CATEGORY

Outplacement Services

Outplacement is a service that companies offer to its exiting employees after a layoff, reduction in force, shutting down of a business unit or when merger and acquisition takes place. In earlier times, corporates had been using the traditional outplacement solutions to help their employees to land to a new job. In last few years, the purpose of providing outplacement services has been highly critical in terms protecting brand name, engagement with current employees and reduce the cost involved in layoff.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Outplacement Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Tech executives plan to increase the revenue by focusing on cost cutting

March 21, 2023PayPal, HubSpot, and HarperCollins announce Layoffs

February 01, 2023Google's parent company "Alphabet" has announced 12000 tech layoffs

January 25, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Outplacement Services

Schedule a DemoOutplacement Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Outplacement Services category is 7.70%

Payment Terms

(in days)

The industry average payment terms in Outplacement Services category for the current quarter is 59.4 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Outplacement Services Suppliers

Find the right-fit outplacement services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Outplacement Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoOutplacement Services market report transcript

Global Outplacement Services Market Outlook

-

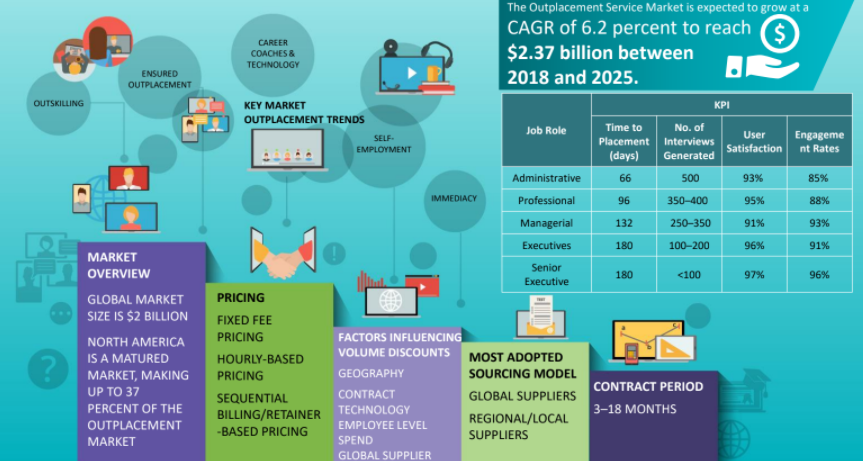

Global outplacement services market size was valued at $2.38 Billion in 2022 and is expected to expand at a CAGR of 5.69 percent during the forecast period, reaching $3160.32 million by 2027.

-

The outplacement market is countercyclical, it tends to do better during down economies and vice versa. Due to flexible work arrangements, mass layoffs by global organizations and start-ups around the world have also grown the importance of outplacement services in 2023

-

Simultaneously, increasing career activism among companies to retain workers in a market, which is going through severe skills shortages, has led outplacement companies to further diversify their business portfolio to include proactive services not directly related to layoffs

-

The market for outplacement services is categorized into two segments based on end-users: Personal and Enterprise. Among them, the Enterprise segment is expected to exhibit the highest compound annual growth rate (CAGR). This can be attributed to the utilization of outplacement services by large enterprises for their workforce.

Global Outplacement Industry Trends

-

North Americas is a highly matured and the developed region, so the growth potential for outplacement services is increasing and would continue in the future. The European region is second most mature and developed region compared with others regions, such as LATAM, APAC, and MEA

-

The North America region is anticipated to exhibit promising growth in the coming years, driven by companies in the region striving to sustain their competitiveness in the market. This has led to resource limitations and employee exits as companies implement strategies to streamline operations and improve their competitive positioning.

-

Australia in the APAC region is considered to mature and developed market for outplacement services with a revenue projected to $242.47 million by 2027, growing at a CAGR of 4.7 percent

-

MEA is an underdeveloped market for outplacement services, due to the gap of maturity among the buyers and suppliers in the countries

-

The APAC market for outplacement services is moderately matures as developed nations, such as Australia and Japan, are better serviced for outplacement/career transitions services

Global Outplacement Drivers and Constraints

The key drivers are safety against litigation, growing customizable services, frequent mass hiring/lay offs. Whereas constraints are budget/funding from head, risks of fraudulent agencies approach, and employee privacy concerns

Drivers

Safety against Litigation

-

It is considered as one of the drivers for the industry, as companies adhere to the litigation risk of not facing any legal action been provided by the employees for laying off and not providing any kind of support

Data Intelligence and Emotional Intelligence

-

The future of outplacement mainly lies on the two major components: data intelligence and emotional intelligence

- Data Intelligence would mainly focus on predictive analytics, big datasets, and data skills, whereas emotional intelligence would focus on element, such as individual support to the employee, insight sharing, and well-being focused

Frequent Mass Layoffs and Hiring

-

Companies doing frequent mass hiring, post which lay offs, lead to the growth of the industry, as they offer outplacement services to their employees

-

For e.g., COVID-19 pandemic lead to revised business strategies, including mass layoffs. This, in turn, lead to an increased demand for outplacement or career transition services for the affected employees, to help them overcome emotional stress and to provide the necessary training and guidance to pursue new career opportunities

Constraints

Budget/Funding

-

Budget constraint is a major problem with most of organizations, generally small and mid-size organizations, which leads to a compromise for outplacement services

Risks of Fraudulent Agencies Approach

-

Buyers should be careful in assessing the service providers for outplacement services, as there might be fraudulent agencies, who give false promises for fulfilling the services for their employees

Employee Privacy Concerns

-

Due to individual’s privacy also the industry constraints for a growth, as not every individual would be willing to take up the services

Cost Structure Analysis : Outplacement Services

Cost components for outplacement services are showcased in this slide. The total cost incurred by engaging global vendor is comparatively higher than regional supplier. This information shall help HSBC in developing its cost-effective approach.

Cost Drivers

Technology cost

- The technology cost of regional providers is similar to that of global providers, as the global companies leverage on their efficient back office system maintenance compared to regional providers.

Personnel cost

- The personnel cost will be higher for the global outplacement provider, as the average experience for career consultants is higher for global compared to a regional vendor, and hence, the salary paid as well.

Profit margin

-

The global suppliers operate through their subsidiary business units, network or association, M&As or third-party vendors across geographies

-

Regional suppliers operate through partnerships or M&As

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now