CATEGORY

Pension Administration Outsourcing Services in the US

Pension administration in the United States is the act of performing various types of yearly service on an organizational retirement plan, such as a 401(k), profit sharing plan, defined benefit plan, or cash balance plan. The Administrators are responsible for managing the day-to-day affairs and the strategic decisions involved with a group's pension fund/plan.The pension plan administrator ensures that money is being contributed into the fund, the proper asset allocation decisions are made and that payouts are promptly distributed among all qualified plan participants or beneficiaries.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Pension Administration Outsourcing Services in the US.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Pension Administration Outsourcing Services in the US Suppliers

Find the right-fit pension administration outsourcing services in the us supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Pension Administration Outsourcing Services in the US market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoPension Administration Outsourcing Services in the US market report transcript

Regional Market Outlook on Pension Administration Outsourcing Services in the US

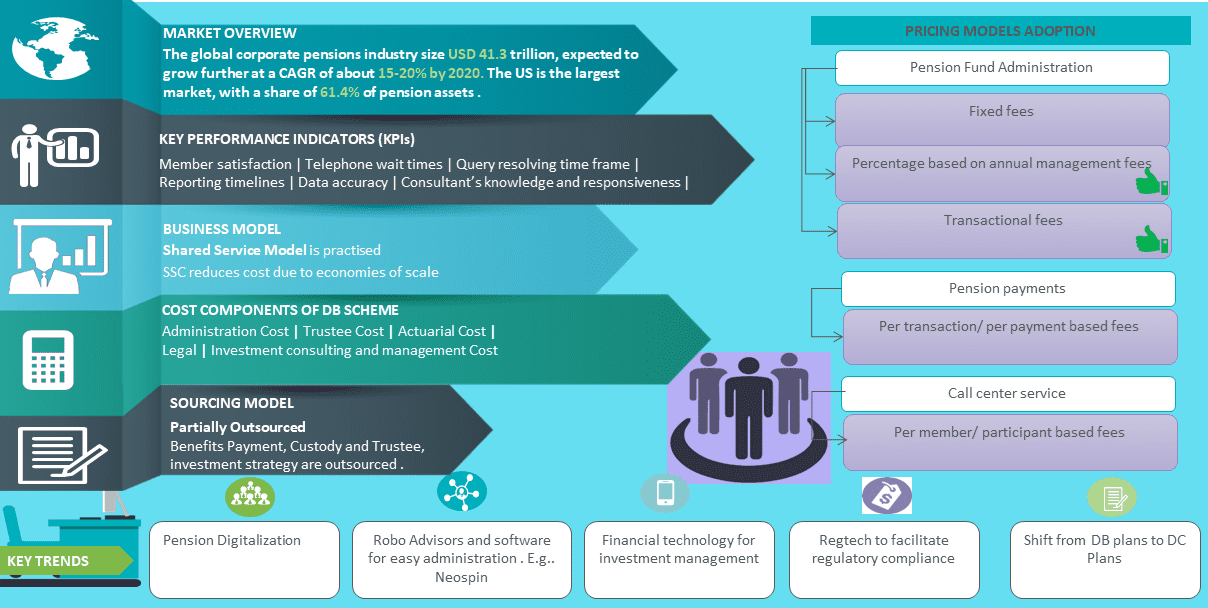

The global corporate pensions industry accounts to USD 41.3 trillion, expected to grow further at a CAGR of about 15-20% by 2020. The US is the largest market, with a share of 61.4% of pension assets .

- The US pension asset market was valued at 25.35 Trillion USD in 2017.

- The pension asset growth rate in US was 12.7 percent in 2017.

- US have more asset allocation to equities compared to other global markets.

- Over the past few years, US has witnessed a shift from defined benefit plans to defined contribution plans.

- In terms of assets Defined Contribution (DC) is dominated in the States.

- Growth rate of DC assets globally was around 5.6 percent for the past 10 years.

- Pension administration in the United States is the act of performing various types of yearly service on an organizational retirement plan, such as a 401(k), profit sharing plan, defined benefit plan, or cash balance plan. The Administrators are responsible for managing the day-to-day affairs and the strategic decisions involved with a group's pension fund/plan.

- A registered pension plan can be administered by any of the following entity- An employer, a pension committee, an insurance company or a third party pension administrator.

- Administrators role starts with enrolling eligible employees into the pension plan, communicating periodically with the plan members(employees) about the plan status, resolving their end to end queries, collecting periodical contributions for the pension fund from the employer and employee, providing pension plan and investment consulting, paying out pension benefits and transferring benefits from one employer to another employer.

- The pension plan administrator ensures that money is being contributed into the fund, the proper asset allocation decisions are made and that payouts are promptly distributed among all qualified plan participants or beneficiaries.

Buyer Trend

Retirement solutions and pension includes series of activities.

- Widely outsourced services are Administration, Actuarial Services, Record Keeping, Insurance and Investment Consulting. Other services are mostly performed in-house in large size organizations.

In North America, the most outsourced activities among US based companies are administration, actuary and record-keeping.

- Only 25% or less, would outsource legal process to an outside counsel. Most of the buyers have partnerships with the legal advisors for managing complex activities.

- Communication activities involved in plan governance and enrollment is cited to be very difficult in the US, thereby indicating higher outsourcing in communication.

- Buyers are trying to outsource call center services with pension administration. Outsourcing with call center services reduces the overall cost of buyers when compared to outsourcing without call center services.

- Buyers are also looking for automated calculation for pension in the software platform which makes it easy for them.

- There is a strong demand for individualization and the increasing economic pressure will drive transformation in the retirement industry.

Business Model – Pension Administration

The pension industry is becoming more complex and to manage this complexity, agile pension companies are planning to focus on a few specialized units, around a provider's actual core competencies, than having a bundled services.

- Initially integrated pension companies operated well because there were only few products and few customers and proper interfaces.

- Later the shared service concept came into being and this model is practiced now. This provides cost benefits as all same kind of job is done under one shared service center which will reduce cost due to economies of scale. But in this model the flexibility is limited.

- In the coming years, pension companies will focus on outsourcing their functions to the companies does best and where lies the competitive advantage. These separate units or kernels would be concentrating on serving the customer, handling the administrative details or managing the assets. Strong demand for individualization would bring this model into practice.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now