CATEGORY

Disaster Relief Fund Management

Disaster relief fund management is becoming complex process for employers due to the changing regulations (IRS guidelines, and employer specific laws) , also tax related issues and the types of disasters that can be served. The report focuses on the various sourcing trends and service providers in the market.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Disaster Relief Fund Management.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Disaster Relief Fund Management Suppliers

Find the right-fit disaster relief fund management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Disaster Relief Fund Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoDisaster Relief Fund Management market report transcript

Regional Market Outlook on Disaster Relief Fund Management in US

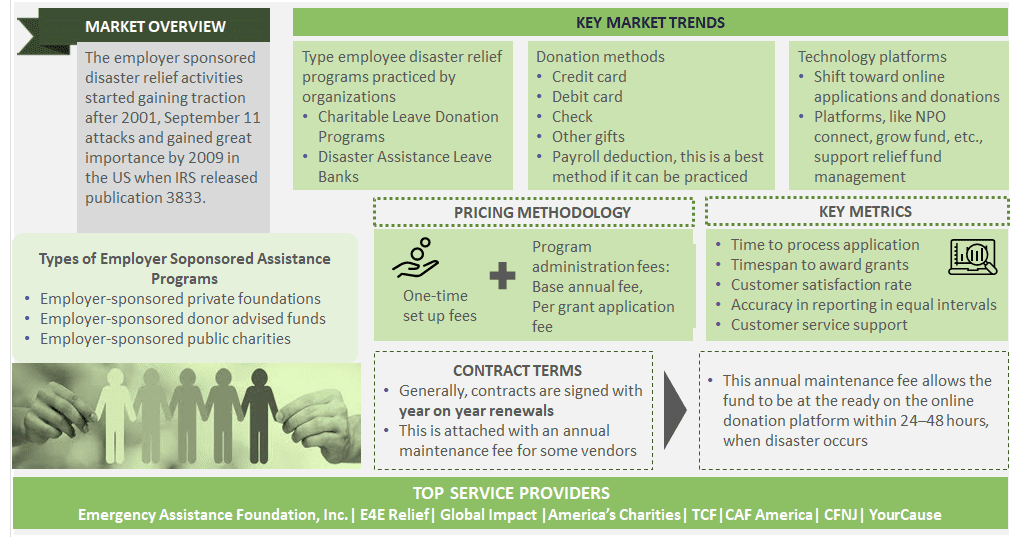

In the US, the concept of employer sponsored disaster relief fund started gaining importance from 2001.Over 60 percent of existing employee relief funds have been created since 2001 after September 11 attacks in the US.

- Initially state and federal government, public system were providing support for the disaster relief

- Public system, like the FEMA and Red Cross offer assistance to victims of disasters

- FEMA fund comes from base funding, which was $615 million in 2017, second funding is called “major declarations”, which was $6.7 billion in 2017. This is from the government

- FEEA also offers disaster relief grants to eligible federal employees

- FEEA has given over 9,000 disaster relief grants, totaling $4.5 million to federal employees since 1986

- Now employers are also creating disaster relief fund to support employees affected by disasters and hardships

- Employers were managing the funds in-house but a shift is seen in large companies to get into partnerships with charity foundations to administer employer-sponsored relief funds

- Employee giving program is also increasing and around 65 percent of companies have their giving program year round

Market Trend

There are different types of employer-sponsored relief programs that allow employers to provide assistance on a tax-advantaged basis. Employer-sponsored charitable organizations is one such type.

Charitable Leave Donation Programs

- This is a employer-sponsored program that permits employees to donate vacation, sick, or personal leave in exchange for employer contributions to charitable organizations

- This allow employees to donate the cash value of unused leave to victims affected

Disaster Assistance Leave Banks—Employee Donations of Leave to Impacted Employees

- Employees can deposit unused leave into the leave bank, which can be used by co-workers, who have exhausted or will exhaust their paid leave to address an illness, family crisis, or a disaster

- Leave banks are not widely used in the private sector

Qualified Disaster Relief Payments—Direct Employer Donations to Impacted Employees

- This is a program that employers establish to allow both the employer and co-workers to assist employees affected by qualified disasters

- Employers should adopt a written policy limiting the use of funds to actual losses

Employer-sponsored Charitable Organizations

- Large employers generally provide disaster assistance to employees through employer-sponsored charitable organizations, like employer-sponsored public charity, donor-advised funds, and employer-sponsored private foundations

Sourcing Strategy

Disaster relief fund management is becoming a complex process for employers, due to the changing regulations (IRS guidelines, and employer specific laws), also tax related issues and the types of disasters that can be served.

The three main ways how disaster relief fund management are carried out:

Insourced

- The company creates their own funds and manages it as a private foundation or directly provide assistance to employees in need

- Organizations have an in-house teams managed by the HR/Public relations department to monitor and administer disaster relief funds

Co-sourced

- The employer partners with an external vendor for the technology platform or the administration process, but maintains an internal staff for internal communication, campaigning, employee engagement activities, etc.

- The vendor is responsible for maintaining a rule-based technology platform, making real-time updates to the system and keeping data current

Outsourced

- When outsourced all services are provided by the vendor, communications, program delivery from evaluating the applications, to awarding the grant dollars while receiving and acknowledging donations, and providing detailed reporting

- The vendor is responsible for maintaining legal updates and ensuring system compliance and meet IRS guidelines

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now