CATEGORY

CMO Formulation

Formulations CMOs offer manufacturing service for Pharmaceuicals like Tablet, Capsule, Injectables, etc. The Global gelatin market is USD 2.6 billion in 2018, It is estimated to grow at a CAGR of 6.6% till 2023

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like CMO Formulation.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCMO Formulation Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in CMO Formulation category is 25.00%

Payment Terms

(in days)

The industry average payment terms in CMO Formulation category for the current quarter is 85.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

CMO Formulation Market Intelligence

global market outlook

- The global market size of pharmaceutical CMO is around USD 128 billion in 2021 and the global market size of CMO formulation is around USD 37 billion in 2021.

- The CMO formulation market is growing with a CAGR 4-5% till 2025

- North America dominates the global CMO market followed by Asia-Pacific region. APAC region is expected to grow with a rate of 10-11% in the market

- The raw material cost varies according to the API and excipients used in the production of tablets and has a major impact on the production cost. In certain formulations raw material cost can be as high as 85-95 percent as well

- Medium and generic companies have outsourced drugs to Indian CMOs for developed markets. Big Pharma, like Pfizer, BMS, AbbVie, also have Indian partners for their US market needs. This trend is likely to continue in future, thereby driving the Indian CMO business for the US market

Use the CMO Formulation market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCMO Formulation market report transcript

Global Market Outlook on CMO Formulation

-

The Global CMO Formulation Market is growing at a CAGR of 4-5 percent CAGR between 2021 and 2025

-

The growth is attributed to increased outsourcing of generic drugs by Big Pharma companies. Additionally, medium and small pharma companies, who do not possess adequate infrastructure, will also outsource, thereby driving the market

-

Presently, North America dominates the global CMO market followed by the Asia Pacific region. However, APAC has been noted with the highest CAGR of 10-11 percent in the market

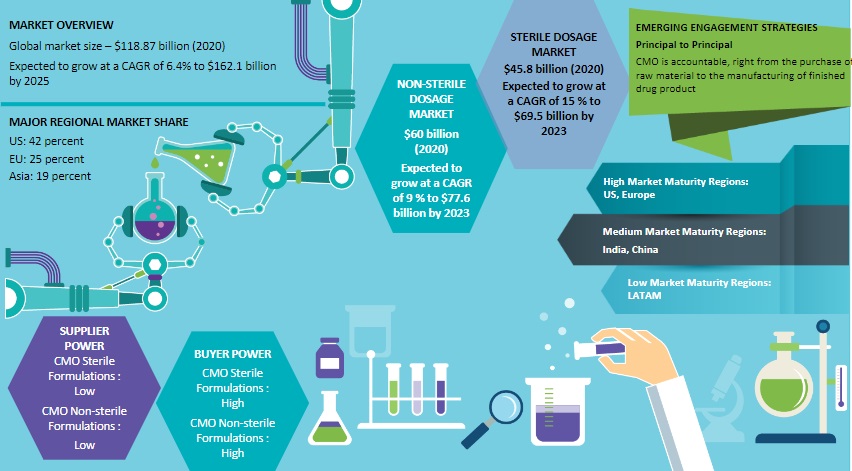

Global CMO Formulations: Market Overview

Supplier Concentration CMO Market

The CMO market is moderately fragmented. However, CMOs differentiate their capabilities, based on their ability to handle the high potent drugs (OEL limit)

Supplier Concentration: CMO Formulation Market

Fragmented market. Growing at a higher CAGR than the API market. Solid dosage formulation holds a major share among CMO formulation market.

Global CMO Formulations Market - Drivers and Constraints

Drivers

-

The pharmaceutical sector's tendency to focus on core competencies and a trend to outsource formulations to CMOs to achieve cost savings are the major market drivers.

-

Requirement for end-to-end service providers, including drug development and manufacturing, is further driving the CMO market.

-

In emerging markets, countries, such as Russia, Ukraine, Indonesia, and Iran, are promoting domestic production of drugs, which is expected to boost the outsourcing to regional CMOs

Constraints

-

As the market is highly fragmented, margins of traditional CMOs, who offer conventional manufacturing services, are under pressure.

-

Introduction of GDUFA is expected to have a negative impact on CMOs' profits. In such cases, small CMOs are expected to transfer the incremental cost to their customers, which would affect their business.

-

CMOs predominantly manufacture generic drugs. The volume of generic drugs decreases annually, leading to a constant look out for business to maintain their utilization rates

Key Industry Trends and Market Shifts (Pharma CMOs)

Key Trends: Non-Sterile Formulations

-

Non-sterile market is driven by increasing outsourcing of formulation development activities and increased in patent expirations of products

-

Major companies, like Catalent, Aesica, have expanded their drug development capabilities in the past

-

Additionally, high-potent solid manufacturing will also drive the market

Key Trends: Sterile Formulations

-

Fill–finish service is the major driver of sterile market

-

Pharmaceutical companies are looking to introduce pre-filled syringes for existing and new products. Hence, CMOs have expanded their prefilled syringe filling capabilities

-

Lyophilisation and high potent drug manufacturing are also major focus areas for CMOs

Global CMO Formulation Market: Day One Analysis

Number of Suppliers

-

The contract manufacturing industry is now exhibiting a trend toward consolidation

-

Large CMOs are constantly expanding their capabilities, so as to provide an end-to-end service to the pharma companies. These expansions are predominantly done inorganically, thereby leading to consolidation

Number of Customers

-

Big Pharma companies are outsourcing their low-volume generic drugs to CMOs, so as to rationalize their manufacturing footprint. Additionally, they are looking for CMOs, who could help them in formulation development

-

In growing markets, such as India, China, Brazil, pharma companies are looking for CMOs, who can cater to their local needs. Hence, there is an expected increase in outsourcing activities across the globe

Why You Should Buy This Report

- Information about the global CMO market size, market overview, drivers and constraints, etc.

- Regional market outlook of formulation CMO in US, China, India, and Europe.

- Day one analysis, category portfolio analysis, AQSCIR, SWOT analysis of the global CMO market and Porter’s five force analysis of CMO sterile and non-sterile formulations.

- Emerging CMO trends, supplier analysis, key supplier profiles, etc.

- Best procurement practices, cost structure, sourcing, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.