CATEGORY

Commodity Transportation And Backhaul Opportunities South Africa

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Commodity Transportation And Backhaul Opportunities South Africa.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Commodity Transportation And Backhaul Opportunities South Africa market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCommodity Transportation And Backhaul Opportunities South Africa market report transcript

Regonal Market Oulook on Commodity Transportation And Backhaul Opportunities

Trucking Best Practices and Benchmarking

Contract Terms and KPI's

- Primary distribution contract is about 2-3 years and secondary distribution contracts revolve around 12-18 months

- Standard payment period in South Africa is 30 days from the date of invoice

- Main KPI is OTIF (On Time In Full) as customer service excellence is one of the main strategic objectives of the business

Service Provider Engagement

- National players are mostly selected for primary distribution of finished goods from the manufacturer to the distribution centers

- Regional players are selected for secondary distribution, mainly due to the shorter distances travelled and multiple deliveries

Rail Freight – South Africa

Market Analysis

- The South African rail market is not fragmented as Transnet is the only freight rail operator in the market. Mining and heavy industries, agriculture and forestry supports the growth of freight rail network and drives the demand for rail freight

- The maximum life span of the fleets being 46 years, almost 51 percent of the fleet in South Africa is expected to retire soon

Supplier Analysis

- Transnet is made up of the following business units: Agriculture and Bulk liquids, coal, container and automotive, iron ore and manganese, steel and cement, mineral mining and chrome

- Transnet freight network consists of 31,000 track kilometers and 22,500 route kilometers and moves 10 percent of the nation's freight annually. Transnet also links South Africa's neighboring countries like Namibia, Botswana, Mozambique, Lesotho and Swaziland

Capacity &Utilization

- Due to limited capacity, Transnet experiences high demand in the major corridors. Hence, shippers prefer rail mostly to transport raw materials but due to high costs, shippers prefer to engage road transporters instead of Transnet

- Transnet is continuously raising investments in order to expand its network and capacity by 2020

Rail Opportunities for Client

- Long Hauls: The client can make use of rail freight for long hauls of more than 250kms for transporting commodities such as grains and hops along with malt

- Capacity: Due to various strategies and expansions the capacity of rail freight is set to increase thereby Client can make use of rail to transport even its palletized goods and finished products in the future

- Cross Border:Transnet also have rail connections with cross border rail freight service providers which the client can leverage upon for its cross border shipments to Botswana, Namibia, Swaziland, Lesotho and Mozambique

Backhaul Opportunities – South Africa

- South Africa is one of the largest country in Africa with a broader landscape. Hence, manufacturers in South Africa are widely spread across various industries and provinces

- The client's scope for engaging these manufacturers for backhaul opportunities are quite high as most of the manufacturers have production plants along the client's lane of operation

Transport Infrastructure Capability - South Africa

- Currently, a majority of line haul portion of the freight movements are through road/rail mode, and distribution activities at the origin and destination are carried out by trucks

- Around 90 percent of the volume movement from ports are done via road. This includes goods from industries, such as consumer goods, agriculture, pharmaceuticals and automotives

- Rail freight mode is mostly used for bulk commodity movement from the port region

- Transnet is aggressively investing in rail mode for improving the capacity, infrastructure and reliability, especially for industries such as mining and agriculture, to expand the usage of intermodal in the coming years

- In 2013, about R290 million was invested to expand the iron ore line from Sishen to Saldanha. To upgrade the aging equipment, additional 32 locomotives will be acquired, of which,16 are already delivered

- For general freight business, a total of ~R13 billion was invested in 2013. More than 100 locomotives and few hundreds of wagons were ordered to improve the facility further

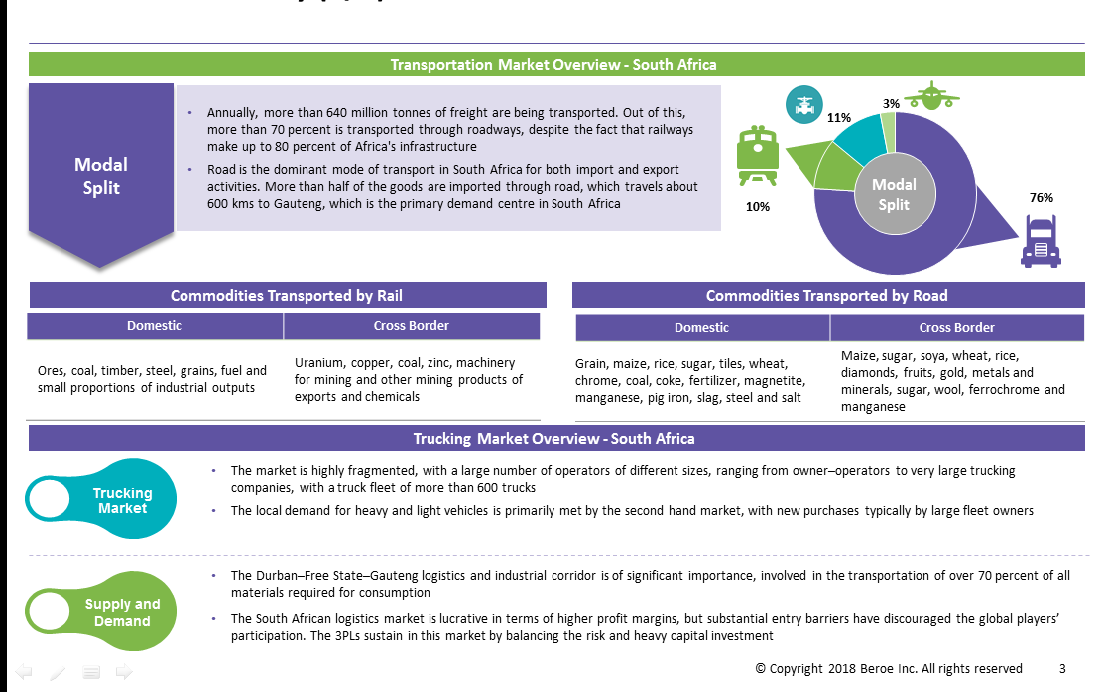

Transport Market Overview - South Africa

- Road is the most dominant transport mode in South Africa for both import and export activities. More than half of the goods are imported via road which travels about 600 kms to Gauteng, which is the primary demand centre

- Majority of the goods exported from the country are coal, iron ore and manganese, which are generally moved by rail or intermodal

- Annually, more than 640 million tonnes of freight are being transported, out of which, more than 70 percent is moved by road, despite the fact that railways make up to 80 percent of Africa's infrastructure

- At present, the supply–demand imbalance is extremely high because the country is over dependant on the import of goods for domestic consumption, which is higher compared to the value of goods exported

Trucking Market - South Africa

State of Trucking Market in South Africa

- The market is highly fragmented with a large number of operators of different sizes, ranging from owner-operators to very large trucking companies with a truck fleet of more than 600 trucks

- The local demand for heavy and light vehicles is primarily met by the second hand market, with new purchases typically by large fleet owners

- Low sale of new vehicles further signifies the depreciating condition of fleets, poor infrastructure condition and the resultant high logistics cost, due to high truck maintenance

Road Line Haul Trend in South Africa

- Line haul shipments are predominantly truckload and used for consolidated shipments. The primary loop is from the port to the plant, plant to DC or distribution to large retail outlets

- While primary distribution is through key transport corridors, wherein the road conditions are fairly good, they are forced to undergo multiple tolls, which adds to the total operating cost

- The engagement model for primary distribution is to outsource to a 3PL with regional presence. This would help in reducing the cost associated with empty backhauls

Secondary Haul Trend in South Africa

- Final mile delivery of finished goods within metropolitan and urban areas is done using a low-capacity truck. This enables access to destinations, which have weight restrictions

- Secondary transportation is carried out by 3PLs or standalone transportation service providers with local presence and hubs that provide opportunities for collaborative distribution and cost reduction

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.