CATEGORY

Employee Benefits

Employee benefit services including pension administration, health support, rewards and recognitions, pharmacy benefits, financial benefits are outsourced to HR consulting/outsourcing service providers to optimize cost and obtain technology related support to smoothen the employees experience within the organisation.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Employee Benefits.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Mayer Brown brings onboard a New York cybersecurity official

April 20, 2023Clifford Chance brings onboard US antitrust partners in the midst of enforcement push

April 19, 2023Shearman's former energy innovation practice leader joins Weil

April 18, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Employee Benefits

Schedule a DemoEmployee Benefits Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Employee Benefits category is 11.46%

Payment Terms

(in days)

The industry average payment terms in Employee Benefits category for the current quarter is 50.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

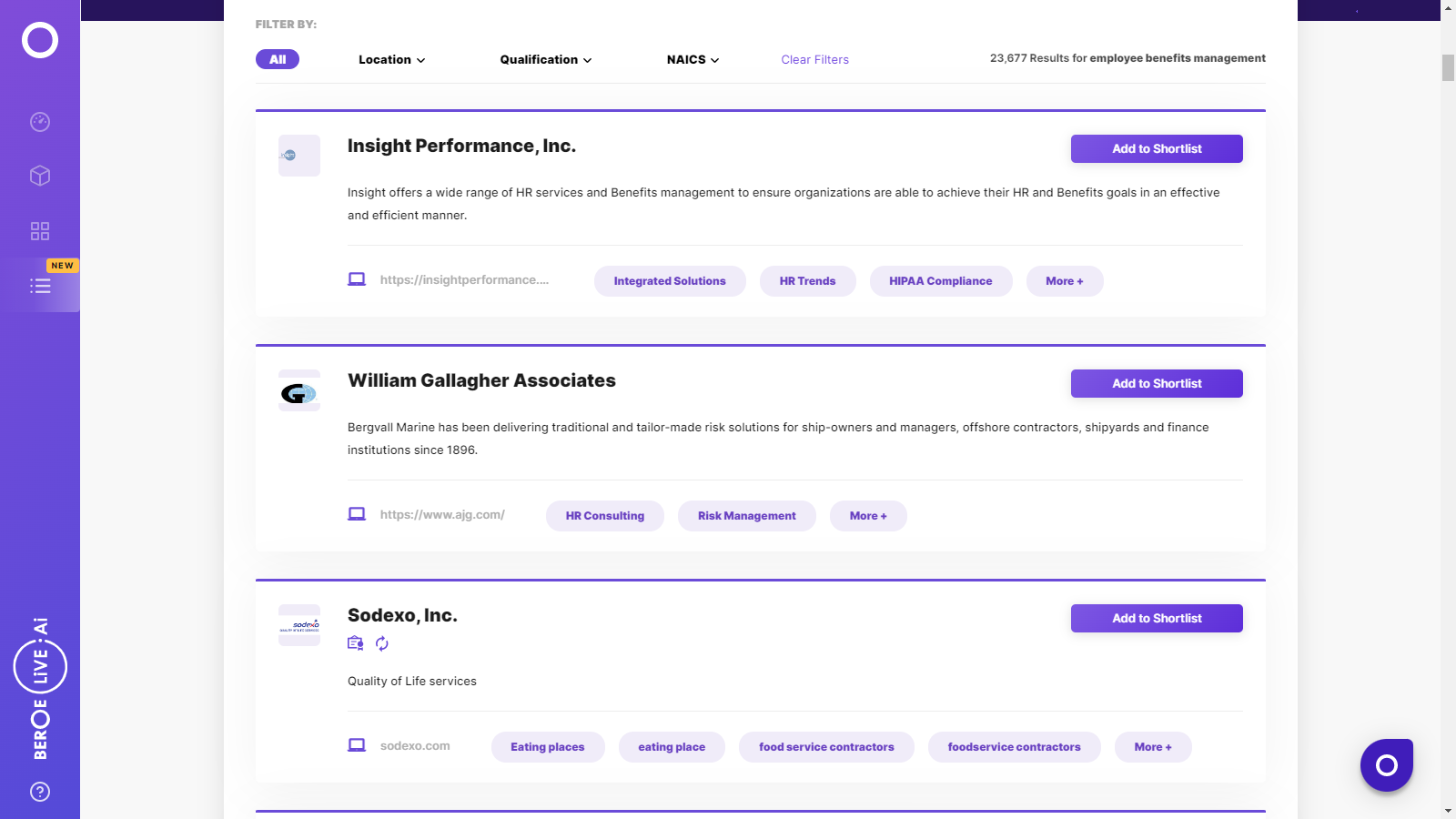

Employee Benefits Suppliers

Find the right-fit employee benefits supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Employee Benefits market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEmployee Benefits market report transcript

Employee Benefits Management Global Industry Outlook

The global benefits management market is valued at $32 billion in 2016.

- The market is forecasted to grow at a CAGR of 5–6 percent and reach $36 billion in 2018.

- Regions such as Europe and North America and parts of APAC such as Australia, Japan, Hong Kong and Singapore have high market maturity.

- South Africa, India, Brazil and China are expected to be the future growth driving markets for benefits management services.

- KPIs for employee benefits management include the accuracy of processing payments, HR data timelines and third-party interface timelines.

- The major cost components in the employee benefits market include: Administrative costs: 35 percent, Outsourcing costs: 10 percent, Technology:10

percent, Compliance & Documentation:15 percent. - Employee Benefits Spend Categories can be divided into:

(i) Mandated Benefits (Social Security Insurance, Workers Compensation, Unemployment Insurance)

(ii)Sponsored Benefits (insurance, benefits, retirement benefits, medical assistance benefits and expatriate benefits) - The global contract operates on a PEPM pricing model, while the spend volume portion of the contract operates on a commission based or a combination of

hybrid pricing models. These are the methods widely prevalent in the industry. Emerging countries in the Asia Pacific and Latin America outsource tactical

activities such as claims administration, reimbursement, call centre support, and data entry through local engagement for a contract duration of 1–2 years. - Major growth drivers in the North American BAO market include the introduction of the Healthcare Reform Act by the Obama Administration and the rising cost of drugs. Others include web-based decision-making analytics tools and the emergence of healthcare exchange offered by mature BAO providers

Employee Benefits Management Global Market Maturity

Global benefits service providers are focusing on entering emerging markets such as APAC and Eastern Europe by partnering with regional and local service providers

- As an initiative to consolidate spend on employee benefits, Fortune 500 companies are entering into multi-country BAO engagements with global service providers

Employee Benefits Management Industry Trends

- The global BAO market has increased by 5 percent since 2014; this has been realized due to the scalability of the suppliers who have been able to adapt to the changing business needs.

- The European and North American BAO market accounted for about 60 percent of the global market share in 2016. The U.S., UK, Germany and Australia are the most mature countries, in terms of single-country BAO deals.

Why You Should Buy This Report

Global Benefits Management Market drivers and constraints and regional market outlook in areas like North America, Europe, Middle East and Africa. The report lists out the opportunities and challenges in each of these regions. The benefits of market research include a report on the Porter’s five force analysis of developed and emerging markets. The report gives insights into supply trends and does a SWOT analysis of major players like Aon Hewitt, MetLife Inc., Aetna Inc., Fidelity Investments, etc. It gives a cost and pricing analysis and a pricing forecast.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now