CATEGORY

Consumer Healthcare

Studies on consumer trials that accelerates consumer

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Consumer Healthcare.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Bayer issues call for renewable consumer healthcare packaging

September 13, 2022Haleon emerges from GSK consumer healthcare spin-off

July 28, 2022Swanson Health Launches Swanson W/I/O?

August 10, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Consumer Healthcare

Schedule a DemoConsumer Healthcare Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoConsumer Healthcare Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Consumer Healthcare category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Consumer Healthcare category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Consumer Healthcare market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoConsumer Healthcare market frequently asked questions

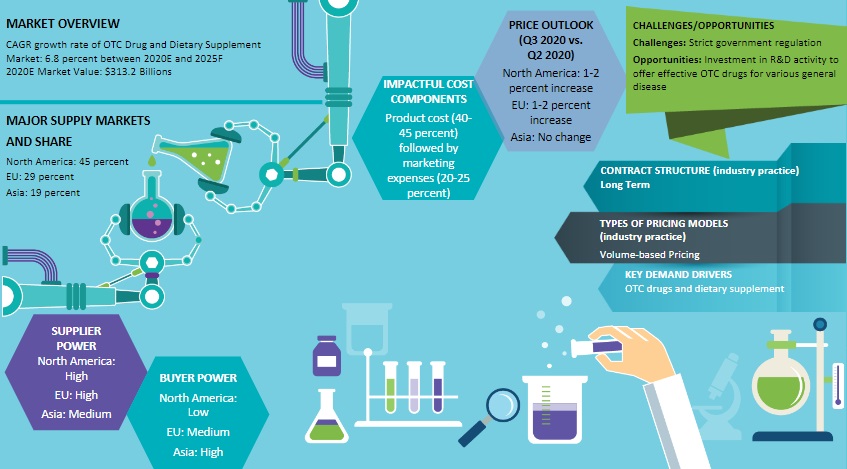

As per Beroe's analysis, the consumer healthcare market size of different continents like North America, Europe, Asia Pacific, and Latin America is $266.59 Bn, $208.95 Bn, $144.10 Bn, and $100.87 Bn respectively.

Consumers suffering from mild gastrointestinal conditions usually rely on drugs like laxatives, antidiarrheals, and digestives.

The practice of self-medication reduces the pressure on medical services and patients living in rural areas can easily access it. Further, it will also positively affect the market beyond 2020.

As per the insights from Beroe's report, the key suppliers of the consumer healthcare market are: Myoderm Piramal Healthcare Catalent Inc. Quantex Recipharm ABCO Laboratories, Inc. Zeon Lifesciences North Carolina Clinical Research Novex Clinical Research Covance

From Beroe's report, one can conclude that the US and Europe are the major markets for consumer healthcare products, whereas, APAC is growing rapidly at a CAGR of 18 percent.

As per the consumer healthcare market report shared by Beroe, the volume-based model is the most preferred model in the consumer healthcare market, while the service-based model is alternatively preferred by the consumers. Similarly, the FTE model is more preferred when it comes to pricing, while FFS and fixed-unit price are alternate models prevalent within the consumer healthcare market.

Following the data from Beroe's report, with a shift in buyer trend and increasing outsourcing of consumer healthcare services, the suppliers are expanding their capacities. Similarly, strategic partnerships between CROs and big consumer healthcare companies will drive flexibility, reduce costs, and extend expertise.

As per Beroe's report, the following are the main drivers of the consumer healthcare market: Increasing use of online resources and e-commerce websites Self-medication Aging population Focus on wellness

The following three constraints are prevalent within the market: Increasing regulatory framework across the regions Prevention of abuse and misuse by the consumers Counterfeiting prevention

As per the global consumer healthcare market, the availability of low-cost drugs to the public is the main driving force for the emerging consumer healthcare market.

Consumer Healthcare market report transcript

Global Market Outlook on Consumer Healthcare Services

-

The global demand is expected to grow at approx. 8 percent CAGR through 2022–2028, which is estimated to reach $614 Billion by 2028F

-

The OTC drugs and dietary supplements are the major growth drivers

-

The adoption of self-care, personalized nutrition, and effective utilization of OTC drugs for minor disease could be the future trend in the consumer healthcare space

-

High adoption of traditional product for treatment of minor diseases, such as cold and cough, could accelerate the market of traditional product across Asia

Global Market Size and Growth Forecast

-

Consumer health products do not require a written prescription from healthcare professionals but can be purchased directly from a pharmacy store.

-

For instance, consumers with mild gastrointestinal conditions use gastrointestinal drugs such as laxatives, anti-diarrheals, and digestives. The practice of self-medication also reduces the pressure on medical services and is easily accessible to patients in rural areas. This growing practice of self-medication is expected to positively affect the market for consumer healthcare market until the end of 2020. Factors like the increasing use of online resources and e-commerce websites will aid the prospects for market growth

-

For instance, websites such as healthkart.com, vitacost.com, and vivavitamins.com offer a wide array of vitamin health drinks, protein shakes, and supplements online. Also, these sites offer live interactive chat sessions to provide instant support to individuals who face challenges while purchasing such products. This recent shift toward the use of e-commerce websites and online resources is expected to drive the market growth for consumer healthcare products during the forecast period.

Outsourcing Adoption Rate

Companies are looking out ways to reduce costs, to overcome capacity constraints, to minimize fixed costs, minimize product-market cycle times and to achieve capital efficiency. Further, these companies are extending their global footprints and try to localize their products. These companies, therefore, are turning to value-based outsourcing and becoming ‘Consumer Centric.’.

Key Outsourcing Trends

-

Increasing R&D Failures

-

Capital Efficiency (30-50 percent Cost Optimization)

-

Global Footprints and Localization

-

Capacity Constraints for product & line extensions and new products

-

New Product Development & Delivery Systems Technologies for product differentiation

-

Value added generics

-

Emerging Markets

-

Need for operational excellence in terms of GMP and regulatory compliance

-

Need for integrated & specialty services

-

Need for cost efficiencies due to patent expirations and increasing generics competition

-

Access to proprietary technologies for achieving product differentiation

Consumer Healthcare Services : Regulatory Trends

Regulatory paradigms that are evolving at regional level and changing worldwide

-

Evolving of defined and transparent regulatory guidelines for prescription, OTC, dietary supplements, nutritional products etc

-

Regulatory frame work for controlling each & every function research, manufacturing, quality control, labeling, packaging, storage and distribution, logistics etc.

-

Regulatory framework for proof of efficacy and safety

-

Restrictions on animal testing

-

Restrictions on the usage of certain packaging components like plastics for liquids

-

Post-marketing vigilance onthe efficacy & safety

-

Anti-counterfeiting measures throughout the ‘supply chain management

Growth Drivers and Constraints

Drivers

-

Entry of CPG Companies

-

Need for cost efficiencies due to patent expirations and increasing generics competition

-

Access to proprietary technologies for achieving product differentiation

-

Leverage of external R&D sources between companies and vendors

-

Value-based-payment Models

-

Entry of numerous small, virtual start-ups having little market that have no manufacturing capacity and product development experience.

-

Government Policies to provide ‘Affordable Healthcare & Easy Access to Healthcare’.

Constraints

-

Increasing ‘Regulatory Framework’ across the regions.

-

Burden of proof w.r.t. health benefit claims and safety esp. in EU

-

Prevention of abuse and misuse by the consumers

-

Counterfeiting Prevention

-

A&M of Vendors with Global CMO Companies thereby minimizing business opportunities and affecting Consumer Healthcare Market-R&D

Consumer Healthcare Services : Market Trends

The consumer healthcare market remains highly competitive and fragmented albeit leading companies continue to consolidate their market position through high-profile and strategic acquisitions.

-

A positive regulatory outlook in key markets, due to new initiatives and frameworks looking to facilitate OTC approvals, will also prompt companies to seek access to new markets.

-

Drug manufacturers, regulators, and consumers are increasing pressure on pharma companies to make the Rx-to-OTC switch, as non-prescription medications are cheaper and easier to access.

-

Beyond basic efficacy data, potential benefits of a switch could include increased access to treatment options, improved quality of life, improved public health, enhanced consumer awareness and involvement, or greater worker productivity

-

A high M&A activity is witnessed in the personalized nutrition segment, as companies active in the space are working toward building a sustainable end-to-end ecosystem

-

M&A is expected to remain very active in the coming years fueled by strategic long-term commercial priorities, as companies look to increase revenues through expanded product portfolios.

-

Technology providers are also entering the consumer healthcare market by strategically partnering with the top players of consumer healthcare to develop a consumer and financial engagement platform which is more patient focused

-

COVID-19 has a significant impact on consumer behavior, a greater number of people are now utilizing trackers to monitor their health condition and fitness

-

A high number of people are opting for virtual clinics and telemedicine, encouraging companies to expand their offerings in the new emerging market

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.