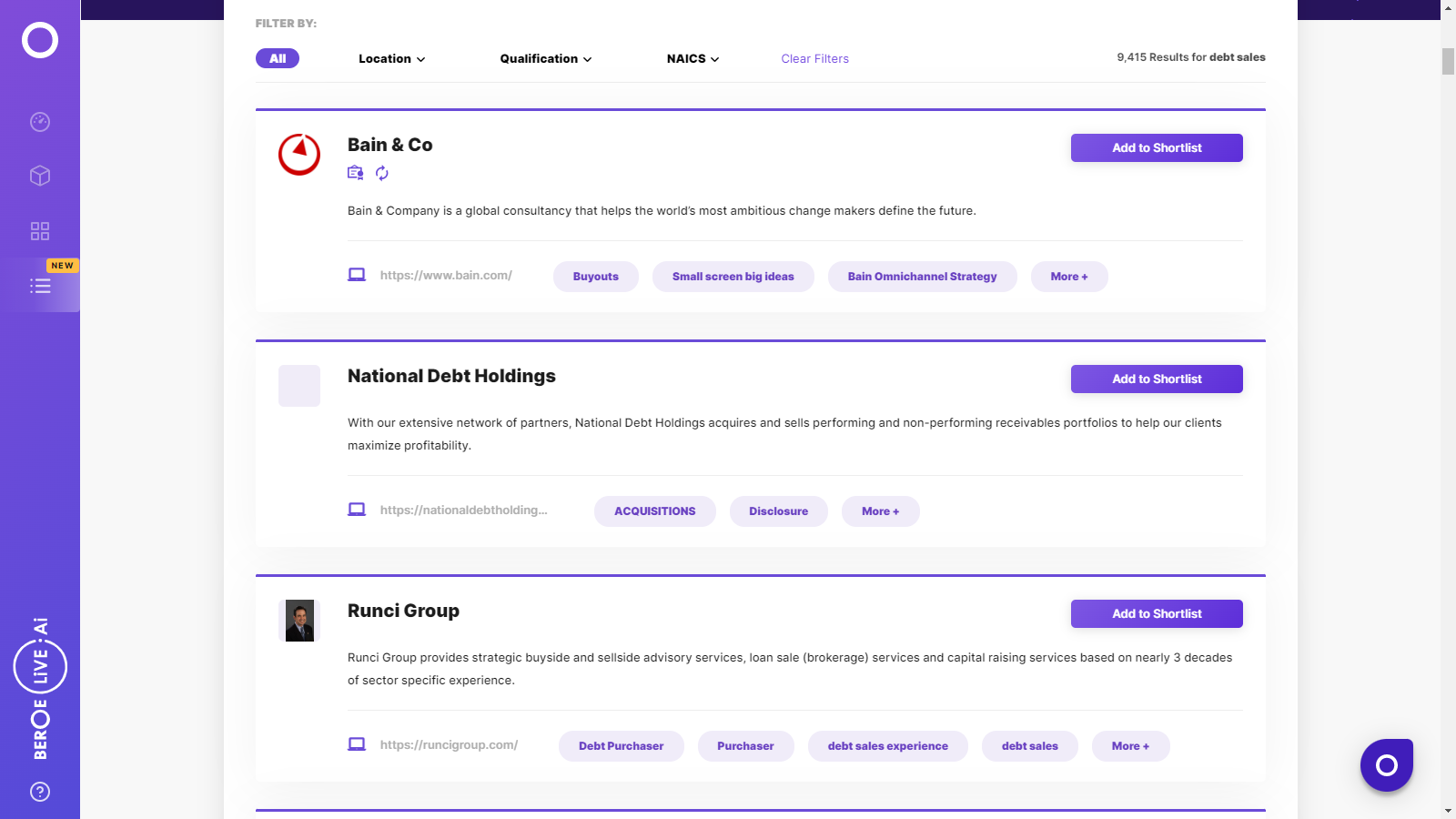

Debt Sales Suppliers

Find the right-fit debt sales supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Debt Sales market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDebt Sales market report transcript

Debt Sales Global Market Outlook:

Global Capacity: $1.1 trillion (Estimate for 2022)

Annual Growth Rate: Approx. 5 percent (2022-2026e)

-

The global debt sales market doubled in 2022*, due to the COVID-19 pandemic, economic slowdown, and rising credit risk and the estimated credit losses of banks are expected to increase by 12 percent in 2022 and return to pre-pandemic levels by 2025

-

The highest supply of NPLs is from banks in Europe, followed closely by the North American region. NPL sales are expected to grow in 2022-2023 with an increase in bank’s capital management and with players in non-banking sectors building better expertise to handle NPLs and are looking for a steady cash in-flow

-

Buyers are focused on purchasing smaller portfolios, mainly due to the lack of funds and capability to buy higher portfolios, which comprise of 60 percent of the total market estimate

Debt Sales Growth Drivers and Constraints

Increase in loan defaults and the need for liquidity by Banks will be the major growth drivers for this market. The increase in data security costs will be the major constraint.

Drivers

Increased Loan Defaults:

- The slow down in the economic activity could result in an increase in non-performing loans. Banks will try and sell their NPL’s to maintain sufficient cash requirements. Increasing defaults on mortgage debt, credit card debt, student loans and medical bills have increased the supply for debt amongst banks and other financial institutions

Cash Flow Requirements

- An increase in defaulters, has caused a cash constraint and hence increase in the need for liquid assets by Banks.

Constraints

Increase in Costs due to Regulatory and Security Requirements

- The increase in need to adhere to regulatory requirements like the General Data Protection Regulation (GDPR), California Consumer Privacy Act has increased the compliance costs related to data privacy

Debt Sales Key Technology & Market Trends

Use of online marketplaces or exchanges to sell NPLs by banks and use of Machine Learning, Artificial Intelligence, and Data Analytics by Debt Buyers to achieve better recovery are the key technology trends.

Banks in the APAC region are trying to offload their NPLs at a deep discount to local Private Equity (PE) Firms and international investors.

Use of Technology by Debt Buyers

-

Machine Learning, Artificial Intelligence, and Data Analytics are being used to analyze the Payment Patterns of customers. This can be used to identify repeat defaulters

-

This analysis can help Debt Buyers to create a repayment plan and timely reminders, and hence, achieve better recovery

New Investors to enter the Market (especially in the APAC Region)

-

Investors are considering APAC Markets as a new source of investment. Banks in this region are willing to sell their NPLs at a deep discount. This sale is not only attracting local PE firms and investors but also international investors

-

With economies reorganizing and restructuring their financial service companies, investors are identifying new ventures to invest in

Use of Online Channels to Sell NPLs

-

With increasing digitization, online marketplaces or exchanges or platforms are available to facilitate easy disposal or sale of NPLs by banks via auction process

-

This trend is prominent in the Asia Pacific region, mainly in China. A secondary online market, where Asset Management Companies (AMCs), can further sell a portion of their NPLs to third-party investors at a higher price also exists

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now