CATEGORY

Cedar Wood Oil

Cedar wood oil can be procured around the year as raw material are available through out the year being found in cold climatic conditions. For better oil yield and quality the saw dust are prevented from exposure to sunlight before distillation.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Cedar Wood Oil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCedar Wood Oil Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCedar Wood Oil Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Cedar Wood Oil category is 4.60%

Payment Terms

(in days)

The industry average payment terms in Cedar Wood Oil category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Cedar Wood Oil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCedar Wood Oil market report transcript

-

Global essential oil production is estimated to grow at a CAGR of 6.83 percent from 2020 to 2025, and it is primarily driven by the growth of a few key essential oils, such as orange oil, mint oils, clove oil, and patchouli oil. Robust growth of end-use industries, such as food and beverage, personal care and cosmetics, and aromatherapy, has translated into an upswing in the demand for the product.

-

The global essential oil market is set to grow at a CAGR of 6.83 percent until 2025. The CAGR is revised lower from 7.9 to 6.63 on account of the slowdown in production in China in 2022, and global demand destruction, owing to the existing recessionary trend and a strong USD

-

In terms of demand, APAC is expected to witness the highest growth, of approx. 11 percent from 2019 to 2025

-

Orange oil leads the segment, by a market share of approx. 29 percent and is projected to grow at approx. 9 percent/year. Food and beverages leads all applications with over 30 percent

-

Europe and Asia Pacific lead in terms of market share (over 40 percent) and projected growth (approx. 9 percent/year)

-

Growing consumer awareness is a key driving factor for the global Essential Oil market over the speculated period. A major shift from synthetic to natural additives is seen, due to the growth in the organic products industry

-

Growing use of essential oil in the preparation of natural flavors and fragrances, on account of their increasing demand across key end-use industries is also expected to fuel the market growth

Cedar Wood Oil Supply and Demand Analysis

-

As per the latest available data on the 2022 cedarwood oil output, Chinese cedarwood oil production is estimated at nearly 1,900 tons, while the American cedarwood oil production is pegged at 1,100 tons. The Indian cedarwood oil production is estimated at 650 tons while that of Morocco is estimated at 100 tons. In 2023, the cedarwood availability is expected to be higher in the major regions.

-

The US and Europe are the major consuming countries of cedar wood oil, wherein in Europe, France, Germany, and Spain constitute about 80 percent of this demand. In past few months, three major distilleries of Texas suffered from a massive fire, which is likely to impact supplies. Additionally, current availability of oil is seen to be in deficit as opposed to the current demand

-

India is estimated to have produced nearly 650 tons of cedarwood oil in 2022, with higher supplies of raw material (saw dust), owing to the country being the world’s largest railway manufacturer. Majority of cedar wood oil is consumed in the FMCG industry and flavors &fragrance, where majority of cedar wood oil is used for insect repellants, soaps, air fresheners, and household detergents. Apart from these industries, cedar wood oil is being used for medicinal purposes

Supply and Demand Assumptions

-

Precise production for cedar wood oil is not available due to it being clubbed with other essential oils like clove oil and nutmeg oils. Being distilled from saw dust makes it more challenging to reach accurate numbers for production

-

It is roughly estimated that the leading producers of cedar wood oil are the US, China, and India, while countries like Africa and Morocco are also producers of cedar wood oil

Cedar Wood Oil Trade Dynamics

-

American cedar wood oils are predominantly used domestically and imported by Japan for derivative manufacturing. Indian cedar wood oil is imported mostly by the US and Europe and minimal quantities are imported by Japan.

-

Western Europe (France, Germany and Spain) and Japan are the major buyers of cedar wood oil. Chinese cedar wood oil are imported in Western Europe, which are used more in fragnace oils and perfumeries. due to there low content of cedrol

-

American cedar wood oils are imported by Japan, where they are to be used for derivative manufacture, such as cedrol, cedryl methyl ether, acetyl cedrene, and cedryl acetate, due to their high levels of chemical isolates

-

Chinese exports are estimated above 400–500 MT per annum, while exports from the US are around 250 MT per annum (the country produces about 700-800 MT of Cedarwood oil Texas itself). India produces about 650 MT, out of which, close to 50 MT of the oil is exported.

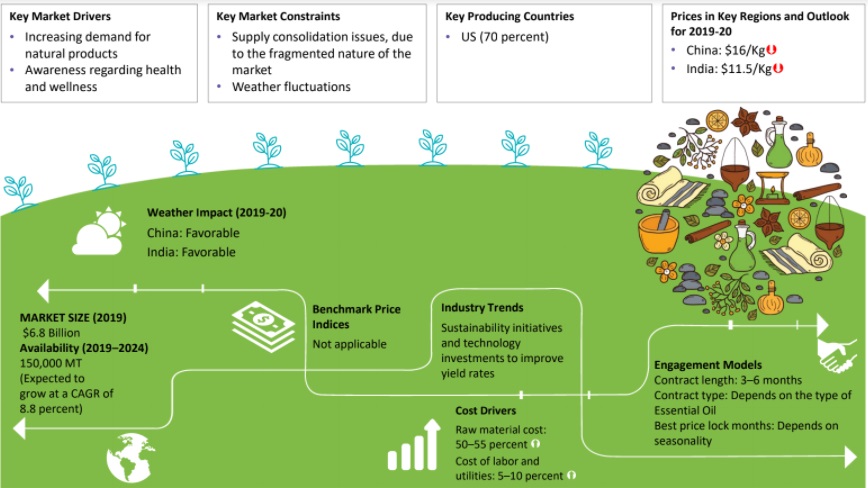

Cost Driver Analysis

-

The cost of cedar wood contributes to about 50 percent of the overall production of cedar wood oil. As labor is cheap in India, transport contributes to a major portion of the overall cedar wood oil production in the country. The current surge in energy costs and labor costs are likely to add to the higher production costs. The strengthening Dollar is also estimated to impact the export market for cedarwood oil.

-

The cost of production of cedar wood oil in India follows the same pattern as the US. Labor availability and farm operations have been constricted in most of the producing origins

-

The contribution of transport cost towards cost of cedar wood oil production in India is higher as compared to the US, as most supplier factories are located in the North, whereas their warehouses are located elsewhere. The quality checks are done at the factory and sometimes again at the verify to ensure buyers get standard quality cedar wood oil

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.