CATEGORY

Clinical Staffing Services

Staff employed for the clinical trial industry.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Clinical Staffing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

N2Growth Inc. acquired FluidMind Consulting

July 04, 2022N2Growth Inc. acquired FluidMind Consulting

July 04, 2022N2Growth Inc. acquired FluidMind Consulting

July 04, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Clinical Staffing Services

Schedule a DemoClinical Staffing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoClinical Staffing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Clinical Staffing Services category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Clinical Staffing Services category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Clinical Staffing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoClinical Staffing Services market report transcript

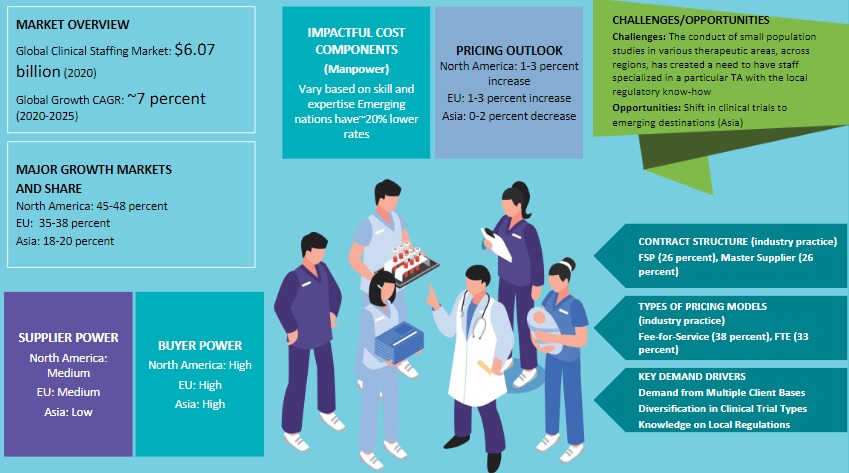

Global Clinical Staffing Services Market Outlook

-

The global clinical staffing market is expected to be $8.54 billion in 2023 and demand is expected to grow at approx. 8.5–9 percent CAGR through 2021–2026

-

Increasing complexity associated with clinicaI trials in terms of protocol, study procedures, trial design, volunteer recruitment and globalization of clinical trials demanding regional regulatory compliance are the major factors driving the market.

-

Availability of large talent pool coupled with cost savings opportunity due to reduced labour wage is shifting the focus to emerging nations

-

Large CROs have been continuously expanding their supply base through acquisitions and partnerships to provide integrated services

Clinical Staffing Market

-

Life sciences and biotechnology companies are increasing their use of outsourced labor through CROs and staffing firms to meet the increased capacity of their workforce. As a result of outsourcing, these clients will benefit from cost structure advantages, improved flexibility in addressing fluctuating demand, and access to greater expertise

-

The demand for outsourcing clinical trials has increased globally with increase in the clinical trials market ($63 billion by 2025). As new medications, devices, and therapies are introduced to the market, the need for skilled staff including CRAs, clinical trial scientists, statisticians, regulatory affairs scientists will increase. The growth rate for statisticians is expected to be highest (33 percent) due to rapid evolution of augmented technologies in clinical trials

-

Due to the increased demand for skilled clinical resources globally, many established have expanded their functional services into clinical functional resourcing services

Growth Drivers and Constraints

Drivers

Clinical Trials Increase Drives Clinical Staffing Needs:

- An increase in newly registered trials was seen in the regions of East Asia (+220 percent), Japan (+90 percent), South Asia (+45 percent), Southeast Asia (+45 percent), the Middle East (+35 percent), Africa (+30 percent) and Latin America (+20 percent).The developed markets of the US and Europe saw a rise of +36 percent and +32 percent respectively.

Demand from Multiple Client Bases:

- Though pharma companies have the biggest spend (> 40 percent) in terms of clinical staffing, suppliers also cater to medical device, biotechnology, consumer health etc.

Diversification in Clinical Trial Types:

- The conduct of small population studies in various therapeutic areas such as Oncology, Rare Diseases, across regions has created a need to have staff specialized in a particular TA with the local regulatory know-how

Constraints

Local Regulations:

- Stringent regulations to conduct trials in certain emerging markets has restricted suppliers to provide resourcing solutions in these markets.

Limited Resource Availability:

- Though markets of the US and Europe have >22 percent turnover rates for clinical/scientific staff, the emerging markets of Japan and China have limited number of qualified employees. This in turn causes a supply crunch, slowing down the staffing market.

Clinical Staffing Market Trends

CROs Expansion into Staffing

-

With increasing clinical trials globally, CROs are setting up FSP units for staffing, wherein CROs engage with pharma companies through master supplier, function service provider or hybrid model

-

As a result of war on talent and increasing demand for clinical resources, CROs will continue to establish functional resourcing units either as a separate entity or have FSP units

Future Trends

-

Mid size CROs would further expand into resourcing, as the demand for insourcing and FSP models from pharma companies would increase

-

CROs would in the future move more jobs to low cost countries for certain job roles (data management, biostatistics etc.), thus freeing up spend for other key areas such as clinical monitoring

-

Internal talent development programs within CROs would be seen as an alternative to retain and build talent

-

Companies are looking forward to getting additional trained resources for remote data review and implementation of new technologies

War on Talent

-

Pharma is balancing between overall cost reduction objective and rising FTE rates. Shortened contract terms to manage risk at a gradually growing FTE rate is observed

-

This is due to CROs paying high salary along with performance bonus to retain talent

-

The war of talent will further increase, creating higher demand for CRA’s. CROs will continue to pay premiums to retain talent

Increased Eqity Investments for Innovation

-

PE firms are investing in buying and merging established staffing firms with the aim to bring innovation in staffing management for emergency services across therapeutics

-

Ex: Synergy Surgicalists and EA Health merger to manage emergency departments using leadership experience analytics and ‘physician first’ initiative for clients. Enhanced Healthcare Partners is the PE firm interested to reap benefits in the merger

Digital Technology to Boost in Future

-

Though digital technology has been making some noise in the industry, the current COVID pandemic has forced companies to experiment digital and other innovative/disruptive means of service offerings, to ensure process continuity

-

Digital technology platform are used to know availability of staff at various sites and other ERP data integrated into them

-

It not only helps for healthcare providers, but also is greatly during early clinical trial phases and for the advancing home visit trials

-

EDC and EMR systems providers are focusing on their capabilities for remote access

Cost Drivers and Cost Structure

-

As the outsourced volume and spend increases, staffing only companies reduce their sourcing cost by 20–30 percent through common technology platforms, direct sourcing and shared service centers; thus reducing their overall cost by 15–20 percent

-

A portion of the supplier’s reduced cost is given as volume discounts to the sponsor, who invariably look to re-negotiate with suppliers as the spend increases

Why You Should Buy This Report

- Information about clinical staffing market analysis, trends, drivers and constraints and Porter’s five force analysis of the global clinical staffing market.

- Technology trends, supplier landscape, list of major suppliers,

- Access to engagement models, sourcing models, cost analysis, pricing analysis, key performance indicators.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.