CATEGORY

Castor Oil

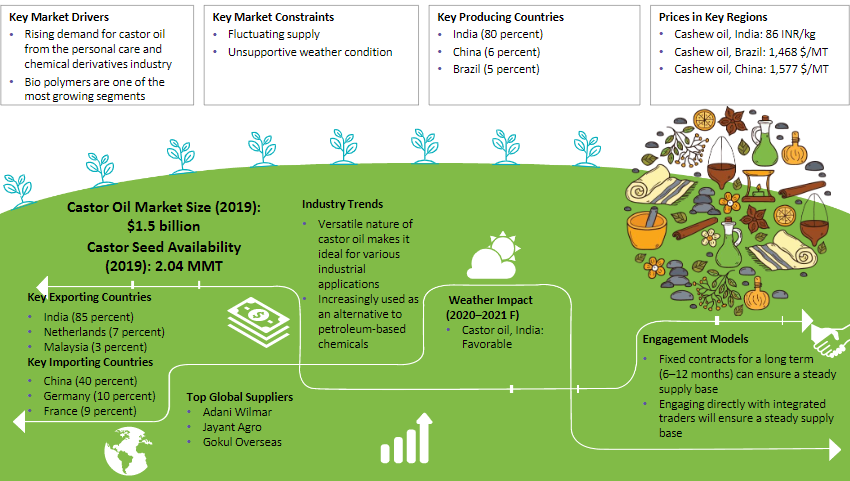

Major sourcing destinations for Castor oil are India, China and Brazil. India contributes for about 90% of world productionof Castor oil followed by Brazil & China

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Castor Oil.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCastor Oil Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCastor Oil Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Castor Oil category is 4.60%

Payment Terms

(in days)

The industry average payment terms in Castor Oil category for the current quarter is 30.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Castor Oil market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCastor Oil market frequently asked questions

The major sourcing destinations for castor oil are India, China, and Brazil, with India being the major contributor accounting for about 90 percent of the global production of castor oil.

As per Beroe's castor oil industry reports, the global castor oil market supply is 0.6-0.7 Mn T.

Higher production and transportation costs have led to a low margin for suppliers while putting the market in an unattractive position for domestic manufacturers.

Over the years, the castor oil supply has been observed to consecutively decline due to the shift in cultivation to more remunerative crops in India.

The demand for castor seeds is expected to witness a drastic increase with the increase in the application of end-use industries of castor oil and its derivatives.

As per Beroe's industry analysis reports, the castor oil market prices were expected to soar during the mentioned period due to the huge gap in the supply-demand curve.

Due to the fall in castor oil prices, world imports have been reported to increase by 14 percent during the 2015-16 period and by 6 percent during the 2016-17 period. The lower prices also led to a significant drop in the cultivation of the crop in India, Brazil, China, and other countries.

Although Latin America is among the top supplying regions of castor oil in the world, it loses its competitiveness with India because its domestic consumption exceeds the supply.

Brazil is the major castor seed-producing country in Latin America, and it has seen a production decline of over 35 percent in the forecast period.

The factors that led to the decline in castor seed production include ' ' Poor yields/harvest ' Higher production and transportation costs ' Termination of financial assistance from the government to promote castor cultivation and extraction of castor oil for the biodiesel industry

Castor Oil market report transcript

Global Market Outlook Of Castor Oil

-

The global castor oil market is estimated to value at $1.6 billion in 2022, and it will grow at a CAGR of 3.8 percent by 2026

-

The APAC region is dominating the castor oil market, and it is likely to drive the market growth in the forecasted period

-

Castor oil prices witnessed an increase of an average of 2.4 percent in November 2022. Castor seed supplies continue to remain tight in India; however, reduced demand from export markets, like China and Europe, are supporting the downward price movement. Combined factors like revival in acreage and likely revival in castor oil supply are likely to support the downward price trend in the coming weeks.

Castor Seed: Supply Analysis

-

Castor seed production is estimated to witness a steep increase in 2022–2023, owing to a sharp rise in acreage in key producing regions, like Gujarat, Rajasthan, etc. Delayed monsoon are likely to encourage farmers to grow crops like castor that are less dependent in irrigation water.

-

India is the largest castor seed producer in the world. It accounts to around 80 percent of the global castor seed production

-

China and Brazil are the major producing countries, with 6 percent and 5 percent of the world’s castor seed production, respectively

-

Castor seed acreage for the 2022-23 season in India is expected to rise, as farmers are likely to have planted castor seed as an alternative to groundnut oil seed, in states, like Andhra Pradesh, Telangana, Gujarat, etc. The input cost of castor is relatively lower, encouraging farmers to increase the seed's acreage

-

Gujarat is the largest producer of castor seed in India

-

Palanpur, Kadi, Deesa, Patan are some of the major castor seed and oil trading mandis in India

-

Castor seed production in 2021-2022 is estimated to be around 1,506 Thd MT. It is a decrease of around 12 percent from the previous year’s record production levels. Despite this castor oil production did not decrease steeply, as ample castor seed carry overstocks were available from last year

-

Castor oil production is expected to increase in 2022-23 by approx. 2 percent

Global Castor Oil Market Outlook Trade Dynamics

This section of the report gives details of the global castor oil market share. Castor oil prices and availability are driven by various global factors that are detailed in this section of the report. Any standout past trends in the market demand are described. It details the castor oil production market share by the major producing countries. The global supply-demand analysis is presented graphically along with the castor oil market forecast. Global trade volumes, as well as the country-wise import and export statistics, are listed.

Regional Market Snapshot

The castor oil market trends differ in different geographical regions. This part of the report presents detailed facts about the regional castor oil market size, price trends, price drivers as well as the castor oil market forecast for each country. The castor oil market trends that are peculiar to each region and country are listed. The castor oil market share of exporting countries and the countries that they export to are listed. Importing countries and the market share of the countries that they import from are also given.

Supply–Demand Dynamics: Latin America

In spite of being one of the major supplying regions, Latin America loses its competitiveness with India, as the region's domestic consumption exceeds the supply.Castor seed production growth targets in Brazil, the key producing country in Latin America, has not been accomplished in 2016–2017 and has declined beyond 35 percent this year.Latin America currently contributes to approx. 25 Thd T of castor oil supply, the world's largest supplier in 1970–1980s. Imports surged in 2016–2017 beyond 50 percent to meet the raising demand in the region.Production in Brazil for castor seed and oil has been curbed over the years, owing to several factors, as in poor yields/ha, higher production costs, and transportation costs.Financial assistance from the government to promote castor cultivation for use of castor oil in the biodiesel industry has been terminated, owing to the high cost of cultivation. This has further decreased the attractiveness for castor in Brazil.

Industry Drivers And Constraints

The castor oil market demand is driven by the need for vegetable oils, edible oil as well as oils and fats used in the food industry. Changes in the industries that drive the demand affect the castor oil market trends. Weather patterns, customer preferences, and technological innovations also affect the demand in a positive or negative manner. This section of the report helps one fully comprehend the forces that change the castor oil market outlook.

Price Trend And Forecast

This section of the castor oil market report details the historical price trends in the recent past and the reasons for any big changes. It also details the castor oil market forecast based on price and demand.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.