CATEGORY

Carbon Black

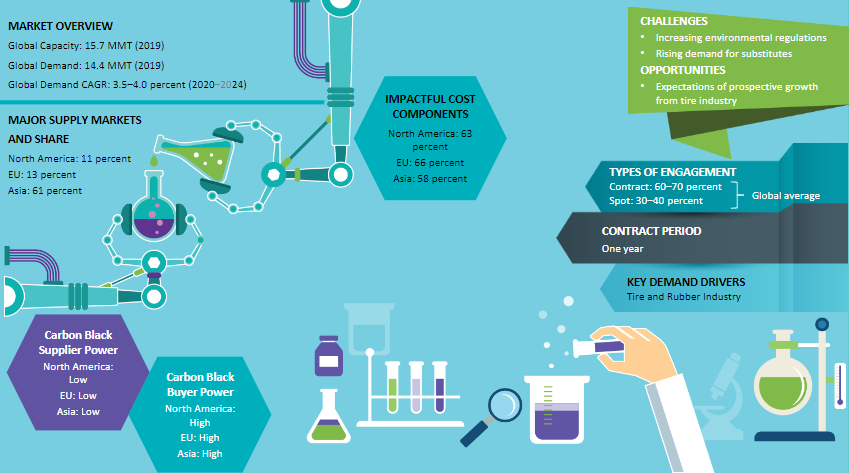

Carbon Black market is driven by the demand from rubber industry. In terms of the supply base, top suppliers account for more than 40% of the installed capacity.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Carbon Black.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCarbon Black Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCarbon Black Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Carbon Black category is 5.00%

Payment Terms

(in days)

The industry average payment terms in Carbon Black category for the current quarter is 70.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Carbon Black market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCarbon Black market frequently asked questions

The global carbon black market stood at 15.78 MMT as of 2017. The demand is expected to grow at a CAGR of 3.5-4.0 per cent until 2022.

Producers in the Asian region have an advantage in the carbon black industry over the western players as they have an abundance of coal-based feedstock. However, western producers have better process technology which gives them a 35 percent low operational cost than the Asian players in the market. High supply and demand for carbon black market share can be seen in areas, such as North America, Europe, and APAC.

Some of the top suppliers in the global carbon black market are Aditya Birla Carbon, Cabot, Orion, Jiangxi Black Cat, and CSRC.

It is expected that the demand from the tire and rubber industry will continue to lead the growth and impact the future of carbon black industry. Environmental regulations and low-profit margins are the leading causes of capacity reductions. However, these capacity reductions won't cause any major impact as enough capacity is available.

The carbon black market price and availability are driven by the CBFS in the region. The US and European markets have a balanced dependence on crude and coal-based CBFS, while the Asian market depends on coal-based CBFS.

Carbon Black market report transcript

Carbon Black Market Size and Global Outlook

-

The global carbon black capacity stands at 16.1 MMT. Demand is expected to grow at a CAGR of 2-4 percent until 2026

-

Demand from the tire and rubber industry is expected to lead the carbon black industry growth

-

About 0.65 MMT of capacity is expected to be added in Asia and Russia during 2022–2026.

-

Environmental regulations and low-profit margins are the major reasons for low-capacity additions. The impact of low-capacity additions is expected to be minimal, as there is enough capacity available

Demand Market Outlook

- Carbon black pricing and availability are highly driven by the CBFS in the region. The US and Europe carbon black market have balanced dependence on crude and coal-based CBFS, while the Asian market is highly dependent on coal-based CBFS

Supply Market Outlook

The level of consolidation of each supply market varies greatly. The supply market capacity for the major markets is described. The differences in the availability of the raw material as well as the better use of technology in certain countries create cost structure variations. These variations and the causative factors are also stated.

Carbon Black Industry Best Practices

The industry pricing practices and the calculation of the carbon black price are stated. The individual components of the pricing calculations are also described. Carbon black pricing is tracked from the feedstock right up to the yield.

Global Market Size - Carbon Black

-

The global carbon black market was valued at $13.11 billion in 2021, and it is expected to reach $14.55 billion by 2026.

-

The market size has reduced from the past forecast, due to the impact caused by COVID-19 in 2020. Market volumes and values have trailed back to 2018–2019 levels in 2021. The trend continued in 2022, however the trend is expected to change in 2023 and overall, the market size to drop from 2022 levels

Global Capacity–Demand Analysis

-

Global installed capacity in the carbon black market was at 15.3 MMT in 2022, and about 0.8 MMT of capacity expansion is set to happen from 2022 to 2025 by various players.

-

Currently, the carbon black market is facing a tight supply situation, mainly due to the rising crude oil prices, amid the Russia–Ukraine war and issues with feedstock supply. These issues are expected to affect the global carbon black market in the upcoming months

Capacity:

-

On the capacity front, about 0.63 MMT of capacity is expected to be added to the global carbon black supply base by 2025

-

Operating rates are currently low, due to weak demand in 2022 and the operating rates were in the range of 70-80 percent. The current run rates are expected until 2023. The operating rates are expected to improve from 2024 are expected to be in the range of 75-85 percent

-

Growing environmental regulations against carbon emissions have led to carbon black producers in the US, focusing on adding capacities at their plant locations in Asia to meet their domestic demand

Demand Outlook:

-

Carbon black consumption is expected to increase at a steady pace over the next five years, largely spearheaded by the demand from the tire industry

-

Besides rising consumption in the overall packaging industry, including food packaging, carrier bags, industrial film, lamination and high-quality protective packaging, will boost the demand for carbon black. Additionally, developing regions, such as India and China, are now moving toward making their countries electric vehicles nation in the coming 4–5 years that is pushing the demand for carbon black in the upcoming period

-

China dominates the global carbon black demand with about 42 percent of the market share in 2021

Global Demand by Application

-

Tire industry (67 percent) is the major driver for carbon black demand. However, demand from the specialty blacks sector (9 percent) is expected to grow at a faster rate, owing to increasing downstream demand from pigments and coatings.

Global Market Outlook

The carbon black market dynamics in each country are different. The supply, demand, and market nuances of each region are detailed in this section of the report. It gives an at-a-glance analysis of all the major regions.

Regional Market Snapshot

This section examines each regional market in detail. It provides vital information about each market and the maturity of the suppliers and buyers in the market. The report analyses the capacity vs demand of each region as well as the market share of the key suppliers. The demand trends, supply, and capacity are explained. The trade dynamics report of each region details the import and export share by country. This export and import pattern is analyzed with the reasons for the existing trade dynamics.

Global Trade Dynamics

-

Carbon black trade between Asia and Europe has been increasing notably in the last five years, driven by the partnerships between the European buyers and Chinese manufacturers. Dependence on Chinese material has increased manifold in the European market

-

Intra-region trade is high in Asia, where the import and export among the Asian countries are high and constitute to a significant portion

Cost Structure Analysis

-

The production cost of carbon black is lowest in Asia, due to availability of cheap feedstock and low labor rates. The use of distilled coal tar, due to vast resources of coal, is the key reason for the low production cost. Feedstock holds ~60 percent share in the cost structure of carbon black production.

-

Furnace black process is the standard route for carbon black production. Over 90 percent of the producers follow this route

-

The cost of carbon black production is the lowest in China. Production cost in Europe is 46 percent more than China, while the same in the US is 43 percent higher than producing carbon black in China

-

The cost of carbon black production is least in Asia, due to use of distilled coal tar as feedstock, most preferable choice for the Chinese producers. China dominates the global carbon black capacity with a share of 40 percent

-

Production cost of carbon black through furnace black process gives 8–15 percent margin, which will vary according to the demand

Market Overview

- The production cost of carbon black is lowest in Asia, due to availability of cheap feedstock and low labor rates. The use of distilled coal tar, due to vast resources of coal is the key reason for the low production cost. Feedstock holds ~60 percent share in the cost structure of carbon black production.

- About 0.91 MMT of carbon black capacity is expected to be added to the global production base by 2022. Except for Russia, all the other capacities are concentrated primarily in the developing regions

- Currently, the demand for carbon black continues to be positive, supported by the automobile industry with a sufficient supply in place. The carbon black market witnessed expected change in price levels

- Tire industry is expected to remain as the major demand driver

- Environmental regulations are affecting the carbon black business growth

Industry Analysis

The carbon black market industry analysis section examines and analyses the industry from all perspectives to present a well-rounded report on each of the major regions.

Industry Drivers and Constraints

It is very important to learn the industry drivers and constraints to fully understand the carbon black market. The report describes the major downstream applications that drive the sector. It also enumerates the emerging new applications that can drive demand in a big way. The growth of existing applications will also cause a cascading increase in carbon black demand.

As with every industry, there are constraints and challenges to the carbon black industry. This section of the report tells us about factors such as government regulations and customer preferences among others that could dampen the demand. The challenges offered by substitutes are also explained.

Why You Should Buy This Report

-

Details on the Carbon Black market ize, the demand analysis, imports and exports, carbon black market news and carbon black world outlook.

-

It gives the trade dynamics, Porter’s five force analysis and demand-supply trends and outlooks of the North American, Europe and APAC region (which includes the India carbon black market)

-

The report lists out the key industry drivers and constraints

-

Overview of key suppliers like Aditya Birla carbon, Cabot corporation, Orion Engineered Carbon, etc, their profiles and SWOT analysis.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.