CATEGORY

Beverage Cans Australia

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Beverage Cans Australia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Beverage Cans Australia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBeverage Cans Australia market report transcript

Regional Market Outlook on Beverage Cans

APAC Beverage Can Market (2023E–2027F)

-

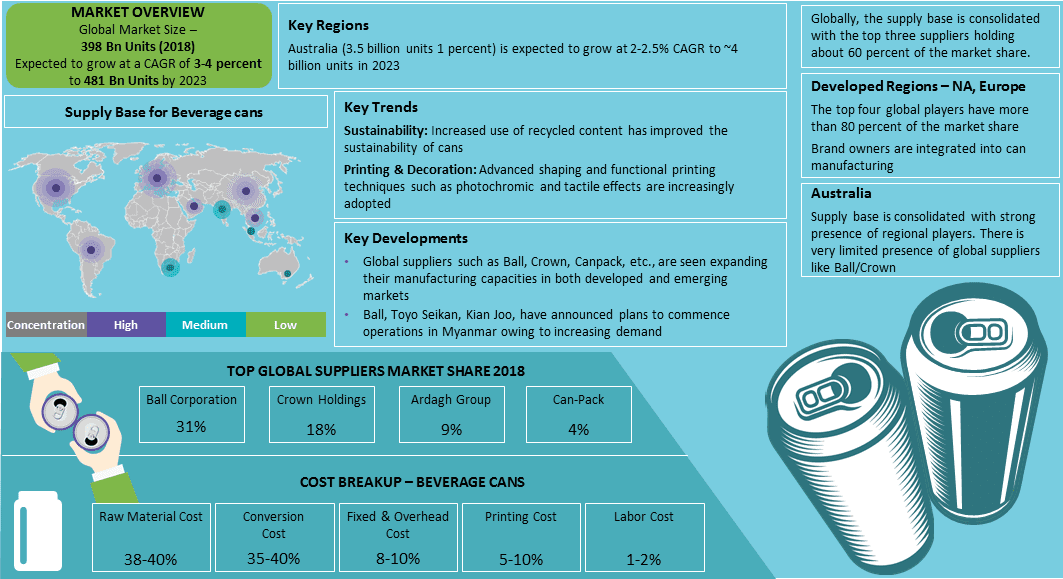

Maturity of Suppliers: The supply base is fairly consolidated with a strong presence of both global and regional players. Large global players are seen expanding their facilities in markets, such as Saudi Arabia, India, Myanmar, Thailand, Vietnam, etc., increasing their market share in these regions

-

Maturity of the Buyers: Global beverage manufacturers are large with huge volume requirement and have a higher bargaining power with the suppliers. They also negotiate global supply contracts with the suppliers. There is also a growing number of smaller regional players adopting metal cans for their products

-

Demand Trends: There is an increasing demand for slim cans (250ml) especially for the functional drinks, RTD beverages, etc., which have a CAGR of about 5-6 percent are expected to drive the demand. Consumption of beer, one of the largest end-use segments for beverage cans is expected to grow at about 6-7 percent CAGR across Asia. However, the government’s recent efforts to drive down the consumption of alcohol could affect this growth. Lot of South-East Asian countries like Indonesia and India have imposed ‘sin tax’ on carbonated beverages, hence we can expect a lull in demand for beverage cans from these segments.

-

Supplier Overview: There has been a few expansion activities in China, Pakistan and in a few Southeast Asian countries

Industry Drivers and Constraints

Drivers

Downstream Demand

- Changing lifestyles of the consumers and the increasing preference for on the go food and drinks could increase the demand for beverage cans

- The increasing availability and adoption of beverage cans in new end-use segments such as water, functional drinks, etc., could also drive the demand for beverage cans

Sustainability features

- Aluminum cans are increasingly seen as a sustainable packaging option due to their recyclability. Brazil and Japan have high recycling rates of about 98.2 percent and 82.5 percent respectively, with other markets also following suit

- Light weighting efforts over the years has help to reduce the weight of cans to about 13grams (330ml), which has led to improved sustainability and significant reduction in transportation and material costs

Constraints

Product Substitution

- Increased use of plastics for CSD and its penetration in to beer packaging could deter the demand for metal cans

- Larger packaging formats such as Kegs offered in 3 liter and 5 liter pack sizes are becoming increasingly popular in indoor parties and other occasions

Supply Base Consolidation

- The consolidated nature of the supply base for bevcans with about 4 players controlling more than 80 percent of the market would make it difficult for smaller beverage manufacturers to adopt bevcans and may prefer plastic bottles to increase their bargaining leverage

- The increased switching costs and cost of innovations would tend to raise due to the consolidated supply base even for large suppliers

Beverage Cans – Market Trends

Preference for Slim cans over standard cans

-

There is an increasing demand for specialty can in both emerging and developed markets

-

This is due to the consumers preference for smaller pack sizes and also the increasing consumption of non alcoholic beverages and other new end-use segments in cans such as water, RTD beverages, wines, craft beers, etc., which are increasingly being packed in specialty can sizes

-

While the smaller can sizes are seen as an affordable option in the developing markets such as Thailand, Vietnam, etc., which are also seeing an increasing demand for slim cans

Increasing recycling rates for aluminum cans

-

Increasing awareness about the sustainability of metal cans and the successful can collection programs have led to increase in the recycling rates of the cans

-

Brazil has the highest recycling rate in the world with about 98 percent, ahead of Japan and Argentina. However, the developed markets such as US and Europe have a lower recycling rate of about 64 percent and 75 percent respectively

-

Can manufacturers are seen implementing sustainability measures such as light weighting, increasing recycled content in the raw materials, etc., to improve the sustainability of their cans

Product Substitution Trends

-

Plastic has been gaining strength as a strong substitute for metal cans especially in the markets of NA, Europe and China. Though plastic is being largely used in beverages, the need for product differentiation and the development of plastics with improved sustainability features would lead to brand owners adopting plastics. Beer in plastic cans are popular in Europe

-

Metal is seen to be increasingly taking over the share from glass bottles. In particular many craft beers, ciders, wines, etc., which have been predominantly packed in glass bottles are being seen in metal cans. The availability of advanced metal decoration techniques is also driving this trend

Beverage Cans Australia Market Overview

- The supply base is highly consolidated with regional players more than 80 percent of the market supplied by the top three global players and in smaller quantities by regional players.

- Global beverage manufacturers are large with huge volume requirement and have higher bargaining power with the suppliers. They also negotiate global supply contracts with suppliers.

- Market Drivers: CSD is a mature market within Australia with seasonal demand. Average per capita consumption of beverages remain at 141.4 lt is in 2018. This demand is expected to increase marginally by 1-1.5% in the next 3-5 years.

- Beer consumption is expected to increase by 3% CAGR over till 2023 with almost 65-70% being consumed in cans.

- The energy drinks segment is seeking massive growth within this region with stiff competition among manufacturers Red Bull and Coca-Cola (Amatil). Growth in this segment at 8-10% CAGR until 2023 is expected to boost the demand for beverage cans, especially slim/sleek cans in this region.

- Market Constraints: Premiumisation and growing craft brewery within the country might have a slightly negative impact on beverage cans demand

- Austria remained the largest import destination for Australia, owing to a strong presence of Ardagh Group and the bilateral trade treaty existing between these two countries.

Why You Should Buy This Report

- Information on the Australian beverage cans market size, demand by application and region, value chain analysis, global outlook, exports and imports, etc.

- Industry drivers and constraints, key trends and innovations, etc.

- Porter’s five forces analysis of the Australian beverage cans market.

- Supplier analysis, market activity and profiles of key suppliers.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.