CATEGORY

Biomarkers

Assays to evaluate presence or progress of a disease.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Biomarkers.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoBiomarkers Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoBiomarkers Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Biomarkers category is 5.40%

Payment Terms

(in days)

The industry average payment terms in Biomarkers category for the current quarter is 73.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Biomarkers market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBiomarkers market frequently asked questions

As per Beroe, the primary factors that drive the growth of the biomarkers market are: Increasing diagnostic applications of biomarkers Rise in R&D funding from the government Growing number of CROs Low cost of clinical trials in the developing countries High prevalence and incidence of chronic diseases New initiatives for biomarker research

The main uses of the biomarkers within the industry are: Predicting the prognosis and selecting dose regimes Detecting therapeutic advances and adverse responses For patient satisfaction based on efficacy or safety prediction They can also help to select appropriate patients for treatment with certain drugs, hence enables personalized medicine

According to Beroe's insights, the genomics-based biomarker platform is the fastest growing and heavily adopted technology.

As per Beroe, the genomics biomarker market is expected to grow at a CAGR of nearly 25 ' 26 percent, while for proteomics and imaging biomarkers, the growth rate is anticipated around 12 ' 14 percent and 14 ' 15 percent respectively in the next five years.

The cancer biomarkers market is estimated to grow at a CAGR of 15 ' 15.5 percent and its market share is expected to reach a valuation of $32,632.11 million by 2024.

As per Beroe's study, the core factors that drive the growth of the cancer biomarkers market include: An increasing rate of cancer patients Technological advancements of omics Need for personalized cancer treatments The rise in government funding for cancer research

Cardiovascular disorders are expected to grow at the highest CAGR of 15.9 percent to reach a valuation of $25,063.53 by 2024.

Cardiac biomarkers are majorly used as risk stratification for various CVDs like myocardial infarction, congestive heart failure, ACS, etc.

According to Beroe's report, some of the widely used biomarkers for CVD as an integrated diagnostic approach include: CK ' MB Troponin I and T Myoglobin BNPs IMA

Following the insights from Beroe's analysis, it can be said that the market is moving more towards global as: Regional engagement requires revalidation in secondary labs The local engagement has difficulty while developing complex biomarkers

The key suppliers include the following names: Covance QPS Immune Health SGS Charles River PRAHS

The global market size of biomarkers is nearly $29 Bn which grows at a CAGR rate of 13 ' 14 percent.

The four restraints that are hampering biomarkers procurement for the corporates are: High capital investment and low cost-benefit ratio Poorly suited regulatory and reimbursement systems Technical issues related to sample collection and storage Government regulation and ethical problems Complex process

Biomarkers market report transcript

Global Market Outlook on Biomarkers

-

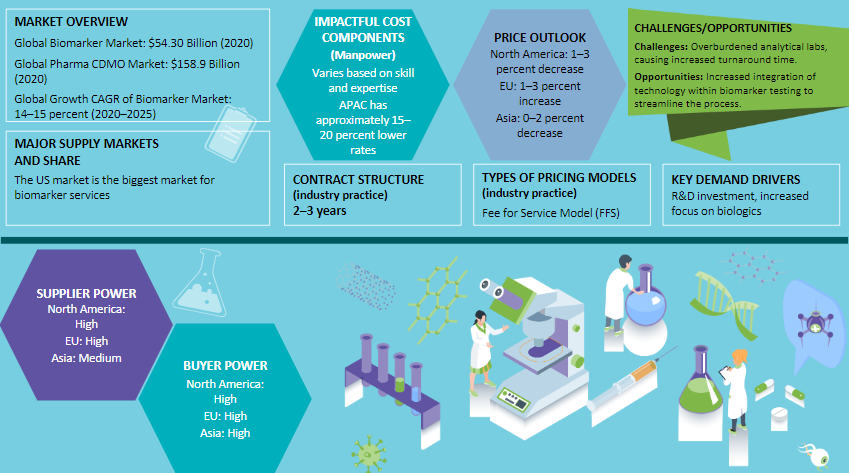

The global demand for biomarkers is expected to grow at approx. 14–16 percent CAGR through 2022–2028

-

Pharmaceutical companies are outsourcing manufacturing and development services, due to the nature of business being capital intensive and the growing demand of biologics and generic medicines

-

North America is the preferred region, followed by Asia Pacific, mainly due to the low cost of operations and continuous evolving nature of regulations

Biomarker Market

-

Cancer had the biggest market share of USD 16.07 billion in 2022 and is expected to grow at a CAGR of 15-17 percent during the forecast period.

-

The market growth is mainly driven by factors, such as increasing diagnostic applications of biomarkers, rise in R&D funding from government, growing number of CROs, low cost of clinical trials in developing countries, high prevalence and incidence of chronic diseases, and new initiatives for biomarker research

-

Genomics-based biomarker platform is the fastest growing and heavily adopted technology among others. In fact, the genomics biomarker market is expected to grow at a CAGR of approx. 12–15 percent in the next five years

-

Proteomics biomarker discovery, albeit more complex, is expected to grow at a CAGR of 14–16 percent

-

Imaging biomarkers, on the other hand, are expected to grow at a steady rate of 14–15 percent, over the next five years

-

Biomarkers are important for predicting prognosis and selecting dose regimes. They are helpful for detecting therapeutic advances and adverse responses as well as for patient stratification, based on efficacy or safety prediction

-

Biomarkers are essential tools for the selection of appropriate patients for treatment with certain drugs and so, enables personalized medicine to a greater extent

-

Secondary End Point Biomarkers is expected to grow at a CAGR of 14.7 percent from 2022 to 2026 and is expected to reach $4.9 billion in 2026

-

The North American sub-continent constitutes the biggest market share to the global biomarkers market. The major growth in this continent is because of the modern healthcare infrastructure facility, new product launches, entry of new industry players in the business/market sector, wide utilization of biomarkers, and strong development trends in contract research organizations and pharmaceutical firms in this continent, dynamic government initiatives and increase in the disease prevalence

Cancer

-

The cancer biomarker market is expected to grow at a CAGR of 15–17 percent

-

The market share of cancer biomarkers is forecasted to reach $46 billion by 2028

-

The growth factors include:

–Increasing rate of cancer patients

–Technological advancement of Omics

–Need for personalized cancer treatments

–Rise in government funding for cancer research

- Among the regions, Asia Pacific will continue to grow in the next five years

Cardiovascular

-

Cardiovascular disorders are expected to grow at the highest CAGR of 14–16 percent and is expected to reach $20,450 million by 2026

-

Cardiac biomarkers are used as risk stratification for various CVDs, such as myocardial infraction, congestive heart failure, ACS, etc.

-

Some of the widely used biomarkers for CVDs as an integrated diagnostic approach include CK-MB, troponin I and T, myoglobin, BNPs and IMA

Drivers and Restraints : Biomarkers

Drivers

- Increasing diagnostic applications of biomarkers

−Personalized medicine, an emerging practice of medicine that uses an individual's enetic profile to guide decisions made, in regard to the diagnosis, prevention, and treatment of diseases.

−Companion diagnostics involves the use of biomarkers that provides biological and/or clinical information that enables better decision making about the development and use of a potential drug therapy

-

Increasing R&D funding for pharma and biotech companies

-

Non-invasive biomarkers can help in decision making during interim analysis in protocols

-

Accuracy in result - Biomarkers can also reflect the entire spectrum of disease from the earliest manifestations to the terminal stages

-

Increasing number of CROs and low cost of clinical trials in developing countries

-

Multi-marker Application: Combination of markers used in the care, along the entire spectrum of disease, by improving screening, simplifying diagnosis, clarifying prognosis, and tailoring treatment

-

Gene-level diagnosis: Cancer diagnosis is becoming more easier with the incorporation of molecular markers, such as DNA, RNA, micro RNAs, and proteins

Restraints

-

High capital investment and low cost-benefit ratio

-

Poorly suited regulatory and reimbursement systems

-

Technical issues related to sample collection and storage

-

Government regulation and ethical problems

-

Complex process

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.