CATEGORY

Base Oil - Group II

Base oil is the major feedstock for all lubricants which has its key end use in automobile and machinery and personal and home care segment. Group II base oils are superior in terms of both physical and chemical properties and it is produced by hydrocracking process. OEM regulations and environmental concerns in the Western markets have not only changed the lubes consumption pattern there but has also impacted the fundamentals of tier I feedstock base oils market.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Base Oil - Group II.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Exxon Mobil to continue operations at 380,422 tons/year Group I plant in Singapore

July 19, 2022Exxon Mobil to continue operations at 380,422 tons/year Group I plant in Singapore

July 19, 2022Exxon Mobil to continue operations at 380,422 tons/year Group I plant in Singapore

July 19, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Base Oil - Group II

Schedule a DemoBase Oil - Group II Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoBase Oil - Group II Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Base Oil - Group II category is 5.00%

Payment Terms

(in days)

The industry average payment terms in Base Oil - Group II category for the current quarter is 90.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Base Oil - Group II market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBase Oil - Group II market frequently asked questions

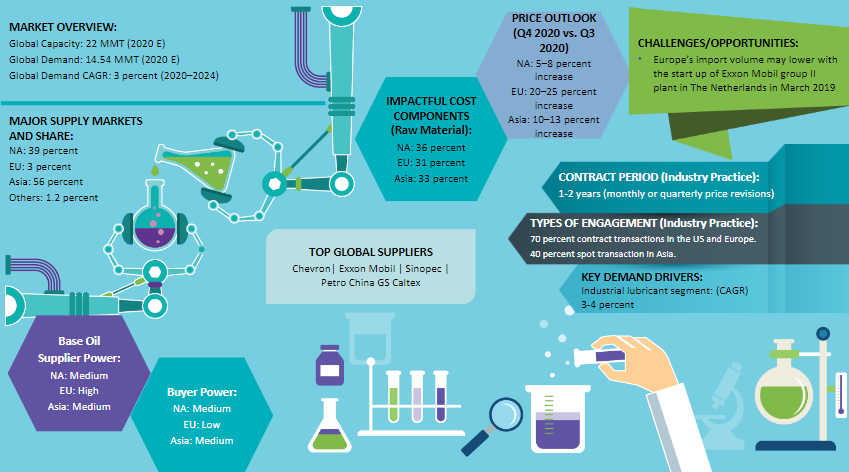

As per Beroe's base oil market analysis, the major players in the global base oil market are North America (39%), EU (3%), Asia (56%), and other countries (1.2%).

Beroe's base oil report highlights certain base oil price trends as well as market updates. As per the report, a huge demand is expected from the industrial segment in Asia. Considering the industrial lubricants sector is one of top consumers of base oil, rise in mining activities is considered to drive the demand. A considerable demand is also expected to come from the automobile sector due to a rise in vehicle production. A sustained shift towards pure base oils has created a rise in group II quantities.

The global base oil market is expected to grow at a CAGR of 3 percent by 2022.

As per Beroe's base oil market analysis, major demand is expected to arise from Asia and the US as most of the derivative units, including industrial, automobile, and metal processing are located in Asia. The automobile and the mining sector with a growth of 2-3% and 3% respectively are expected to be the key segments propelling the demand. Automobile and lubricant sectors are expected to drive a significant amount of demand.

Base Oil - Group II market report transcript

Global Base Oil Market Outlook

The global group II market is expected to grow at a CAGR of 2-3 percent during 2021–2025

- The robust demand growth from Asia, especially the industrial segment, is expected to drive the growth for base oil, and demand for industrial area is expected to grow at a CAGR of around 4 percent

The industrial lubricants sector is the second largest base oil consuming segment in the global market

- Increasing mining activities in the Asian market are expected to drive the demand for group II base oils

Base Oil Market - Demand Outlook

-

The global group II base oil market has excess capacity and is expected to further increase in the next 2–3 years, due to capacity additions, mainly in Asia

-

Major demand is expected from Asia and the US market, since most of the derivative units (industrial, automobile, and metal processing) are lined up in Asia. The automobile (2–3 percent growth) and the mining sector (3 percent growth) would be the key segments driving the demand. Around 1.5 MMT capacity additions are planned for lubricant production

Global Market Size - Group II Base Oils

-

Outbreak of COVID-19 lowered market size in 2020, as strict lockdowns in the US, Europe, and Asian countries restricted people's movement and resulted in lower demand from machine and auto lubricants

-

Market witnessed a sharp rebound in 2021 with firm demand and higher crude oil prices supported firm price increase across all the regions

-

Despite lower demand from Q2 2022, prices of base oils have witnessed an uptrend and hence, the market size witnessed an increase, however, price drop and weak demand to have a negative impact on the market size in 2023

Global Capacity–Demand Analysis : Base Oil

- Consistent shift toward highly pure base oils has led to an increase in group II capacities: Rising environmental concerns and regulations proposed by OEMs have consistently increased the demand for group II base oil demand. Moving forward, the same trend is expected to continue, due to improved demand from automotive segment from developing countries

Market Outlook

-

Demand for light vehicles to grow at a CAGR of 3–4 percent: Increasing light vehicle sales is expected to drive the demand for automobile lubricants through 2025

-

Group II capacity additions are planned in Asia and the US: Changing dynamics in the US resulted in almost 30 percent of the players switching from group I to group II capacities. The US is expected to remain a net exporter with excess group II supply in the domestic market

Engagement Outlook

-

One-year contract with quarterly price revisions: In the US and Europe, players can engage in year-long contract with quarterly price revisions

-

Spot buying is preferred in Asia: In Asia, spot buying is mostly preferred, since the consumers buy group II base oils and convert it in-house for their personal care applications

-

Bulk cargo shipments are preferred for contract buying: CPG players can buy their volume in bulk at one stretch to save ocean freight charges and increase volume discounts

Base Oil Global Demand by Application

- Group II base oil finds its end-use application in CPG in the form of solvents used in the production of cosmetics and personal care products. Growing demand (CAGR of 3–4 percent) from large volume buyers, like industrial and process oils in the European market, are expected to pose supply threat to small volume CPG players

Downstream Demand Outlook

-

Demand for automobile lubricants to grow at a CAGR of 2–3 percent: Due to increasing light vehicle sales in the developed regions and heavy duty containers sales in the developing regions, demand for auto lubricants is expected to increase during the next five years

-

Demand for metal woking fluids is likely to increase, due to increase in mining activtiies in the US market. The mining industry has been showing tremendous growth in the North American market, and it is expected to grow at a CAGR of 1-3 percent during 2021–2025

-

Process oil is expected to grow at a CAGR of 2–3 percent: Investment planned in rubber prodcution is expected to increase the demand for process oil during the next five years

Base Oil Global Trade Dynamics

-

South Korea and Singapore remain as net exporters in the Asian market: Low feedstock cost and low demand for group II base oils in the domestic market made these countries net exporters to European and other Asian countries

-

Europe remains a net importer, due to non-availability of feedstock and less production in the region: Changing dynamics in the Western markets have resulted in the increased usage of group II base oils in all the major downstream sectors (automobile, industrial, process, and metal working lubricants). This has left less base oils for other derivatives, turning Europe into a net importer. This trend is expected to continue for the next five years

Industry Drivers and Constraints : Base Oil

Demand from automobile lubricants will drive the demand for group II base oils for the next 3-4years. Shift towards cleaner fuels and cleaner industrial lubricants from western markets to drive the demand for group II base oils

Drivers

Growth in industrial lubricants segment

- Industrial lubricants segment is expected to grow at a CAGR of 2-3 percent across the world, which is likely to pull the demand for group II base oils

Firm demand from mature markets

- North American and European markets which consumes group II mainly for auto lubricants production is expected to post steady demand for group II, due to the healthier base oil to lubricants conversion margins

Group I to group II conversion margins

- Group I base oil is converted on purpose to group II. This conversion is done only when the margins between these two products are above $250

Constraints

Shift to lighter feed slate

- Due to the LPG revolution in Europe, many cracker units have switched to cheaper ethane as feedstock rather than conventional naphtha, which has reduced the production of lower cuts in the Europe market

High temperature hydro cracking unit has to be installed:

-

For producing group II base oils higher level of hydrocracking is required. All the refiners are not upgraded with facility. Capital investment involved with maintenance issues makes most of the refiners reluctant to install these unit

-

Across the globe 20 refiners are upgraded with this facility. Hence players who are forward integrated with lubricant (Independent lubricant blender) production only have this group II production facility

Base Oil Cost Structure Analysis

Feedstock crude price is lower in Asia and expected to trend lower during the next five years due to the decreasing crude prices. This positions the Asian players at an advantage in the global market due to competitive pricing and hence, Asia will grow as a best cost sourcing destination for group II base oils in the next five years.

-

Crude and regional energy with gas prices are the key indicators to track the prices of Base oils: Since group II base oils are produced though hydrocracking at varying boiling points ranging from 300 degree Celsius, gas is used as a burning agent in the refineries. Hence, gas prices plays major role in deciding the base oil prices

-

In most of the regions, electricity prices are government regulated and are seldom volatile and hence tracking prices combined with seasonal patterns will enable buyers to keep track of price trends of base oils

Innovations, Trends And Events

This market report lists technological innovations if any that affect the base oil market. The most current trends and noteworthy must-know events are important information. The base oil market price is particularly sensitive to environmental issues and sustainability as well as the relevant innovations and regulations. The trends that result in response to the need for environmental sensitivity and sustainability are listed. This encompasses all stages of the industry’s processes in a cost-effective and energy-efficient manner.

Why You Should Buy This Report

- This industry report on the global base oil market outlook provides the cost structure and price analysis of Group II base oil.

- The report provides the base oil price trends, supplier trends, global share, key profile and does a SWOT analysis of major base oil suppliers like Chevron Phillip, Exxon Mobil, Sinopec, and LyondellBasell.

- The report lists out the key drivers and constraints and does Porter’s five force analysis of North America, Europe, and Asia base oil market.

- It lists out the key technological trends and innovations for the regional base oil markets.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.