CATEGORY

Caps and Closures

The report covers Caps and closures across food, beverage, personal care and health care segments. The demand dynamics and trends are covered across 4 regions. Metal closures are also covered briefly in the report

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Caps and Closures.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Gerolsteiner introduces tethered caps

March 30, 2023Tri-Sure to showcase closed loop PCR closures for steel and plastic containers

March 30, 2023Berry launches smart digital closure for Pharma segment

March 27, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Caps and Closures

Schedule a DemoCaps and Closures Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Caps and Closures category is 4.20%

Payment Terms

(in days)

The industry average payment terms in Caps and Closures category for the current quarter is 100.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Caps and Closures market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCaps and Closures market frequently asked questions

According to Beroe, the net market share for plastic caps and closures market is nearly 73 ' 75% and 24 ' 25%. The rest of the market is shared between rubber and cork.

The beverage industry is the largest end-use segment accounting for 50 ' 55% of the market. Bottled water is known to be the fastest-growing end-use market with a CAGR of 7 ' 8% primarily in the America and APAC region owing to the transition of users from CSDs to healthy beverages.

According to the Caps and Closures Market Report by Beroe, the penetration of anti-counterfeiting closure is on the higher side in alcoholic beverages which is directly influencing other F&B segments too. Different innovations like holograms, QR codes, RFID chips, etc. are influencing the growth of other F&B segments and as the market grows, the industry will adopt cheaper and scalable mechanisms.

The endless pressure from the consumer, especially from the mature market, is forcing brands to opt for user-friendly designs. The brands are now making features like child resistance a mandatory requirement and it's anticipated that the incorporation will offer multiple user-friendly functionalities.

Dispensing and smart closures are mostly used in the pharma sector for their packaging and the firms use techniques like NFC or Bluetooth to communicate dosage and promotional information to their customers. This attracts a higher price for smart closures compared to conventional ones and thus packaging cost increases in the pharma industry.

As per the Caps and Closures Market Research report shared by Beroe, PP and HDPE both are preferred resins for manufacturing plastic closures via injection molding. However, it's an old technique and hence firms rely more on compression molding as it's faster in mass production and manufactures light-weight closures.

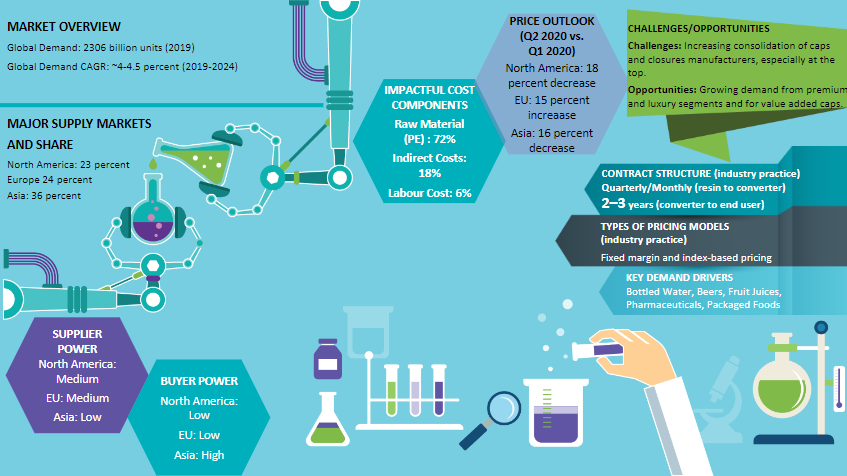

Believing in the insights shared by Beroe Inc., the global caps and closures market growth is expected to be around 4 ' 4.5% w.r.t volume by 2023, and plastic caps and closures will be the driving factor. The same report also indicates that bottled water will grow too, with a CAGR rate of 7 ' 8%.

As per the caps and closures market news, metal closures will observe a downfall from 24% to 22% in the market shares because plastic closures will be replacing them in multiple sectors including beverages, cosmetics, and pharma.

Caps and Closures market report transcript

Global Market Outlook on Caps and Closures

-

Plastic caps and metal closures hold a market share of about 73–75 percent 24–25 percent, respectively. The rest is shared between rubber and cork

-

The beverage industry is the largest end-use segment and accounts for about 50–55 percent of the overall market

-

Bottled water is the fastest growing end-use market (CAGR 7–8 percent), especially in the Americas and APAC, as more consumers switch from CSDs to more healthy beverages

-

Adoption of user-friendly features, such as dispensing and child resistance, is driving the value growth in the market, at a CAGR of about 5–6 percent, until 2026

-

Development of flexible packaging options, such as pouches, is restraining the market

Key Trends and Innovations

- Anti-counterfeiting Closures: The penetration of anti-counterfeiting closures is high in alcoholic beverages, especially in the premium segment. Currently, such closures are penetrating other F&B segments. Innovations include holograms, QR codes, RFID chips, etc. As the market grows in other segments, cheaper and highly scalable mechanisms will be adopted by the industry

-

Functional and User-friendly Closures: As a result of growing consumer pressure, especially from mature markets, brands are switching to more user-friendly designs. Features, such as child resistance, are becoming regulatory requirements. These factors are expected to foster a multitude of innovations that offer many user-friendly functionalities, such as dosage measuring, dual-spout closures, etc

- Dispensing and Smart Closures: Many pharma firms have incorporated dispensing closures or smart features into their packaging. Techniques, such as NFC, Bluetooth, etc., are being used by firms to communicate dosage and promotional information to consumers. As such closures command a much higher price than conventional ones, the cost of packaging is expected to increase in the pharma industry

Value Chain Analysis: Plastic Caps

The report analyzes the value chain for plastic caps and metal caps individually. The manufacturing process of caps and closures are organized into tiers in the value chain. The proportional contribution to the overall value at each stage of the process is stated. The value chain also has a power shift at each level that has been described in the report. The key global suppliers involved in the value chain are also listed.

- PP and HDPE are the preferred resins for manufacturing plastic closures. the Injection molding process is the most favored technology for manufacturing caps and closures

- Compression molding is a new technology, but it has started replacing injection molding in the manufacturing closures, owing to faster process in mass production and the ability to manufacture light-weight closures

Global Market Size: Caps and Closures

-

The caps and closures market is expected to grow at the rate of 4–4.5 percent by volume during 2023E–2026, with plastic caps and closures driving the demand

-

In the next five years, beverages, especially bottled water will drive the volume growth, whereas user-friendly and functional closures in personal and home care and pharma are likely to drive the value growth

-

Plastic caps contribute to 75 percent of the entire caps and closures market and expected to drive the market with a CAGR of 4.5–5 percent during 2023E–2026

-

The increasing demand across beverages, especially in the emerging markets, is the main growth driver

-

The bottled water segment is expected to drive volume growth in the near future, with a CAGR of 7–8 percent, during 2023E–2026

-

The market share of metal closures is expected to decrease from 24 percent to 22 percent by 2026, as plastic closures replace metal in multiple segments across beverages, cosmetics, and pharma

-

Corks expected a decline of around 3 percent CAGR

-

Rubber stoppers are expected to witness a significant growth of 7–8 percent, with growing parenteral route administration in the pharma market

-

The value growth is expected to be driven by an increasing demand for user-friendly closures, especially in the personal and home care segment

Regional Market Overview

-

The APAC is the largest market for caps and closures and is likely to experience a strong growth in the next five years, with growing beverages in the domestic market

-

The EU and North America are expected to grow at a CAGR of about 2-3 percent and 3–3.5 percent, respectively, driven by bottled water and beverage segments

-

APAC, with a market share of about 36 percent, is the fastest growing market, with an estimated CAGR of about 5–6 percent over the next four years

–The growth is driven by rapidly growing market for beverages, especially bottled water, beer, and other juices

–The market share is likely to surpass 40 percent by 2026

-

Africa and the Middle East are expected to witness a similar growth as that of Asia, due to the growing disposable income and penetration of beverages

–In Africa, demand for metal caps and closures is expected to grow at about 4.5–5 percent CAGR during 2023E–2026, compared to the global growth of 2–2.5 percent CAGR

-

China accounts for over 15 percent of the global market for plastic caps

–China would continue to grow at about 7–7.5 percent CAGR in the segment, owing to increasing domestic and export demand

–Exports from China have been growing at about 6–6.5 percent CAGR over the last three years

-

Volume growth in North America and EU is considerably slow, owing to the slowing down of key end-use markets, like CSD and beer

–The bottled water market is growing at 7–8 percent CAGR, sustaining growth in the next five years

Global Demand by Application

-

Downstream segments, such as bottled water (CAGR 7–8 percent), beverages (CAGR 3–3.5 percent), and pharmaceuticals (CAGR 5.5–6 percent), drive the demand for caps and closures, while pressure from end-use consumers for more functional packaging in personal home care and pharma segments drive innovations.

Global Trade Dynamics

The balance of imports and exports in each region are wildly varied. Some regions remain the top importers of caps and closures while others are in decline. The fastest-growing importers are also listed in the report. The value of the imports and exports in each region is illustrated. The reasons for the changing status of the region are also analyzed and described.

Global Exports of Caps and Closures

Certain countries are the largest exporters of caps and closures and dominate the global market. This caps and closures market report illustrates the export market share of each country. It also details which countries each region exports to, with facts and figures pertaining to export volumes.

Global Imports of Caps and Closures

The market share of imports is illustrated country-wise. The countries from which each country imports alongside the import volumes are listed.

Regional Market Snapshot

This section of the report analyses the market of each region individually. The regions that are studied are North America, EU, APAC, and LATAM. The report gives a detailed analysis of the regional market information, market maturity, takeaways, market demand by material, demand by the industry as well as the export and import data.

Industry Analysis

The report goes into in-depth analysis and studies globally and regionally. The developed regions and emerging regions are described separately. The report analyses the supplier and buyer dynamics in each market. The challenges and constraints are also described.

Industry Drivers and Constraints

This section of the report clearly lists the different factors that drive industry growth. The innovations and increasing applications of caps and closures that help the industry grow are described. Likewise, the factors that pose a challenge to and that constrain the industry are listed.

Key Industry Trends: Plastic Caps and Closures

The caps and closures market news and important trends are detailed. The innovative closure or cap is described and the details of how the market is likely to react to and apply the innovations are analyzed. Examples of how and where the new trends are applied are given.

Innovations in Personal and Cosmetics

The highly competitive and challenging world of personal care and cosmetic products is constantly innovating in response to customer expectations and competition. This has fostered advancements in the design as well as applications of caps and closures. In some cases, the very purpose of a cap/closure has been reinvented. The timelines of these innovations and their details have been explained and illustrated. Some of these innovations are in response to eco-friendliness and sustainability trends. Caps and closures include pumps that are integrated into the caps of some products. Some companies have innovated and created signature dispensing cap and closure solutions.

Key Industry Trends: Food and Beverage

The food and beverage industry is also very competitive and highly innovative. many of the new designs of closures and caps improve the customer experience, improve sustainability, are multipurpose, or fulfill the other demands based on application.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.