CATEGORY

Carbon Steel

Steel is an alloy comprising of predominantly iron and carbon. Due to its high tensile strength and low cost, it is a major component used in buildings, machines, appliances,infrastructure, tools, ships, automobiles etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Carbon Steel.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Aludium enters into Low Carbon Aluminium market

December 01, 2022China's BF capacity utilization reaches a 22- month high

April 19, 2023Indian Steel Association seeks import duties on steel

April 13, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Carbon Steel

Schedule a DemoCarbon Steel Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCarbon Steel Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Carbon Steel category is 4.80%

Payment Terms

(in days)

The industry average payment terms in Carbon Steel category for the current quarter is 48.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Carbon Steel market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCarbon Steel market report transcript

Carbon Steel Market Analysis and Global Outlook

-

Expected increase in downstream demand to 1,850 MMT by 2024. The decarbonization drive in the steel industry is expected to cause a shift in the feedstock markets requirements as well

-

The Chinese government is keen on reduction of its production levels, in line with their initiatives to reduce carbon emissions and go carbon neutral by 2060. In addition, uncertain trade landscape, tariffs, and export duties are likely to promote volatility in the steel markets

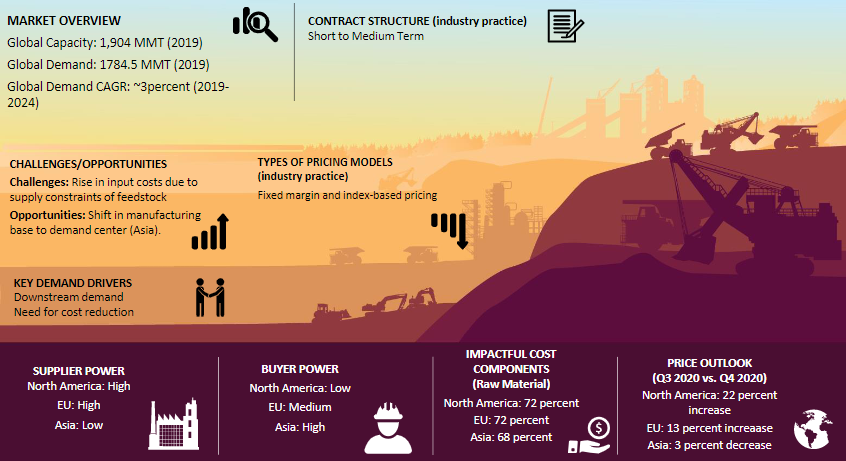

Steel Market Overview - Global

-

The steel production market is expected to grow at a moderate 2-3 percent CAGR during 2022–2025

-

In 2022, the supply chains were highly disrupted, due to the onset of the Russia-Ukraine war in H1 2022. Although the disruption levels have reduced in H2 2022, the negative macroeconomic sentiments still remain. For 2023, the outlook is highly uncertain on rising inflation, and the possibility of a recession, constraints to energy supplies, etc.

Global Steel Drivers and Constraints

Drivers

Downstream Demand

- The passing of the CHIPS Act in the US will promote greater investment in domestic semiconductor manufacturing, so that the microchips that are necessary for many essential products will be made locally in the US rather than being imported from overseas. This is expected to address the chip supply challenges faced by US automakers, and boost the steel demand from the sector as we head further into 2023

Need for Cost Reduction

- Increased focus on reducing the total cost of ownership of the steel-making process has led to:

−The adoption of new technologies

−Use of more energy-efficient fabrication, manufacturing process

Technological Advancements

-

Development of new technologies is driven by the need to attain low cycle time and decarbonization of the manufacturing process

-

Suppliers in emerging economies are rapidly adopting technologies, in order to improve efficiency and increase production capacity

Constraints

India’s steel export tariffs

- The Indian government had removed export duties on steel products and iron ore which was initially imposed in late-May last year. Export duties on nine steel products with HS code 7201, 7208, 7209, 7210, 7213, 7214, 7219, 7222 and 7227 will attract nil duty compared with the 15 % levied earlier.

Profit Margins

- Steelmakers in China, at present, are facing low profit margins, due to the COVID outbreak, suppressing the demand in the country in the recent months

Logistics Cost

- Steel and its products have high logistics cost. The Baltic Dry Index acts as an indicator of measuring logistic costs of dry bulk category, such as steel. Increased logistics cost impacts the import of raw material and increases the domestic and landing cost of steel, exporting nations

Cost Structure Analysis : Carbon Steel

-

Iron ore, coking coal, ferrous scrap, nickel, and other alloys are the key raw materials in manufacturing of steel. It accounts for more than 60 percent of the total manufacturing cost globally

-

Steel prices are highly co-related with raw material prices, such as iron ore, ferrous scrap, and nickel prices

-

In order to mitigate price fluctuation, end user should enter in short to medium-term contracts with steel makers

-

Raw material is the key cost driver that constitutes approx. 64–75 percent of the production cost

-

Based on demand, end-use industries should have short-term contracts with steel makers to avoid the price fluctuation risk

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.