CATEGORY

Corn

The Corn market is currently in a state of oversupply with rapidly falling prices. Wet milling of corn also yields several types of end-products such as starch, polyols and others which find application in many industries.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Corn.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Bulgaria and Slovakia plan to ban import of Ukrainian grains

April 20, 2023European Commission criticizes decision by Poland and Hungary on ban of Ukrainian grains

April 17, 2023Europe faces drought again across southern parts of the region

April 17, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Corn

Schedule a DemoCorn Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCorn Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Corn category is 4.00%

Payment Terms

(in days)

The industry average payment terms in Corn category for the current quarter is 95.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Corn market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCorn market frequently asked questions

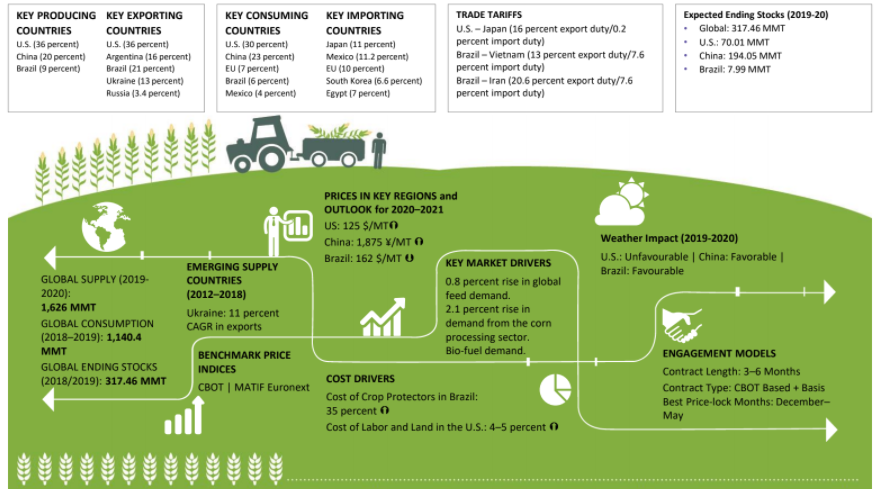

The global supply of corn during 2019-2020 reached 1163 metric million tons (MMT), while the consumption pegged 1140.4 MMT. This trend is driven by tremendous production in developed regions and rising demand from the feed and citric acid industries.

As per Beroe’s study, the US and China collectively account for over half of the global corn consumption, owing to the high concentration of corn starch and corn processing industries.

Corn starch finds use in producing sweeteners and sorbitol, which is a crucial ingredient in vitamin C. Further, the global sorbitol market will grow at a 3.6% CAGR. In comparison, the corn starch market will rise by around 5% CAGR over the years ahead.

The global corn market is receiving major impetus from the increasing demand from the feed (by 0.8%) and corn processing industries (by 2.1%). Furthermore, the rapid shift toward biofuels is adding another leg of growth.

The US and Brazil collectively make up for around 60% of the overall corn exports, followed by Argentina (16%), Ukraine (13%), and Russia (3.4%).

The COVID-19 pandemic has led to surplus supplies in the US along with reduced demand from the animal feed sector, especially from China, which will hit the corn prices. In addition, corn stocks are expected to hit record levels. Furthermore, the declining demand from the domestic feed industry will fuel a downtrend in corn prices. As such, end-users prefer spot buying.

Corn market report transcript

Global Market Outlook on Corn

-

The global production in January 2023 is estimated to reach 1,155 MMT

-

The key factors driving the growth include demand from the end-use segments, such as the citric acid market and feed industry in China, Canada switching to green fuels and increased domestic utilizations in most countries, amid the pandemic. Unfavorable weather conditions in key growing destinations, coupled with a loss of Ukrainian grain exports, also impacted the market this year

Global Supply–Demand Analysis

-

The global production has risen by approx. 11 percent over a five-year period as a response to the rise in demand by approx. 14 percent during the same period

-

The major drivers of demand and supply are the end-use industries, such as corn starch and animal feed, which influences the price trend

-

The global supply of corn has been rising by approximately 11 percent over five years. The global production in 2022 is forecasted to reach 1,217 MMT from the previous year’s 1,129 MMT

-

China is boosting its food reserves by stocking the majority of the world’s grain reserves in its largest stocking base in Dalian port. The country is expected to have 69 percent of the world’s corn reserves and 51 percent of wheat by this year. Overall, this has led to a shoot-up of global commodity prices, which will continue the trend this year as well

Est. Corn Global Demand by Application (2021–2022)

-

The global demand from the feed and residual sectors has risen by about 14 percent over a five-year period and expected to rise by approximately 5–10 percent this year compared to previous years

-

Rising corn prices could make it less attractive feedstock for animal feed, and instead shift to other substitute crops

Est. Corn Consumption by Country (2022 E)

-

The U.S. and China are the top consumers of corn because major corn processing end-use segments are based in these countries

-

The U.S. consumption of corn has risen by about 8.8 percent over a five-year period, while for China, the increase is 15 percent

-

China is a key supplier in the corn starch processing industry, and it has a significant global market share of end products, like polyols and HFCS

-

The U.S. demand for corn comes from the feed and industrial sectors

Global Corn Trade Dynamics

-

LATAM countries have traditionally been competitors of the US for exports. However, this year dry weather conditions in Brazil, coupled with delayed plantings, are expected to heavily impact second crop quality

-

Post reports on significant crop reduction from South American regions, China has announced its plans to begin stockpiling of grains to ensure food security. The country expects to stock up 70 percent of the global corn supplies by mid 2022. Rationing of corn stocks for ethanol and feed uses have already strengthened price trends.

-

According to USDA forecasts for China, corn consumption for animal feed market is expected to hike by 2.8 percent in 2022/23 while corn output has been cut down. This is mainly due to the push in oilseed production and unfavorable weather conditions. Corn exports could reach 20 MMT for 2022/23 while import volumes for 2021/22 has been revised to 23 MMT. 2021/22 import volume estimates have been reduced by 2MMT due to contraction in China import post war

Cost Structure Analysis: Corn

The total cost for the production of corn in the US is approx. $927/acre. In the case of Brazil, the cost is BRL 2674.29/Ha.

US (2022)

-

The total corn production cost for the US is $927/acre

-

The total operating cost and total allocated overhead cost comprise 48.7 percent and 51.3 percent of the total cost, respectively

-

Seed, fertilizer, and land rent constitute the major cost components

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.