CATEGORY

Learning & Development

Corporate training refers to the formal and informal mode of educating new joinees and existing employees on various topics both technical and softskills to enable the workforce to perform better. Organisations are investing considerably on technology and micro training solutions to increase the productivity of the employees. Various types of training solutions provided are e-learnning, blended training, virtual training, gamification etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Learning & Development.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Ciphr Acquires Marshalls

April 04, 2023Wisetail Announced the Launch of a New Product Called OnTrack

April 03, 2023(ISC)? Makes Certified in Cybersecurity? Exam Available in More Languages To Address Global Workforce Shortage

February 13, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Learning & Development

Schedule a DemoLearning & Development Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Learning & Development category is 7.70%

Payment Terms

(in days)

The industry average payment terms in Learning & Development category for the current quarter is 45.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Learning & Development Suppliers

Find the right-fit learning & development supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Learning & Development market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoLearning & Development market frequently asked questions

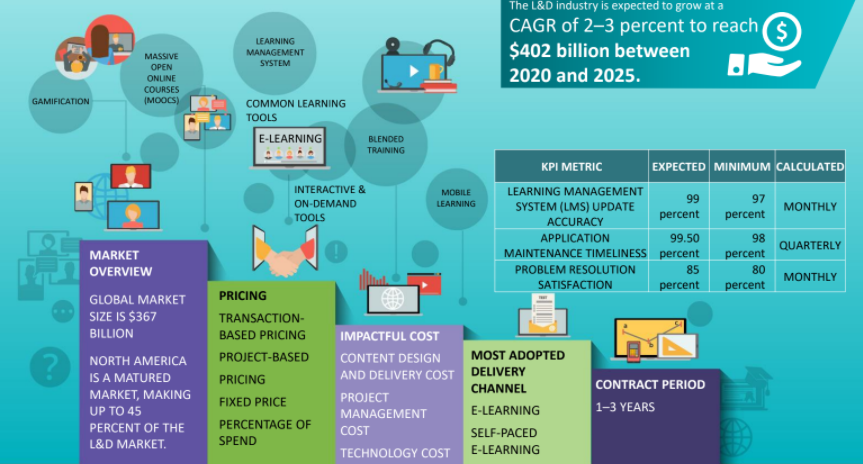

As per Beroe's training and development industry report, the L&D industry is expected to reach $446.1 billion between 2017 and 2020.

As per Beroe's L&D trends 2020 report, the high market maturity regions in the training and development industry are North America, Western Europe, some parts of APAC such as Australia, Japan, Singapore, and Hong Kong.

The L&D trends are the increase of e-learning services in developed regions such as the US and Europe due to a steady rise in the demand for gamification, rise in LMS applications and e-learning tools. Another one of the most important learning and development trends is the fact that there is an increasing growth of self-paced learning.

As per Beroe's global training and development trends report, the training and development industry is expected to grow at a CAGR of 4-5% by 2020.

The key drivers for the learning and development industry are the growth of the corporate e-learning market, rising investment in training and development, and the rise of technology-based training solutions.

Learning & Development market report transcript

Global L&D Industry Outlook

-

The market is forecasted to grow at a CAGR of 2–3 percent to $377 (E) billion and $393 billion between 2023 and 2026, respectively

-

Onset of the pandemic has had a significant impact on the technology-enabled training services market

-

Regions, such as North America, Western Europe, and some parts of APAC, such as Australia, Japan, Hong Kong, and Singapore, have a high market maturity. APAC and parts of LATAM are expected to be the future growth-driving markets for L&D services

Global L&D Industry Trends

-

In developed regions like the US and Europe, e-learning services are expected to increase mainly due to consistent increase in demand for gamification, increase in applications providing LMS platforms and rapid e-learning tools. In the US and Europe, self-paced learning is growing exponentially, with an increasing urge to learn more, new topics based on the convenience of the employees.

-

The top buyers of the mobile learning market were the US, Brazil, Indonesia, China, and India

-

China, the US, Indonesia, India, and Brazil are expected to be the top buyers

-

In developing markets, currently, very few service providers are technically equipped to integrate the VR in e-learningfew service providers are technically equipped to integrate the VR in e-learning

Global L&D Market Maturity

-

Europe and North America are well-matured markets. Globally, top MNCs are outsourcing their L&D activities to global and regional suppliers

-

APAC and LATAM are witnessing higher adoption due to the efforts by large global buyers to consolidate the supply base

Global L&D Drivers and Constraints

-

The learning and development industry is expected to grow at a CAGR of 2–3 percent

-

The corporate e-learning market is expected to grow at a CAGR of 9–10 percent during 2023–2025

-

Training directly effects revenue growth, and hence, organizations have increased their investment in training and development

-

The key drivers are transforming traditional training to effective, measurable and technology-enabled training solutions by outsourcing to global/regional suppliers

Drivers

Technology-enabled Training Solutions

-

RethinkCare expands Neurodiversity resources to foster more inclusive workplace cultures – RethinkCare, the leading global behavioral and mental health platform for employers from RethinkFirst has come up with new and updated neurodiversity resources to help companies better attract and retain neurodiverse talent

-

Schoox and Cognota partner to help organizations to maximize the business value of training – Learning management and talent development software provider, Schoox, announced a new partnership with Cognota, the leading provider of operations software built specifically for learning and development teams

-

Chekhub Partners with Nomad Futurist Foundation to launch the Nomad Futurist Academy

-

The partnership resulted in the Learning Management Systems (LMS) platform to enable robust educational and training initiatives for the Nomad Futurist Academy

Operational Benefits

-

Outsourcing to a single global L&D supplier would allow buyers to standardize the level of services across various locations. Productivity and efficiency could be enhanced through the introduction of various critical performance indicators and compliance clauses in the contract

-

Centralized procurement through a regional model will help buyers re-examine their budgets on a regional scale

Constraints

Budget/Funding

-

Budget constraint is a major problem with some mid-sized organizations, which leads to a compromise in training delivery platforms such as digital aids

-

Creating or fitting existing content into the e-learning platform would be difficult for companies with budget constraints

Change Management

-

Internal (SMEs, content designers and training experts), as well as external stakeholders should be communicated with effectively about their roles and responsibilities before implementing e-learning

Cost Structure Analysis : Learning & Development

Cost Drivers

Amidst of pandemic, the cost involved in learning technology has significantly increased. Major cost drivers of corporate training services are:

-

Trainer rates influence the overall training cost, as it is the key cost factor in virtual classroom-based training

-

Instructional design for content curation and module design

-

Advancements in learning technology: Buyers are more focused on learner engagement and learning retention, hence, the buyers are opting for technology-enabled delivery methods, such as gamification, simulation-based training, virtual reality training

Why You Should Buy This Report

- This analysis report by Beroe provides information about the worldwide training and development industry statistics, industry trends, drivers and constraints.

- It gives the regional market outlook of APAC, Australia, and Europe, among others, and provides Porter’s five force analysis of the developed and emerging markets.

- It gives insight into supplier trends and key supplier profiles, cost structure breakdown, key spend categories and price forecast.

- Furthermore, the study on global training and development trends lists out the best sourcing and pricing models.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now