CATEGORY

Ammonia

The global demand for ammonia is expected to grow at a CAGR of 3-4 percent during 2016 - 2022: The impetus for this growth comes from demand in Asia, which is expected to grow at 3 - 4 percent, due to increased demand from the agricultural segment

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Ammonia.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Aramco and Linde to develop low carbon hydrogen supply chain using ammonia cracking technology.

March 21, 2023Restart of US LSB industries

January 30, 2023Mabanaft and Hapag-Lloyd to explore supply potential for green ammonia in Germany and the US

January 30, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Ammonia

Schedule a DemoAmmonia Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAmmonia Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Ammonia category is 20.00%

Payment Terms

(in days)

The industry average payment terms in Ammonia category for the current quarter is 75.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Ammonia market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAmmonia market frequently asked questions

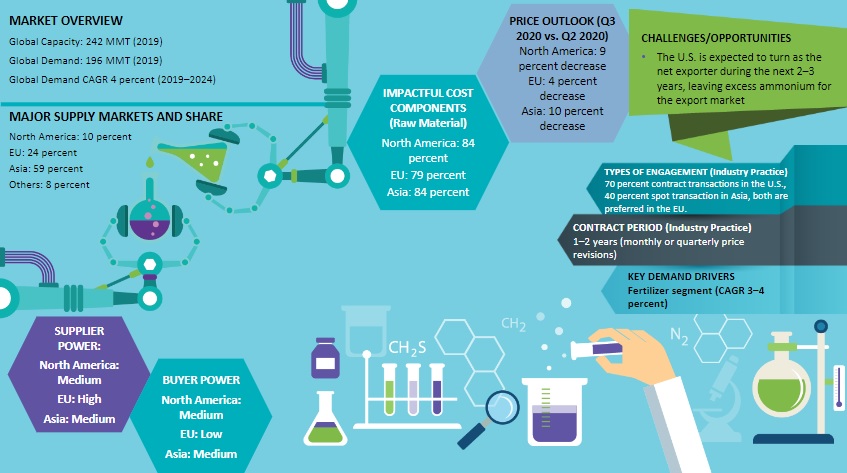

The key players in the global ammonia market as revealed by Beroe's ammonia market report are North America (10%), EU (24%), Asia (59%), and other countries (8%).

Beroe's ammonia market outlook identifies certain key trends such as the demand from Asia rising at a rate of 3-4% as a result of increased demand from the agricultural sector and the non-fertiliser sector accounting for around 13% of the total ammonia market share.

The ammonia market growth as per Beroe's ammonia market research is found to be at a CAGR of 3% by 2022

The key drivers of the global ammonia market are considered to be capacity additions, primarily in the US which is expected to increase the global supply in 2-3 years. This may also lead to an increase in ammonia availability in the export market. The Asian and US markets are expected to see a major demand since they house most of the derivative units. Although the US has remained a leading importer in the previous decade, this year onwards it may be different. Moreover, the fertilizer sector is expected to drive a major part of the demand for ammonia.

Ammonia market report transcript

Key drivers of demand for ammonia

- Since it is a naturally available compound and is easily available in air, water and soil there is an abundant amount available. It is not hazardous to the environment either.

- It is a key component used in products used by people on an everyday basis. Almost 90% of the products that we buy have some amount of ammonia in them.

- A huge amount of ammonia is used in agriculture and its products.

Global Ammonia Market Outlook

-

The global demand is expected to grow at a CAGR of 1-2 percent during 2022–2025: The impetus for this growth comes from demand in Asia, which is expected to grow at 1-2 percent, due to increased demand from the agricultural segment

-

The non-fertilizer sector accounts for 8 percent of the global ammonia-consuming segment

-

Increasing mining activities in the Asian and LATAM markets are expected to drive the demand in these regions

Ammonia Demand Market Outlook

-

The global supply is expected to improve in the next 2–3 years, due to capacity additions.

-

This will increase the availability of ammonia for the export market

-

A major demand is expected to come from Asian and the US markets, since most of the derivative units (fertilizer, direct application, and industrial usage) are lined up in the US and Asia. The fertilizer (3–4 percent growth) and industrial sector (3–4 percent growth) would be the key segments driving the demand. Around 10 MMT capacity additions are planned for the fertilizer production

Global Ammonia Market Size

-

Demand to grow at a CAGR of 1-2 percent: The total global demand is expected to reach 200 MMT by 2025

-

The fertilizer segment to drive the demand: Significant demand is expected from the fertilizer segment with the growing population in the developing region. NPK/NP fertilizer contributes to a major portion of the demand

-

The US import dependency to reduce: The US has remained as the biggest importer in the past decade. However, moving forward, the US dependency on imports is expected to decline sharply, ending the era of massive imports from Trinidad and Tobago. This is due to the huge capacity additions expected to come online during 2022–2025.

Global Capacity: Demand Analysis : Ammonia

Huge capacity additions in the Russia and Asia: More than a dozen of standalone and integrated ammonia plants are nearing completion, and it is expected to bring additional ammonia available in the merchant market. Thereby, reducing the pressure on ammonia prices

Market Outlook

-

APAC is expected to drive the demand: APAC accounts for over 50 percent of the global capacity in 2022

-

Major capacity additions planned: Huge availability of low-cost natural gas in the Middle East and Africa is expected to increase the ammonia capacity in these regions.

-

The huge capacity addition in ammonia might ease the demand situation in the short term, however, with increasing population and less availability of arable land, the demand for ammonia is expected to remain firm in the long run

Engagement Outlook

-

Two-year contract with quarterly price revisions: In the US and the EU, players can engage with two-year long contract with quarterly price revisions to secure supply in the region. This is mostly preferred by fertilizer players, since prices are based on agro seasonality

-

Bulk cargo shipments are preferred for contract buying: Fertilizer and explosive players can buy their volume in bulk volume around 50,000 MT at one stretch to save ocean freight charges and increase volume discounts

Ammonia Global Trade Dynamics

-

Globally, only 12 percent of the ammonia produced is traded, and the rest is used captively to convert into nitrogen-based fertilizers

-

North America: Imports in to US have reduced considerably in the past two years due to capacity additions.

-

EU: Russia is expected to remain ammonia surplus (4.3 MMT excess), and it is expected to cater to the merchant market

-

Asia: The Middle East is expected to remain as the key supplier of ammonia to India

Ammonia Global Demand by Application

-

Demand from the non-fertilizer segment is expected to grow at a CAGR of 3-4 percent

-

The demand for Ammonia increased in 2022 due to the huge demand from the fertilizer segment and industrial sector.

Downstream Demand Outlook

-

Demand for Urea is exppected to to grow at a CAGR of 1-2 percent: Urea contributes more than 50 percent of the demand and is the major driver for the Ammonia market.

-

Demand for ammonium nitrate is expected to grow at a CAGR of 2–3 percent: Demand for ammonium nitrate is expected to increase from the APAC region, due to the new agricultural policy. This policy has permitted the usage of ammonia in all agro and explosive products. This is expected to drive the demand in the APAC and Middle Eastern regions

-

Agricultural policy changes in the Western Europe for ammonium nitrate is expected to decrease the production: The ammonium nitrate production has decreased around 0.2 MMT in the western European market, after the implementation of the new agricultural policy. Limited usage of ammonium nitrate in the agro-based fertilizers

-

DAP/MAP demand is increasing from the Chinese market: A significant growth is expected in this segment, due to high crop yield in the Chinese landscape

Global Exports

-

Excess demand in the US and established trade route between the US and Canada lead to trade ease between these regions. Canada exports around 30 percent of the ammonia produced to the US market

-

Capacity expansion in Russia has significantly added to the availability of ammonia in the merchant market, and it is expected to continue in the near future

Cost Structure Analysis : Ammonia

After the advent of shale gas, the US Gulf region is becoming the new hub for low-cost production of ammonia. This is expected to leave some ammonia from Mexico and the US to the global markets.

Gas surplus markets are low-cost production centers

-

The Middle East and South America have traditionally been low-cost production centers, and hence, export intensive.

Coal advantage in China is the new low-cost center

-

Excess coal in China is being put to advantage, as coal developments are bringing down ammonia costs. This is resulting in a surge of new capacities

-

NE Asia is not conducive for methanol low-cost production, and many NG plants are being rationalized

-

Hence, NE Asia largely looks for cost-effective imports from the Middle East, and the most recent trade establishment is the Middle East exporting to India and other SE Asian countries

Ammonia Industry Drivers and Constraints

Drivers

Fertilizer demand to be the major demand driver

-

Growing population in India and China, increase in arable land are expected to increase the demand for ammonia in the fertilizer segment

Supply surge in the U.S. and China

-

New trade flows are being established after the surge in the U.S. capacity. The Chinese supply growth will be consumed domestically, but volume from the U.S. market will have some additions to export the market share

Low-cost regions: feedstock advantage

-

Feedstock costs for ammonia account for 80 percent of the total cash cost, and access to low-cost feedstock is key for the overall ammonia production

-

Natural gas abundance in the U.S. and certain regions, like T&T Venezuela, Middle East, and coal abundance in China drive the global market

-

The Middle East acts as a swing supply market to Europe and North America, based on the price that China sets

Constraints

-

The cost to set up an ammonia plant is relatively high in Europe, as the region does not possess a feedstock advantage like that of China or the U.S.

-

In addition, economic landscape in Europe has always been unpredictable, and hence, this discourages new investment in the region

Regulations on ammonia usage in the agriculture industry

-

CAA has been established in the U.S. and Europe. This act has been implanted to reduce the ammonia content in the air by 30–40 percent.The agricultural industry contributes to 80 percent of ammonia pollutants in the air

Ammonia Market Report Summary

The ammonia market is expected to grow at a rate of 3% per year from 2016 until the end of 2022 according to experts in the field. The major supply markets of ammonia include Asia, North America, and the EU. Asia has the largest supply market as it accounts for 59% of the market, followed by the EU with 24%. North America accounts for 10% of the market while the rest of the world accounts for 8% of the global ammonia market share.

The global capacity of ammonia is 239 MMT in 2017 while the global demand is lesser at 189 MMT in 2017. However, there is an expected increase in demand in the future. Experts in the field predict there to be an increase in demand of about 234 MMT by the end of 2022. The CAGR of ammonia demand will be more than 5.2 percent. It is vital to understand the production size as it gives a full picture of the capacities in various regions for the ammonia market. In North America, the production size is 24 MMT while in Europe the production size is much higher at 56 MMT. Numerous global suppliers of ammonia exist. Some of the top suppliers include Yara, Nutrien, CF Industries, GS Caltex, and Terra.

The end-user industries of ammonia and ammonia liquor/aqueous ammonia include pharmaceutical products, agriculture, mining, and textiles among others. Ammonia is also used as a cleaning product and in the manufacture of products for sanitizing. According to the experts, the NPK/NP fertilizer contributes to the rise in the demand for ammonia and this will most likely continue in the future. This is particularly true in developing regions as they will have a higher demand for ammonia in the next few years. This is due to the increase in population in developing regions which will increase demand in sectors such as mining and agriculture. It is critical to note that more than 10 percent of the global consumption of ammonia is from the non-fertilizer sector. All ammonia that is produced is not traded. In fact, only 12 percent of it is traded while the rest is converted to fertilizers that are nitrogen-based.

The US is moving towards capacity additions that will have a major impact on the ammonia market. Experts predict that the global supply will improve within the next few years. This will continue till the end of 2022 according to experts. The US presently imports more than 3.5 MMT of ammonia. It is the largest region to import ammonia. It used to import ammonia from Trinidad and Tobago. However, it has planned capacity additions of more than 5 MMT based on shale gas. This means there will be a big

reduction in imports from that region in the US. 30 percent of ammonia that the US market produces is exported by Canada. As there is a trade route in these regions, trading is expected to improve further.

In the EU region, Russia will have an excess of ammonia as before. That is, Russia always had excess ammonia. Russia generally has surplus ammonia of more than 4 MMT. This excess production can help keep the ammonia prices stable in the future among other factors. In Asia, India imports ammonia from the Middle East and this can continue in the future until capacity additions are completed in various regions of Asia. Globally, 10 MMT of capacity additions is expected specifically of fertilizer production. This is because of the expected growth of up to 4 percent growth in the fertilizer market. Ammonia is required in the industrial sector too which is expected to grow in the region. The expected growth of this region is anywhere between 3 percent and 4 percent.

Ammonia Market Forecast: Ammonia markets in Asia and the US will remain frontrunners over the forecast period. The reason behind this is that both of them are planning derivative units. These derivative units include industrial usage, fertilizer, and direct application of ammonia. The US is going to turn into an exporter rather than a major importer because the production is going to increase rapidly in this region. In fact, it is going to turn into a net exporter in the next few years because it will meet its own demand and leave enough that can get exported to other regions in the world.

The ammonia price is likely to become stable because of capacity additions taking place at the moment. Numerous capacity additions are planned for the future too which can stabilize the ammonia commodity price in the market as there won’t be as much pressure on it. This is because of the excess ammonia that will be available globally as production will increase manifold across the globe. For example, regions such as Asia, the US, and Russia have many plants that are nearly completed which means an increase in ammonia production can be expected soon. These are integrated plants and standalone ones that are being focused on to ensure ammonia supply can meet the expected increase in ammonia demand.

In the ammonia market, there are two types of engagements that are popular; contract transactions and spot transactions. In the US, most of the transactions are contract-based. That is, up to 70 percent of the transactions are contract transactions. In Asia, 40 percent of the transactions are spot transactions. While in the EU, both spot transactions and contract transactions are equally preferred in the ammonia market. The contract period is anywhere between 1 and 2 years in the ammonia market. The ammonia price revisions can take place either every month or every quarter. When it comes to buyer power, Asia and North America have medium buyer power. The EU has low buyer power. The base oil supplier power is medium in North America and Asia in the ammonia market. In the EU, the base oil supplier power is high.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.