CATEGORY

Permanent Recruitment

Organisations are increasingly outsourcing recruitment and related services to third party service providers that can suppport with end-to-end support with sourcing, interviewing, shortlisting and onboarding potential candidates. Recruitment Process Outsourcing firms are becoming one stop solution providers for majority of the recruitment requirements for most of the Fortune 500 players.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Permanent Recruitment.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Infor Launches Talent Empowerment Solution

April 11, 2023US private hiring, services activity cool in March

April 10, 2023White-Collar hiring falls in March amid global woes and shake-up in BFSI sector

April 04, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Permanent Recruitment

Schedule a DemoPermanent Recruitment Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoPermanent Recruitment Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Permanent Recruitment category is 8.00%

Payment Terms

(in days)

The industry average payment terms in Permanent Recruitment category for the current quarter is 71.3 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Permanent Recruitment Suppliers

Find the right-fit permanent recruitment supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Permanent Recruitment market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPermanent Recruitment market frequently asked questions

The two leading trends in the recruitment industry according to Beroe's analysis report are: Artificial intelligence-aided tools and tech advancements are becoming the new normal for buyers looking to enhance the candidate hiring process Integrating technology tools with their recruitment services through M&A and collaborations is another major supplier trend

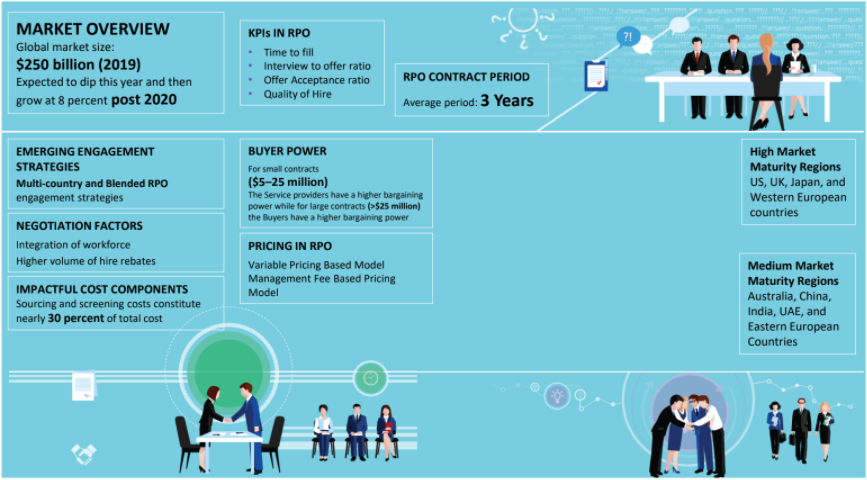

As per Beroe's report, the global recruitment market size is forecasted to grow at a CAGR of 16 ' 18 percent to reach an estimated value of $400 billion. It's worth noting that the existing market size of North America is the highest with $156 Bn valuation followed by Europe, the Asia Pacific, and Latin America each valued at $49 Bn, $27 Bn, and $12 Bn respectively.

The market intelligence report for recruitment indicates that both North America and Europe are high market maturity regions w.r.t the buyers and the service providers because the outsourcing of recruitment services is quite expensive in NA and Western Europe. Even the APAC and LATAM regions are showing an increase in adoption rate since large global buyers are trying to consolidate the supply base. The RPO industry has shown a significant 16 percent growth and it's expected that the wide number of emerging economies will further contribute to the upscaling. Further, with the increase in technology penetration within the RPO market, the recruitment services are expected to rise by 20 percent.

Permanent Recruitment market report transcript

Global Permanent Recruitment Market Insights

-

The war in Ukraine, coupled with sanctions and recession fears across the globe, has dropped recruitment prospects, as companies halt their hiring activity and lay-off significant portions of their workforce, especially in North America and Europe

-

The US has the highest market maturity, followed by the UK, and then, Western Europe. In APAC, countries, like Australia and Japan, contribute moderately in the recruitment market. Other countries in APAC and Western LATAM and eastern Europe are driving the demand for recruitment services such as RPO and Executive search in upcoming years

Maturity of Suppliers and Buyers : Permanent Recruitment Market

-

North America and Europe are mature markets in terms of buyers and service providers. The outsourcing of recruitment services is high in North America and Western Europe.

-

APAC and LATAM are witnessing increasing adoption due to the efforts by large global buyers to consolidate supply base

Recruitment Market Intelligence: Global Recruitment Process Outsourcing Industry Trend

The global RPO industry has been increasing significantly and expected to grow at 9 percent between 2023 and 2028, especially in regions, such as APAC and Europe. The RPO industry will drive a large portion of growth within the permanent recruitment market during this period.

Adoption Rate of Technology in RPO

-

RPO service providers are offering recruitment solutions and technological platforms. Companies either co-source or completely outsource technology platforms to RPO vendors. Various technology platforms exist and large companies have adopted it in the past

-

While ATS helps in managing business units, compliance, hourly positions, social and candidate experience, TAM supports a complete talent database for active, as well as passive candidate profiles for future vacancies, and helps in succession planning with real-time simulations. Along with TAM systems, integrating employer branding tools with recruitment process is an emerging trend in the recruitment landscape.

Supplier Innovations : Permanent Recruitment

-

Currently, Oracle Taleo lacks superior artificial intelligence and machine learning capabilities in ATS solutions when compared to ATS start-up eco-system service offerings to small–medium companies

-

Google Hire ATS is the clear market disruptor and aims to bring down the job advertisement spend incurred by employers, by integrating its Google Ads solutions. Currently, its solutions are targeted at small–medium companies only

-

iCIMS, Hays, Jibe, Johnson & Johnson, FedEx, CareerBuilder, Dice, etc., are some of the early adopters in “Google Cloud Job Discovery Beta Program”

Artificial Intelligence and Machine Learning Capabilities

Resume Sourcing and Matching:

-

“Matching and Filtering” feature will be an add on to ATS software. This will enable companies to source more effectively and right-fit candidate for the job position

Applicant Workflow Automation:

-

ATS software is poised to grow beyond e-mail communication to candidates

-

It helps to automate all ATS related messaging activities through new communication approaches, such as jobbots, chatbots, etc.

Google Hire ATS

-

Besides, announcing “Google for Jobs” search engine powered with Artificial Intelligence and Machine Learning capabilities, Google launched a pilot testing “Google Hire” ATS with about 10 companies in the US

-

Market speculations suggest that Google Hire ATS software will be free-to-cheap by integrating their Google Ads services

-

“Google for Jobs” business model is in similar to “Indeed – job board” in terms of service extension to clients

-

In the initial stages, “Google for Jobs” search engine will partner with LinkedIn, Facebook, Monster, Glassdoor, etc.

Technology Tools Adopted across Industries

-

Most of the multinational companies are adopting various technology tools for recruitment purposes across geographies. There exists homegrown applications for automated reporting and analytics whereas, SAP and Oracle provides talent management suites for managing workforce

-

The adoption technology solutions for recruitment is considered to be high in retail and IT industry

Adoption of the Applicant Tracking System

-

Increasing adoption for technology is encouraging suppliers to adopt innovations and automated tools while hiring

-

Suppliers integrating with artificial intelligence provide high decision-making ability compared to previous tools

Key Technology Trends in RPO Industry

-

Artificial intelligence-aided technology tools are adopted widely by buyers for enhancing the candidate hiring process

-

Integrating technology tool with their recruitment services through M&A and collaborations is one of the major supplier trends

Global RPO Drivers and Constraints

Multinational firms are restructuring their workforce to attain higher labor productivity and leverage the skillsets of the employees. In such situations, cost efficiency, higher productivity and access to better technology drives the recruitment industry across geographies.

Growth Drivers

-

Cost Reduction: Outsourcing recruitment allows the companies to transfer the cost risks involved in recruitment process to the recruitment partners thus reducing cost

-

Social Network Adoption: Buyers are evaluating the option of using social media to identify the potential candidates to best-fit their internal requirement. On an average, 25–30 percent of social tools are adopted by companies across the globe to source and advertise positions for recruitment

-

Scalability: Outsourcing recruitment results in a more scalability and the ability to meet the sudden surge in manpower requirements as it is the core business of the recruitment partner

-

Improving Recruitment Process: Engaging with an RPO will streamline the overall recruitment process. The RPO vendor will analyze the recruitment process to spot the where overlap, inefficiency and excessive costs occur and will device a custom recruitment process

-

Access to Better Technology: The RPO vendors have readily available technology like application tracking system, CV management software that can increase the efficiency of the overall recruitment process

Constraints

-

Lack of Client Adoption Internally: The internal recruitment department, which is already existing might show some resistance to adopt to the new framework and processes brought in by the RPO vendor

Other major constraints are:

-

Competition with internal resources

-

Changing position requirements

-

Unrealistic expectations about talent availability

-

Change in the management from the client’s side

Supplier Selection Criteria : Permanent Recruitment Market

Selecting a service provider includes in-depth analysis of their capability for successful service delivery to the firm. Short listing potential supplier for a firm is derived through the supplier selection criteria.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now