CATEGORY

Aluminum Foils

This report covers Aluminum foil market dynamics in some of the key end use segments like food and healthcare. The region wise demand trends and challenges are analysed here.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Aluminum Foils.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

200% tariff on aluminum imports from Russia to US came into effect last week

March 15, 2023Slovakia's sole aluminum producer, Slovalco, is closing its smelters after 70 years of operation

January 19, 2023Europe's largest smelter Aluminum Dunkerque plans to resume its full capacity back by May 2023

January 17, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Aluminum Foils

Schedule a DemoAluminum Foils Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoAluminum Foils Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Aluminum Foils category is 4.30%

Payment Terms

(in days)

The industry average payment terms in Aluminum Foils category for the current quarter is 71.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Aluminum Foils market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoAluminum Foils market frequently asked questions

As per Beroe's Inc. report, the aluminium foil containers market size is categorized based on the production size of the region. As per the report, North America sits atop the list with a capacity size of 6,50,000 MT, followed by Latin America (LATAM) at 1,50,000 MT and the APAC region with a capacity of just 3.2 MMT.

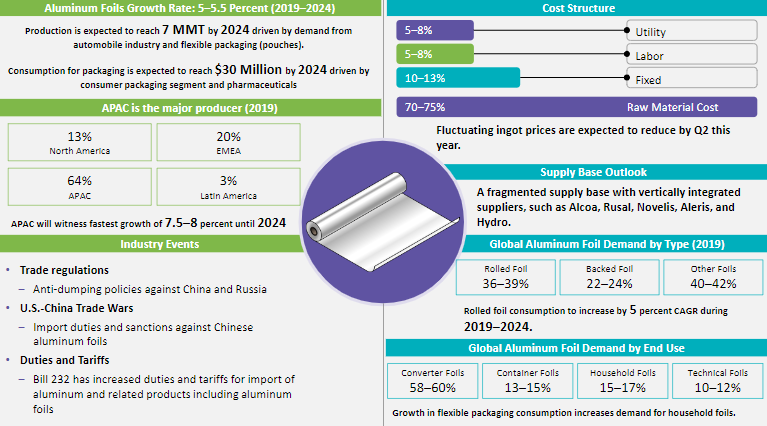

The global production of aluminum foils shows a promising spike over the next few years and is estimated to grow at a rate of 5 ' 5.5 percent CAGR until 2022 and reach nearly 6.4 MMT. Even the aluminum foil packaging market consumption is expected to reach $27.3 Million by 2022 majorly driven by the consumer packaging segment and pharmaceuticals.

The primary consumers of the aluminium foil industry are the developed regions especially the U.S., Canada, and Germany owing to the increased demand from the automobile sector and rising consumption of flexible packaging (especially pouches). On the consumer front, the food and beverage industry is the largest end-user of aluminium foils, occupying nearly 30 percent of the market share. Additionally, the demand from the transportation industry in developed countries like the U.S. and Germany followed by growing consumer spending (on flexible packaging products) from countries like India, Brazil, etc, further influences the growth for aluminium folks.

Aluminum Foils market report transcript

Global Market Outlook on Aluminum Foils

-

The global production of aluminum foils is expected to be at 6.17 MMT during 2023E, and it is expected to grow moderately at 3.5–4.5 percent (CAGR) until 2027F and reach 7.2 MMT

-

Increase in demand from food and healthcare industry and rising consumption of flexible packaging (especially pouches) have bolstered the growth for aluminum foils

Global Aluminium Foil Market Size

The rising consumption of aluminum foil in direct grilling and cooking applications is expected to drive the aluminum foil market. The aluminum foil market is fragmented, and the vendors are deploying growth strategies such as price and quality to compete in the market. Aluminium foil with paper shows promise for growth in the packaging of dairy products in the upcoming years

-

Demand for flexible packaging products with enhanced barrier properties and protection features have boosted the growth of foils in food and retail end-use. Growing applications of aluminium pouches increase product shelf life and hygiene, as it does not alter chemical properties, lose shape or melt during exposure to sunlight

-

The market for aluminum foil is expected to grow significantly in North America as a result of the growing demand of aluminum foil as an insulation material. Additionally, it is expected that rising food and grocery product consumption will further drive the growth of the aluminum foil market in this region.

-

Asia is the fastest growing market for aluminium foils. The demand for foils is increasing especially from the Pharmaceutical sector due to energy crisis and in Europe and lack of availability of foil supply in EU

Global Aluminum Foil Demand by Type

Laminated foils is expected to post positive growth of over 5% during the next 3-5 years backed by strong demand from healthcare industry and retail food segment. Blister foil is the major application in the pharmaceutical industry, medical industry boom in emerging economies foster demand for aluminium foils. Aluminium foils are 100 percent recyclable with many regions looking to increase adoption rates for recycling

-

Converter Foil: Lightweight feature of converter foil has attracted attention of FMCG suppliers, who are shifting toward laminated foil reducing paper/plastics usage

-

Household Foil: There was a significant increase in demand for wraps as consumer trend shifted towards home-cooked meals during the pandemic. Demand for aluminum foil wraps increased especially in household foil segment in the last few years

-

Container Foil: Demand for container foil reduced during the pandemic as food stalls, restaurants and outdoor activities were cancelled resulting in little use of container foils. Container foils saw demand surge from consumers directly using these foils in their kitchen.

-

Technical Foil: The barrier properties and heat reflectivity of technical foils are widely used to improve insulation performance of modern building systems

-

Rolled Aluminium Foil: Aluminium foil is primarily consumed by packaging, transportation, and construction sectors. It is projected that global rolled foil consumption might increase by 4–5 percent CAGR from 2023E to 2027F with the transportation industry being the largest market

-

Backed Aluminium Foil: These include laminated, embossed, backed with paper, plastics, and adhesives. Foil tapes constitute to a major part in backed aluminium foils. Growth in foil tapes is backed by growing demand through online retail distribution. Aluminium foil backed tapes are tamper evident and provide an additional security feature for shipped goods. Developed regions are expected to show moderate growth for backed aluminium foil used in industrial purposes, especially from the electricity sector that uses such foils for insulation purposes. Emerging regions show promise with growing infrastructure in China and India

Aluminium Foil Industry Drivers and Constraints

Drivers

Changing Consumer lifestyle

-

The changing consumer lifestyles in India, together with the rising need for snack foods, alcohol, and beverages, are pushing the demand for aluminum-packaged food products with a long shelf life and sterility

-

Another key development driver for the aluminum foils business in India is the rising need for ready-to-eat confectionaries and pharmaceutical products

Increasing demand from the Food Sector

-

The food segment is dominant in India, as most consumers in the commercial and household sectors to order meals online, and most restaurants, hotels, and other food businesses in the country prefer to use aluminum foils in its packing to prevent contamination of food products

Durability

-

Aluminum foils exhibit superior barrier properties, resistance to heat and oxygen, insulation, moisture barrier properties and aroma retention

-

To its outstanding barrier qualities, aluminum foil is the most chosen packaging material for the Indian Pharma & FMCG products. Since the pharmaceutical and FMCG industries are expanding at such a rapid pace, there is going to be a steady increase in demand for aluminum foil in India

Constraints

Increasing Raw Material Prices

-

Raw material prices are volatile due to raw materials account for the lion's share of the costs associated with producing Aluminum foil packaging. Fluctuating raw material prices can have an impact on manufacturing profitability, limiting the growth of Aluminum foils in packaging

Pinholes in thin gauge foils

-

To preserve goods from environmental cues, thin gauge aluminum sheets have been extensively employed as packaging and household foils. The chance of pinholes and strip break increases as foil thickness decreases

New Alternatives

-

BOPET high barrier films are trying to replace aluminum foil in flexible packaging applications

Inappropriate packaging material for citrus food products

-

Magnesium is frequently included into aluminum foil to improve mechanical strength; nevertheless, higher magnesium percentage leads to decreased alloy stability against mild acids like citric acid products

Collection of Foils for Recycling

-

There are no effective collection systems for used aluminum foils for recycling

COVID-19 Impact on Aluminum Foil Market

The COVID-19 impact is minimal across the globe, except China, where there is new threat of disruptions. With buyers advancing their procurements across the globe, there could be temporary tightness in Chinese market

Short-term Impact

-

Suppliers are expected to back in operation in few weeks in China.

-

The global players are also working on the business continuity plan and looking for alternative sourcing destinations to ensure the supply consistency

Long-term Impact

-

Small suppliers had faced production halt and challenges in movement of goods

-

With the increasing risk buyers would possibly move away from China for critical film requirements.

Innovations in Aluminum Foil Packaging

Thin Gauge Foils – Hindalco – Jan 2022

-

Hindalco has tried to address the problem of breakage in Light Gauge aluminum foils due to its low Ultimate Tensile Strength (UTS) and Hindalco has been successful with it

-

Hindalco initiated a new rolling technique that significantly enhanced the UTS of LG foils, while maintaining high quality in other aspects

-

Hindalco was able to scale up LG foil production for both domestic and foreign markets thanks to the breakthrough. The same method is being used to manufacture medium gauge blister and pharma packaging goods

Non-toxic lid foil laminated with paper – Bilcare - 2022

-

Bilcare crispak PT is a laminated Push through child-resistant & senior friendly (CR) foil is a non-toxic lid foil laminated with paper

-

The foil provides excellent push-through effect

-

Compatible to sealing with PVC used for pharmaceutical packaging application

-

Excellent print adherence, heat resistance, machineability

ASI Coffee Capsules – Amcor - 2021

-

A joint development with the Aluminum Stewardship Initiative (ASI) organization, Nespresso and selected mining corporations has won Amcor an award for an ASI aluminum coffee capsule, which will be marketed by Nespresso

-

The capsule uses ASI certified aluminum to improve the sustainability position of product and brand. The initiative creates a chain of custody, as the whole process needs to be certified and can set a standard for the whole industry

Ultra – i2r - 2021

-

The i2r Packaging Solutions gained an award for its Ultra™, an innovative, smooth wall aluminum foil container, intended for packaging high quality 'ready to cook' convenience products including red meat, poultry, fish, vegetables, BBQ food and desserts

-

Three key design features were applied to add a significant amount of additional structural strength and an overall reduction in pack weight

Gasbag for E-Active Body Control – Wipf - 2021

-

Wipf has received an Alu foil Trophy on its work to develop a totally new suspension system, with its aluminum foil Gasbag for E-Active Body Control technology, for Mercedes-Benz’s latest GLE model.

-

The system, which incorporates the gasbag, influences the lift and yaw of the car body when cornering, accelerating and braking

-

The gasbag features a layer of high-density aluminum foil and several layers of various polyamide films

-

Aluminum assures very high impermeability to gas, while preserving mechanical, thermal, and chemical stability in hydraulic fluid

EasyDoseLid – Constantia Flexibles - 2021

-

The EasyDoseLid from Constantia Flexibles received an award for its lidding system, designed for solid consumer food products stored in liquids, such as mozzarella cheese, pickled cheese, pickles and olives, which become easily separable from the liquid thanks to this novel pouring system

-

Due to the special shape of the lidding the liquid element can be poured before taking out the solid content

Why You Should Buy This Report

This report on the aluminum foil packaging market offers an accurate and comprehensive analysis of market growth drivers, factors (positive and negative) impacting the market growth, current industry trends, market structure, and market projections for the predefined time frame.

This research study on the aluminum foil industry includes an assessment of ongoing tech developments, Porter’s five forces analysis, and extensive profiles of key market players. Further, it offers a review of macro and micro factors critical to the existing industry players and new entrants coupled with a detailed value chain evaluation.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.