CATEGORY

Corporate Health and Wellness Management

Employee assistance and employee wellness programs are benefits provided by employers to their employees to identify and guide employees to resolve their mental, emotional, and physical health. Employers integrate EAP and employee wellness programs to improve employees’ overall health, well being, and increase productivity.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Corporate Health and Wellness Management .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

One in four US employers offer bereavement leaves for pregnancy loss

February 08, 2023APAC employers are facing employee benefits challenges

January 16, 2023Colorado employers to start paycheck deductions for family paid leaves

January 04, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Corporate Health and Wellness Management

Schedule a DemoCorporate Health and Wellness Management Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Corporate Health and Wellness Management category is 6.40%

Payment Terms

(in days)

The industry average payment terms in Corporate Health and Wellness Management category for the current quarter is 55.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Corporate Health and Wellness Management Suppliers

Find the right-fit corporate health and wellness management supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Corporate Health and Wellness Management market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCorporate Health and Wellness Management market report transcript

Corporate Health and Wellness Management Global Industry Outlook

-

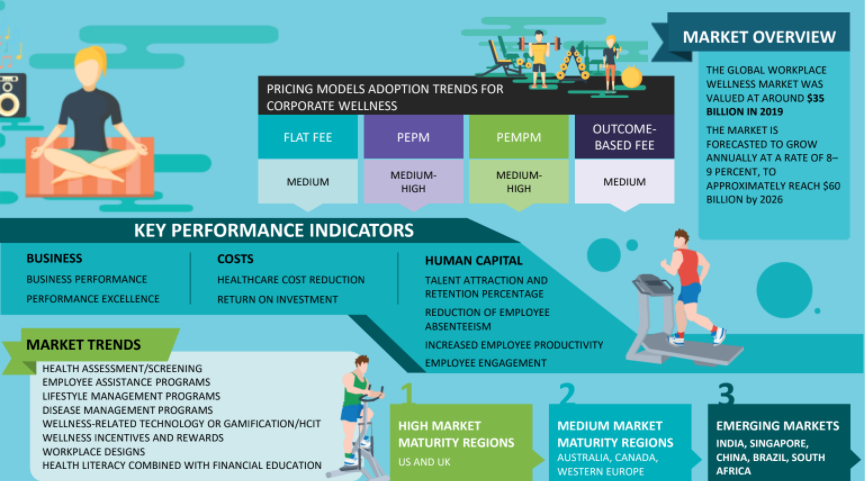

The global corporate wellness market is estimated to grow to $64 billion in 2023 and is forecasted to grow to above $85 billion by 2028, especially post-pandemic and due to Hybrid Work Culture. Health apps and wearable technology has led to an increase in Corporate Wellness

-

The global corporate wellness market is expected to grow at a CAGR of around 6.8 percent during 2023–2028.

-

The US has the highest market maturity, followed by Europe

-

APAC and parts of Western Europe are expected to be the future growth-driving markets for corporate wellness services

Health and Wellness Management Global Market Maturity

-

Around 70 percent of the employees in North America and 40 percent in Europe have access to workplace wellness programs

-

APAC and Latin America are witnessing an increase in adoption, due to efforts by large global buyers to consolidate supply base. In the APAC region, corporate wellness is growing due to rising working population and increased awareness of Employee wellbeing

-

Among all the end users, large-scale organization segment has the highest market share in the global corporate wellness market

Health and Wellness Management Global Industry Trends

-

Increasing levels of employee wellness across the globe signal the increasing buyer maturity and willingness to partner with suppliers

-

Suppliers are also improving their supply capability by providing health screenings, lifestyle management and disease management programs

-

Fortune 500 companies are also focusing on employee assistance programs to increase the employee productivity and reduce absenteeism. In 2022, average spending on wellbeing benefits had been increased.

-

Multinational firms in the Middle East, Africa and APAC are now focusing on improving working conditions and offering annual health, eye and dental checks

-

Health and wellness factors are increasingly influencing real estate decisions across Asia Pacific. More companies across Asia Pacific are now investing in physical infrastructure and wellness programs to enhance their employees’ health and wellbeing as demographic, social and technological developments continue to change the workplace regionally

Health and Wellness Management Technology Trends

- Buyers spend about 10–20 percent of their total workplace wellness expenditure on technology to yield higher employee engagement and higher participation, thus, leading to increased cost savings and effectiveness of wellness initiatives

-

Offering free online office ergonomics software support, telehealth solution for work-related injuries and illnesses are gaining importance

-

Employee engagement software supplier Limeade has released software modules to help large enterprises diversify their workforces and better track engagement and communicate with workers.

-

Companies are using technology suppliers (virtual and augmented reality) to help solve mental health issues. E.g., Psious (Spain), Clevr

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now