CATEGORY

Cocoa

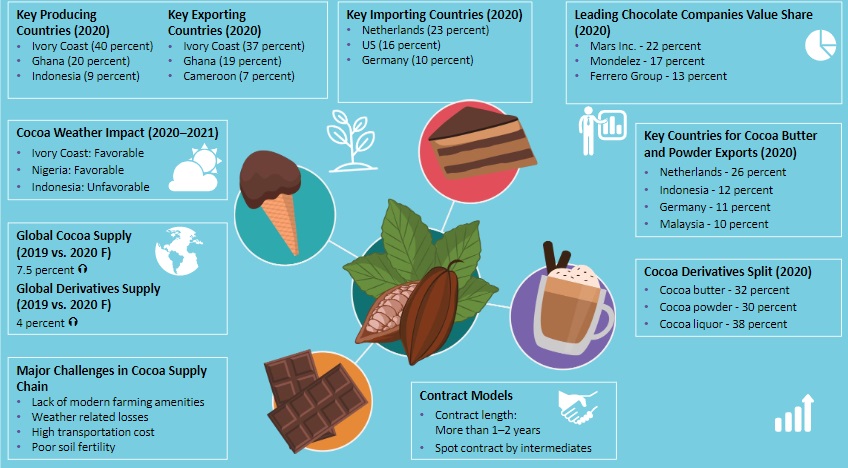

Cocoa is a bean which is dried and fermented to produce chocolate. There are derivatives such as cocoa butter, powder, liquers that are produced from cocoa beans which are used in different proportions to be made into chocolate.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cocoa.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCocoa Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCocoa Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cocoa category is 8.00%

Payment Terms

(in days)

The industry average payment terms in Cocoa category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Cocoa market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCocoa market report transcript

Global Cocoa Market Outlook

- Global cocoa production is expected to witness an improvement as the output from Ivory Coast and Ghana. The official estimates are yet to be released, but as per market estimates, a nearly 8–10 percent increase can be expected in the marketing year 2022–2023

.

Contract Structures

Direct Buying from Farmers >2-–3 years

-

Direct buying from farmers is usually carried over in long contracts for efficient procurement

-

This type of contract has a constraint of reaching the farmers regularly and supplying them technical management, which companies perform as a sustainability action

-

Buying from intermediates may be an easier option of spot buying at a cheaper price

Buying from Intermediates (6–12 months) Short Term/Spot buying

Farmers do not get fair pay, and hence, the sustainability of cocoa market prices, in the future, would be questionable

Buying through Co-operatives >2 years

-

Presence of co-operatives, who liaise between the farmer and the buyer, usually take care of a fair price at both the ends

-

Usually, this type of contract is long term for more than 1–2 years

-

The active participation of co-operatives is directly correlated to the country's political influence and unification of the farmers, which is a drawback of this contract

Cocoa Market Overview - Cocoa, Cocoa Butter, Liquor, and Powder Material Process Flow

Cocoa undergoes extensive processing from the bean to the various end products and by-products of the processes. This section of the report illustrates the process and the product at each stage.

Cocoa Harvesting Season in Major Producing Belts

Cocoa is a seasonal crop and the harvesting periods differ geographically. This section gives an at-a-glance report on the global harvesting seasons with differentiation between the main crop and the mid crop. It also lists the important takeaways on cocoa harvesting.

Cocoa Beans - Market Snapshot

This section gives the market information such as total global production growth, export information, average price, and price drivers for the cocoa beans market.

Cocoa - Supply Analysis

The economic stagflation in EU and the US, coupled with higher logistics and shipments costs, could impact the supply of cocoa.

-

The West African region (Cote D'Ivoire and Ghana) continues to dominate cocoa bean production over the years and has approx. 76 percent of the global market share, due to favorable climatic conditions prevailing in those regions. Apart from this, Ecuador is the major producer of cocoa beans

-

Globally, Europe is the biggest grinder of cocoa, which has approx. 36 percent of the global cocoa grinding market share. In the European region, the Netherlands is a leader in grinding.

The report also illustrates the top cocoa bean producing and cocoa bean grinding regions.

Cocoa Beans - Supply Analysis

-

Global production of cocoa is expected to increase in 2022–2023 crop year compared to the previous year. Grinding is expected to increase marginally.

-

Several factors, such as adverse weather conditions and low yield rates in Mid-Africa, have resulted in a drop in the production of cocoa beans in the present crop year 2021/2022

-

Another major reason for a drop in yield would be a limited supply of fertilizers at a higher cost in the current crop year, owing to the ongoing Russia–Ukraine conflict

-

Demand for cocoa on the other hand witnessed a spike in the first few months of 2022, mainly owing to the resumption of activities in the air travel space, which is a major area of chocolate sales

Cocoa - Trade Dynamics

The trade dynamics of the cocoa bean market such as global trade volume, exports by country, and imports by country are illustrated with key takeaway points.

Cocoa - Pricing And Cost Structure Analysis

The various factors of the pricing of cocoa beans are studied in this section of the report. The key drivers that affect the price are listed. The price trends are illustrated along with future price outlook. The share of the different cost inputs to the final cost is illustrated.

Cocoa Derivatives - Cocoa Butter and Powder Market Snapshot

- This cocoa market report lists the important market and price driver information for the cocoa derivatives individually.

Cocoa Butter - Trade Dynamics

- This section offers information about the global trade volume, exports by country, and imports by country for cocoa butter. It also gives insights about the factors that affect the trade dynamics of the cocoa butter market.

Cocoa Powder - Trade Dynamics

- Some countries are the top consumers of cocoa powder. This report analyses the trade dynamics of the global cocoa powder market and the factors that affect it. The individual components that impact the price of cocoa butter are listed with the price trends and forecast. The price outlook for the next 3-6, 6-9 and 9-12 months are given.

Cocoa Butter & Powder - Cost Structure Analysis

- The raw material, processing, and other costs that add to the final cost of cocoa butter and powder are illustrated.

Cocoa - End-use Demand Analysis

- The end-use applications of cocoa determine the demand in the market. The report details the end-use demand for cocoa butter, powder, and liquor. The top 10 chocolate companies are also listed with their market sales values.

Industry Analysis

- The different factors that affect the supplier, buyer and other market factors are studied alongside the challenges that are faced in the cocoa bean market.

Challenges in Cocoa Supply Chain

- The cocoa bean supply chain is spread worldwide and the levels of supply chain structure and efficiency vary regionally. This report lists the constraints and challenges that are faced by the cocoa bean industry from the farm level to market access.

Trends and Innovations

- The trends and innovations in the market are directly in response to consumer demands and the increased shift to sustainability. This report also has details of the cocoa futures market, cocoa futures market news, cocoa futures market analysis, cocoa futures market size, cocoa futures market trends, and the cocoa futures market outlook.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.