CATEGORY

Employee Relocation Management

Organisations often requires its employees to move from one location to another depending on business requirements and it becomes the organisation's responsibility to ensure the smooth transition of its employees and their families during the process. Organisations are outsourcing these services to relocation firms to minimize the hassles of moving workforce and to support with all relocation related activities.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Employee Relocation Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Sante Fe relocation partnered with Watershed.

April 18, 2023Equus Software has launched a new strategic agreement with Vialto Partners

April 11, 2023A major change in Australian immigration to increase global talent is expected.

April 05, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Employee Relocation Management

Schedule a DemoEmployee Relocation Management Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Employee Relocation Management category is 7.70%

Payment Terms

(in days)

The industry average payment terms in Employee Relocation Management category for the current quarter is 72.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Employee Relocation Management Suppliers

Find the right-fit employee relocation management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Employee Relocation Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEmployee Relocation Management market frequently asked questions

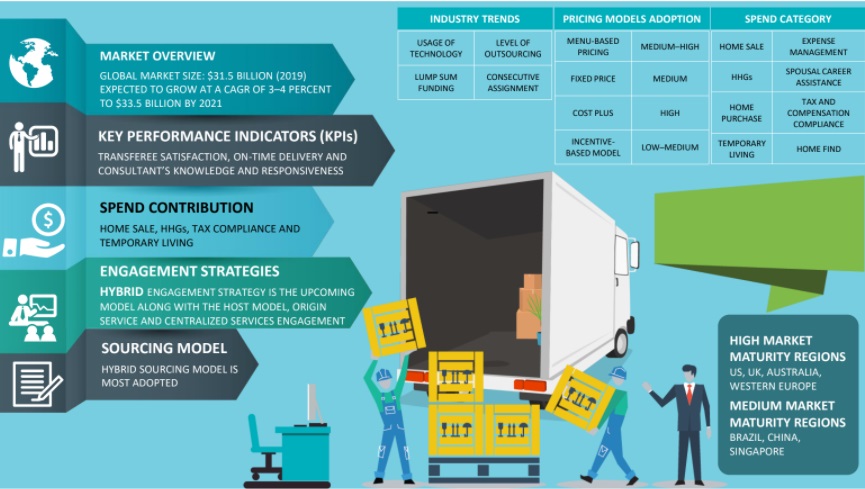

According to Beroe's industry reports, the global employee relocation market is forecasted to grow at a CAGR of 3-4 percent to reach a market value of $32 billion by 2021 from $29 billion in 2017.

The increasing number of international assignments in the U.S., Western Europe, Australia, Singapore, Japan, India, and China is the major driving factor for the global relocation services market.

Transferee satisfaction, on-time delivery, and consultant's knowledge and responsiveness are the key performance indicators of the global relocation industry.

Cartus, SIRVA, Brookfield, Santa Fe, Aires are the top service providers in the global relocation management services market.

The high market maturity regions are the U.S., U.K., Australia, and Western Europe, whereas the regions with medium market maturity are Brazil, China, and Singapore.

The key industry trends in the global relocation management services market are ' ' Buyers in North America and Europe are outsourcing relocation services to global players that can offer end-to-end solutions. ' Global players don't support the regulatory complexity, inflation, and immigration restrictions in Latin American countries. ' APAC and the Middle East are witnessing a rise in international assignments that accelerate the demand for relocation services. ' The buyers have been opting for standalone services and regional niche players.

The major companies are aiming at establishing and expanding their facilities in developing countries. As developing economies like India open up for FDI from foreign players, the number of foreign assignments driving the need for relocation is further increased.

The global relocation services face the following market constraints. ' Inaccurate estimation of the total cost for international assignments by HR managers. ' Currency fluctuations and talent retention affect the cost of relocation. ' Implementations of tiered policies as per different relocation programs like tax grabs present a constraint in the easy transitioning of an expat. ' The new orders from Trump could impact international relocation, especially the inbound movement to the US.

Expense management, temporary living, spousal career assistance, home finding, compensation and tax compliance, home sales, new home purchase, and household goods movement are the major spending categories of the global relocation industry.

Employee Relocation Management market report transcript

Global Employee Relocation Industry Outlook

-

The global employee relocation market is forecasted to grow by $38.2 billion at a percentage of 4–5 by 2026

-

Global mobility professionals are expected to face a rise in the cost of living and International remote working as the top challenges

-

Immigration policies across the globe are changing to support labor shortages

Global Employee Relocation Market Maturity

- Global mobility professionals are expected to face a rise in the cost of living and International remote working as the top challenges.

Global Relocation Industry Trends

-

Rising relocation costs have forced organizations to focus only on high-impact moves and to be more selective in the relocation process.

-

To contain costs and provide a better experience, 70 percent of the companies are planning to add more flexibility to their programs

-

The adoption of Core/Flex programs would increase. The Core/Flex programs are more popular among companies trying to contain costs while offering flexibility to the transferring employee. There is less need for relocation policy exceptions, as core-flex will ensure each employee receives standard or core benefits with flexibility

Key Relocation Technology Adoption Trends

-

The advancement of technology has assisted the automation of compliance processes. It has led to greater efficiencies, but it poses challenges as digital tax requirements vary across the globe. The automation of these processes has a direct impact on the ability to meet international or domestic standards

-

Many relocation companies are designing digital service platforms to remain competitive. The significance of data security and safeguarding user privacy increases as global mobility firms continue to adopt new platforms.

-

Companies' focus on technology will increase. They will focus on integrating business with technology to make the relocation department more strategic. The adoption rate would increase for seamless operations and better experience

Supply Trends and Insights : Employee Relocation Management

Global/Regional Supplier

Increasing the geographical capabilities:

-

Geographical capabilities are increased either by adding a geography under their umbrella or by merger and acquisition (e.g., SIRVA and BGRS merger)

Technology adoption:

-

Clients prefer technology that helps them in all sectors by administering and reporting a relocation program with a single platform. The interested parties can also access it on a single platform

-

The relocation technology should accommodate any number of employees. While choosing the technology, clients can consider its relocation employee growth in the future. The technology should be customizable to the growing needs of the company and its expansion of the global footprint

Tier-2/Local Supplier

-

Check on support service: Crating is a norm for packing, but sometimes its cost is more than the price of the goods moved. A continuous check on these kinds of expenses can reduce the price of the service

-

Integrated approach: The buyer should integrate the services from its shortlisted suppliers as per their capabilities and bring them under one contract agreement. For example, rather than giving the full assignment to a single vendor, give it to those vendors who are specialized in specific services

-

Economic pressure for reducing cost: Economic pressure on corporates has increased the focus on reducing the benefits offered to employees relocating. Multinational corporations are also scrutinising the spend on household goods movement and offering fixed funds to manage their relocation activities

Engagement Trends

-

Most adopted model globally: Global + two or three suppliers

-

Why: To achieve service quality, minimize implementation risk and cost savings

-

Contract Length: 2–3 years, with an option of contract extension, based on performance linked with SLAs. Also, the responsibility lies with relocation management companies to relocate the assignee within the tenure of assignment

-

Pricing Strategy: Cost plus pricing model is adopted, the cost of the services is charged

Why You Should Buy This Report

- The report on the corporate relocation management market lists out the cost components, saving opportunities, and cost and price trend analysis.

- The report offers Porter’s five force analysis of developed and developing relocation industries.

- It provides service portfolios and SWOT analysis of some of the largest relocation management companies such as Santa Fe, Cartus Corporation, and SIRVA Worldwide, to name a few.

- Furthermore, the market research offers corporate relocation industry statistics and supplier insights.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now