CATEGORY

Temporary Labour

Organisations have been increasingly depending on temporary workforce across the globe to fullfill interim workforce requirements and ensure that the operations run smooth. Temporary workforce is being used not only used for blue collar or low skilled jobs but are also depend for niched and technicla roles where it is difficult to source permanent talent. The report provides various industry trends and sourcing best practices and also highlights the potential service providers in the industry

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Temporary Labour.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Singapore-Labor market seeks improvement in 2022

March 23, 2023Australia- Job ads fell 12.2% in Feb 2023

March 23, 2023UK-Increase in demand for temporary workers to London SMEs

April 05, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Temporary Labour

Schedule a DemoTemporary Labour Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Temporary Labour category is 8.70%

Payment Terms

(in days)

The industry average payment terms in Temporary Labour category for the current quarter is 53.7 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Temporary Labour Suppliers

Find the right-fit temporary labour supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Temporary Labour market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoTemporary Labour market report transcript

Global Temporary Labor Industry Outlook

-

The global staffing industry revenue is projected to grow at 7-9 percent in 2023, followed by a growth of 11 percent in the previous year. The temporary staffing industry is expected to generate 84-86 percent of revenue and the Place and Search industry is expected to generate 14-16 percent of revenue.

-

The US, Japan, and the UK comprise a major revenue stake revenue with 53 percent of total revenue, while the top 15 countries combined accounted for 88 percent of total global staffing revenue. Additional 12 countries generated at least $5 billion in staffing revenue

-

Despite of increase in layoffs, employers are highly relying on staffing firms where temporary staffing has been an integral part of labor force.

Global Temporary Staffing Market Overview

-

The global staffing industry is shown 11 percent growth in 2022, followed by a growth of 23 percent last year to a total of $620 billion

-

Three major countries, such as the US, the UK, and Japan, have been the major contributors (53 percent) to the growth revenue of the staffing industry

-

Temporary staffing consists of 86 percent of the overall global staffing industry market share revenue, while Place and Search consists of 14 percent of the overall market share

Global Industry Trends

-

Global economic slowdown have changed the approach and working of the temporary labor industry in recent times. Technology adoption and innovations have taken a major step ahead and advanced the way the world works. Organizations have been investing in training programs to up-skill, re-skill, and cross-skill their workers. And simultaneously, organizations and staffing firms are acquiring small and medium-based tech firms to build diverse product and service portfolio, expansion programs, etc., in order to support workers and employers in this changing world of work.

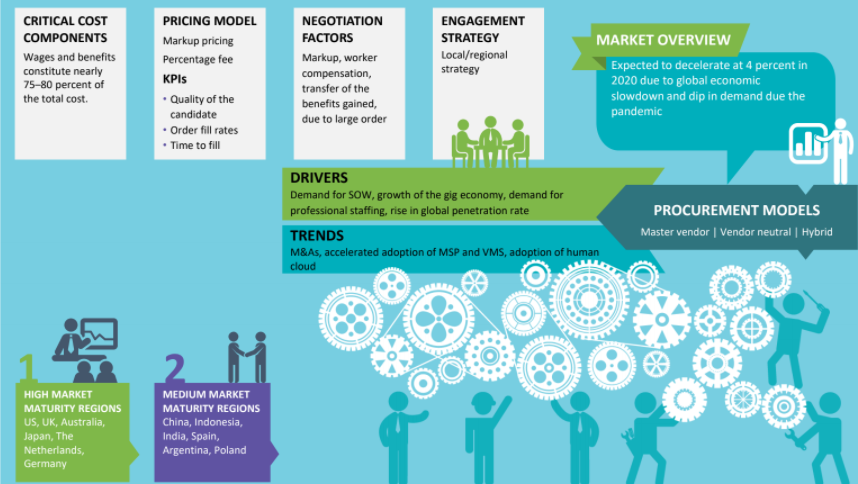

Global Temporary Labor Market Drivers and Constraints

-

Trends observed in the global temporary labor market that serves as the driving force are technology optimization, increased use of gig economy/freelancers/ICs/SOW, increase in staffing M&As, increase in tax, social contributions and minimum wages and upskilling, reskilling and cross-skilling workers

-

Certain constraints have been observed in the market, such as Supply vs. demand gap, The Great Resignation, and higher rate of inflation

Drivers

-

Technology optimization: About 70–80 percent of staffing companies have increased their investment on technology in times of COVID-19. The emergence of human cloud, Artificial Intelligence, Machine Learning, VMS has a positive effect on the industry, as it makes the process better controlled and manageable

-

Increased use of gig economy/ICs/SOW: Category Managers/Organizations have been preferring more freelancers, SOW, ICs, temps, etc., to fill in for the vacant positions in these crisis times. 2022 has been witnessing an increase to 70 percent and the proportion of temps to permanent would be more

-

Increase in staffing M&As: IT staffing/consulting and healthcare witnessed a high number of acquisitions, constituting 32 percent and 23 percent, respectively, last year. About 177 US staffing transactions have been recorded last year

-

Increase in tax, social contributions, and minimum wages: Due to the global pandemic, tax revenues have fallen. The government is trying to regain this money that does not add to employment costs or sourcing costs through intermediaries. However, corporate tax, employment tax, and social charges are the levers in this industry

-

Increase in upskilling and reskilling of the workforce: Due to the COVID-19 impact and war crisis, employers have been capitalizing on reskilling and upskilling their workforce. It has been witnessed that about 20 percent of Category Managers/Employers are planning to address this trend

Constraints

-

Supply vs. demand gap: COVID-19 has prompted a sharp reversal in the job supply/demand ratio. Talent supply in developed economies has been under severe pressure, due to an aging workforce, high youth unemployment, tighter labor markets, an increase in automation, etc.

-

Higher rate of inflation: Inflationary pressure has been increasing in most countries, due to stress on global supply chains and a decline in labor supply. The US and India are facing high inflation rates in 2022, followed by the UK (major staffing markets), where Brexit has its own contributor factor

Cost Breakup and Analysis : Temporary Labor

-

The billing process gains certain efficiencies that saves the money and time of the agency if the buyer uses the services at large from the same staffing agency. This can also be a negotiating factor, where the buyer can demand that the savings be passed on to them

-

The major cost factors for staffing services are basic wages that are paid to the temporary labor.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now