CATEGORY

Clinical IT Services

Use of technology to manage clinica trial data.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Clinical IT Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

ObvioHealth launches new decentralised clinical trial platform

September 19, 2022Site closure and Shortage happen at Factory: GE Healthcare (Shanghai) in Shanghai, CN

July 05, 2022ObvioHealth launches new decentralised clinical trial platform

September 19, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Clinical IT Services

Schedule a DemoClinical IT Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoClinical IT Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Clinical IT Services category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Clinical IT Services category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Clinical IT Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoClinical IT Services market frequently asked questions

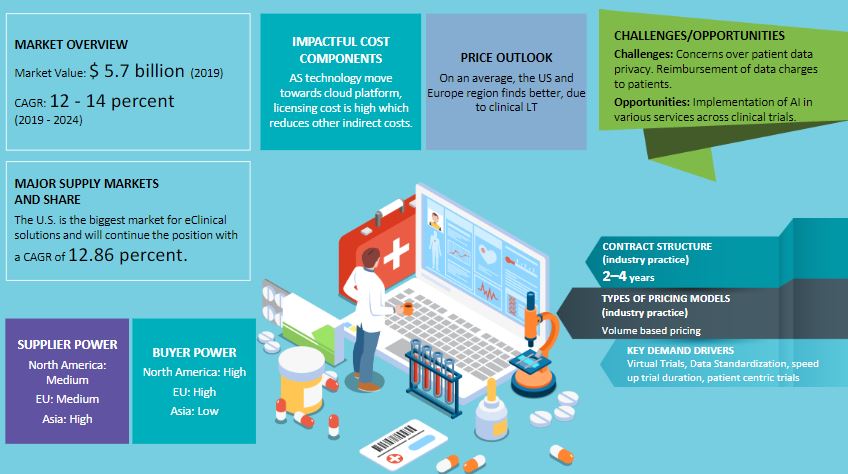

The clinical intelligence market size was valued at $5.7 billion in 2019. According to the clinical IT services research by Beroe, the clinical intelligence market is set to grow at a CAGR of 10 percent in the forecast period. By 2024, the clinical IT services market is expected to grow at a CAGR of up to 14 percent. North America holds the largest clinical intelligence market share of 50 percent to 52 percent. Europe holds the second-largest share of 23 percent to 25 percent. Asia holds a market share of 18 percent to 20 percent.

The US holds the largest market share of eClinical solutions and is expected to grow at a CAGR of over 12 percent. It is expected to retain its top spot in eClinical solutions in the next few years. Asia is growing at a rapid rate; at a CAGR of over 1 percent every year due to the increase in eClinical trials. Clinical trials are the reason behind the higher adoption rate.

According to the Beroe clinical market research, eClinical solutions are expected to grow at a faster rate than ever before. This is going to take place globally. Pharma R&D will use EDC systems for clinical trials and this can push the growth of the market further. Even the CTMS market is expected to grow at a CAGR of more than 11 percent. As per the industry experts, the CTMS market will exceed $2 billion in value by the end of 2022. IRT, IWR, and IVR will hold a market value of up to $1 billion in the coming years. eCOA and ePROs are in higher demand and their growth will take place at a higher pace compared to other technologies. The increased support from the government will help boost the clinical IT services even further. People are asking for better therapeutics and this is another driver for clinical IT services. Outsourcing is expected to CROs as this is increasing according to industry experts. Cost-effectiveness is going to be researched further. RBM or Risk-Based Monitoring is also growing and being implemented. More R&D investment is another driver and trend that is expected to grow in the near future.

There are several clinical trial support services providers. According to research by Beroe, the top suppliers of clinical IT and clinical support services include Parexel, Oracle, BioClinica, and Medidata.

As per the clinical intelligence market analysis by Beroe experts, Covid-19 didn't impact Europe and North America as much as the other nations. This was mainly due to the technological advantage that these nations had before the pandemic. Some nations were able to get a solution while others waited before getting a solution that worked for them. Asia is one of the fastest-growing regions and due to the boost from the government, it is likely going to help the growth of the clinical IT services market. Today, the market is witnessing higher growth than ever before due to Covid-19. Covid-19 helped speed up the clinical IT market.

Asia has high supplier power while the EU and North America have medium supplier power. Asia has low buyer power while North America and the EU have high buyer power.

As eClinical solutions are on the rise, the license cost is the one that will impact the total cost the most while eliminating other indirect costs in the process.

Clinical IT Services market report transcript

Global Market Outlook on Clinical IT Services

-

The global demand for eClinical solutions market is expected to grow at approx. 14.5 percent CAGR through 2022–2026

-

The pandemic has increased the need for technology in trials with live results

-

North America and Europe have a less impact due to COVID because they had the technology upfront. It was few players who either adopted one solution or entire end-to-end solution, now we can see more buyers for every solution

-

Asia is a region that is growing in this field, due to an increase in trials and non-communicable diseases apart from increase in funding from government for research

Global Market Size and Trends: eClinical solutions

-

The eClinical technologies market, driven by increased R&D expenditure in the pharma sector, had a market value of ~ $8.5 billion in 2022 and expected to grow at a CAGR of 13–15 percent until 2026

-

The US represents the largest market for eClinical solutions, owing to the presence of big outsourcing firms and increasing R&D in the region

-

The APAC is the fastest growing market for e-clinical trials, with a CAGR of 14.2 percent, followed by Europe with 11.6 percent. This is driven largely by the huge number of clinical studies and pressure to expedite clinical trials. The APAC eClinical solutions market is expected to reach $2.7 billion by 2022

eClinical Solutions Market Segmentation

10%

Trial Safety and Regulatory

- In recent days, there were many data stolen, data breach, hacking-related issues reported, thus increasing the requirement of this software

12%

electronic Trial Master File (eTMF)

- The market is driven by regulatory requirement, increasing visibility, remote oversight on TMF, etc.

13%

Clinical Trial Management System (CTMS)

- The global CTMS market is expected to reach $2.6 billion by 2023 at a CAGR of around 11.4 percent

15%

electronic Patient Reported Outcome (ePRO)

- Increasing demand to collect patient self-reports through mobile and digital technologies makes eCOA/ePROs to grow at a faster pace than other technologies

15%

Randomization and Trial Supply Management (RTMS)

- RTSM is gaining increased importance with the growth in Interactive Response System, Cold Chain Logistics, Live tracking of kit, etc., and is expected to hold a market value of around $750 million

25%

Clinical Data Management System (CDMS)

-

Adoption of EDC systems by pharmaceuticals to operate clinical trials is predicted to provide this market with lucrative growth

-

Advancement in technologies is considered to be the most important market driver

10%

Others

-

Solutions related to data analytics, core lab integration, ePayment, etc., are gaining traction

-

These solutions are expected to gain market individually, when adoption of technologies, such as AI, is implemented

Drivers and Constraints : Clinical IT Services

Drivers

-

Rising government support for clinical trial through grants and funding

-

Increasing need for software solutions during the clinical trials

-

Rising R&D expenditure by pharmaceutical and biotech companies in the sector is leading to the adoption of technologies that provide cost-effective solutions

-

Rise in the need for better data standardization

-

Rising number of clinical trials, especially across emerging countries in the Asia-Pacific region, offers growth opportunities for vendors of eClinical solutions

Cons

-

Stringent and lengthy government regulations

-

Shortage of skilled research professionals in the field

-

Concerns over patient data privacy

-

Lack of awareness in the society about the benefits of eClinical solutions

-

Import/export regulations related to pharma packages. Adhering to both local and global regulatory guidelines is creating a big challenge

-

Data Charges - Reimbursement of data charges incurred by patients. Proper contracts for the data plan

Technology Trend - mHealth

Usage of Mobile Technology in Clinical Trials

Current

-

Provide patients with access to studies that are active and recruiting patients

-

Allow investigators to access various study materials and tools

-

Offer site training in different iterations, depending on the audience

-

Patient retention activities, such as study visit reminders, medication and diary reminders. There are some new retention techniques, such as online communities, gamification, etc.

Future

-

BYOD

-

Study-specific mobile applications

-

Disease-specific medical devices

-

Better eCOA Platform

New Technologies and Case Studies

Study-specific Mobile Applications

As an alternative to Investigator kits, mobile apps can provide study information along with alerts to sites on updates in the study, such as protocol amendments or changes.

Case:

Supplier has developed a mobile app for site staff. This app includes e-kit, tools for informed consent, inclusion/exclusion criteria, and patient retention to use at the protocol level along with built-in automatic updates and alerts if any related to the study.

Disease-specific Medical Devices

This includes wireless health care devices that can be used to collect data related to a specific study (example: spirometer for COPD study) which in turn reduces mandate visits by patients.

Case:

FDA approved - wirelessly observed therapy (WOT): a novel patient self-management system consisting of an ingestion sensor, external wearable patch, and paired mobile device that can detect and digitally record medication ingestions targeting TB patients

Better eCOA Platform

Text messaging is traditionally used to send remainders for patients, but it is now used to as a part of recruitment and select eligible candidates for a study

Case:

supplier provides an advertising response mechanism for potential study subjects, which allows people to register their interest and determine their fit with the eligibility criteria. When a prospective candidate is identified, their system will transfer the patient’s data to sponsor or CRO automatically for further processes.

Why Should You Buy This Report

- Information about the eclinical solutions market size, trends, segmentation, drivers and constraints, clinical market research etc.

- Technology trends, industry trends, clinical trial technology trends, SWOT analysis of the global clinical IT market.

- Supplier landscape, capabilities, sourcing models, Porter’s five force analysis and other clinical IT market intelligence.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.