CATEGORY

Debt collection Services

Report on top debt collection & debt purchase suppliers across several regions -APAC, US, UK, Africa

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Debt collection Services .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoDebt collection Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoDebt collection Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Debt collection Services category is 6.20%

Payment Terms

(in days)

The industry average payment terms in Debt collection Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

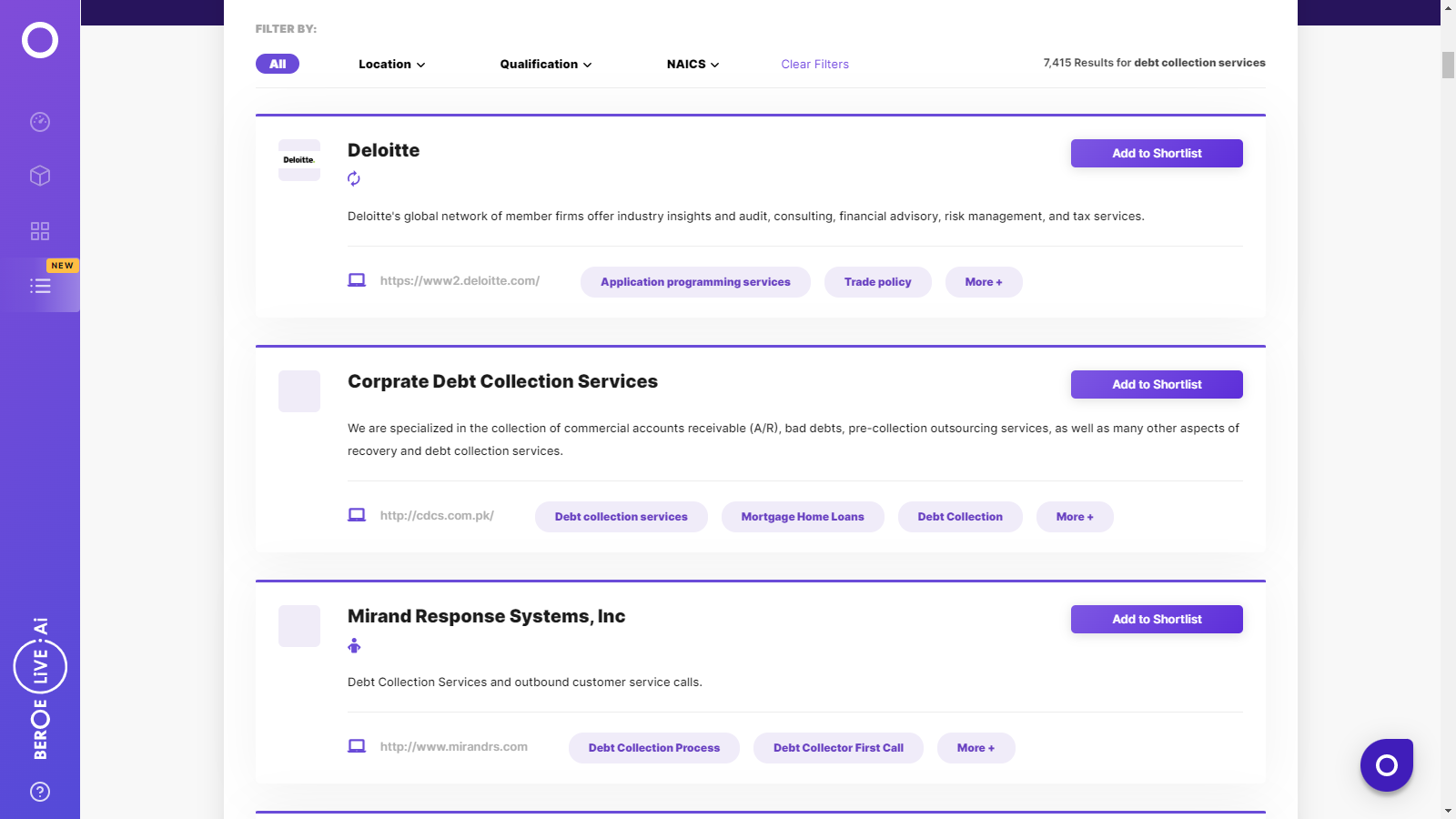

Debt collection Services Suppliers

Find the right-fit debt collection services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Debt collection Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDebt collection Services market frequently asked questions

As per Beroe's analysis, global debt collection industry outlook is a combination of the following pointers: -- The outsourcing of debt collection to third-party agencies is higher in North America and the APAC region -- Rising household debt in Canada that surpassed the country's GDP a while back is expected to drive the third-party debt collection industry in North America -- APAC region banks have a higher tendency to outsource international debt collection activities

Two primary constraints of the debt collection industry are: -- Increasing labor costs ' Debt collection is a labor-intensive process & salaries comprise nearly 30 ' 40% of the total cost. So, any increase in the labor cost will affect the profit margins -- Stringent regulations ' The governments are planning to impose strict debt collection industry regulation policies on the debt collection industry especially for matured regions like North America and Europe which are already bound by directives & acts like FDCPA, TCPA, and CCD.

According to Beroe's report, increasing complexity of the regulatory environment across North America and Europe poses a big threat to the debt collection industry growth.

According to the report, the highest market size is captured by North America at a valuation of $17.05 Bn followed by Europe at $7.58 Bn, and the Asia Pacific at the lowest valuation of $3.3 Bn.

As per Beroe's analysis report, the following are the leading debt collection industry trends: -- There's a considerable increase in the tendency to outsource the in-house process of debt collection especially in the North American companies -- Final demand letter (an additional service for the debt collection industry) has seen a higher adoption rate among the mid-sized companies Invoicing (Transaction) verification (for checking the accuracy of debts) is expected to be lower in North America due to the higher internal efficiency of the creditors.

Debt collection Services market report transcript

Global Consumer Debt collection Services Industry Outlook

-

Outsourcing of debt collection to third-party agencies is higher in North America and APAC

-

APAC banks have a higher tendency to outsource the international debt collection activities

-

Increasing complexity of the regulatory environment across North America and Europe is acting as a threat to the growth of the debt collection industry

Debt Collection Industry Trends

-

Increase in the tendency to outsource in-house process of debt collection has been witnessed, especially among the North American companies

-

Higher adoption of the final demand letter, an additional service for the debt collection industry, has been seen mostly among mid-sized companies

-

Invoice or transaction verification, the process for checking the accuracy of the debts, is expected to be lower in North America, due to the higher internal efficiency of the creditors

-

Credit issuing companies have attempted to manage cash flow and costs by outsourcing debt collection services at higher rates. This trend has resulted in increased opportunities for industry operators

Debt Collection Drivers and Constraints

Drivers

Better recovery rate

- Creditors, incurring huge losses due to increase in delinquent debts, have experienced an improved recovery rate of 10-12 percent, by outsourcing debt collections

Better utilization of time and resources

-

Debt collection is an extremely complex and slow process, especially for smaller banks

-

By outsourcing this process, banks have realized better cost savings, as well as resources which can be utilized for their core functions

Technological advantage

- Better offerings of technology by the Debt Collector Agencies (DCA) such as skip tracing, text messaging, analytics, etc.

Low Interest Rates

- Record low interest rates in countries around the globe have made it easier and more attractive for corporates, individuals and governments to borrow and incur more debt

Constraints

Increasing labor and technology costs

- Debt collection is a labor-intensive process and salaries comprise 30–40 percent of the total costs. But the advent of technology can not offset the costs incurred as subscription to software and other services are just as expensive as hiring extra FTEs. The increasing labor rates, especially in the developed countries, is expected to affect the profit margins

Stringent regulations

- Governments are expected to impose stricter regulations on the debt collection industry, especially in matured regions like North America and Europe, which are already bound by directives and acts like FDCPA, TCPA, CCD

Supply Trends and Insights : Debt collection Services

Strategic Partnerships

- Agencies are looking at strategic collaboration and M&As for growth and larger players are increasingly looking for attractive acquisition partners, who would contribute to profits, expansions, and technological changes to their agencies. The major acquisitions are Experian Group acquiring the digital identity resolution service provider, Tapad, to improve their fraud and identity management services and Atradius expanding their global presence in Europe by acquiring a Portuguese collection agency, Gestifatura. This brings up the presence of Atradius in 34 countries around the globe.

Analytics and Advanced Underwriting Services

-

Agencies are using advanced underwriting tools to track the client customer’s repayment history and patterns, their credit scores and risks, and assets under their name to come to a more informed decision after buying portfolios from banks and other financial institutions. This will help the agencies to prioritize and focus on the sure return of investments (people who can repay the debts) and send the high-risk cases over to legal as soon as possible to speed up the collection process and increase the steady cash flow within the company.

-

Investment in Debt Collection Software: The remote working nature due to the pandemic has made several agencies invest in Debt Collection SaaS providers (both clod and open-API) to facilitate their FTEs to work from their homes and ensure maximum returns during these troubled times.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now