CATEGORY

Storefront Design & Installation Services

A storefront is a facade or entrance structure of a retail store or a commercial building which includes multiple display windows. A storefront attracts the attention of the customer to the merchandise of the store. Commercial buildings use facades as an architectural element

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Storefront Design & Installation Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Project Zipper - RKM 740 Tower designed by J. MAYER H with a unique multi-purposed Zipper-Like fa?ade was completed in Germany

October 19, 2022REHAU WINDOW SOLUTIONS AND AGC GLASS

September 07, 2022Plus? innovative facade

August 29, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Storefront Design & Installation Services

Schedule a DemoStorefront Design & Installation Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Storefront Design & Installation Services category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Storefront Design & Installation Services category for the current quarter is 59.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Storefront Design & Installation Services Suppliers

Find the right-fit storefront design & installation services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Storefront Design & Installation Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoStorefront Design & Installation Services market report transcript

Global Storefront Industry Outlook

-

In 2022, the facade market was estimated at $241 billion globally, and the curtain wall industry is valued at $52 billion

-

The façade market is anticipated to have a CAGR of 5–7 percent

-

The global market for windows and doors used in the overall construction was estimated at $312 billion in 2022

-

The curtain wall industry is expected to grow at 6-7.5 percent annually from 2022 to 2026

-

Façade market is dominated by the APAC region, with more than 35 percent of total share

Major Trends Observed

-

A Growing Demand for Controlled Environments in the retail, office and commercial sectors has led to higher technological advancement

-

Adoption of InDecative and Lighter Materials such as smart glass, recycled plastic and reflective glass is being highly adopted in the industry

-

Big retailers prefer to engage with a preferred supplier regionally, owing to economies of scale, standardization, and quantity discounts

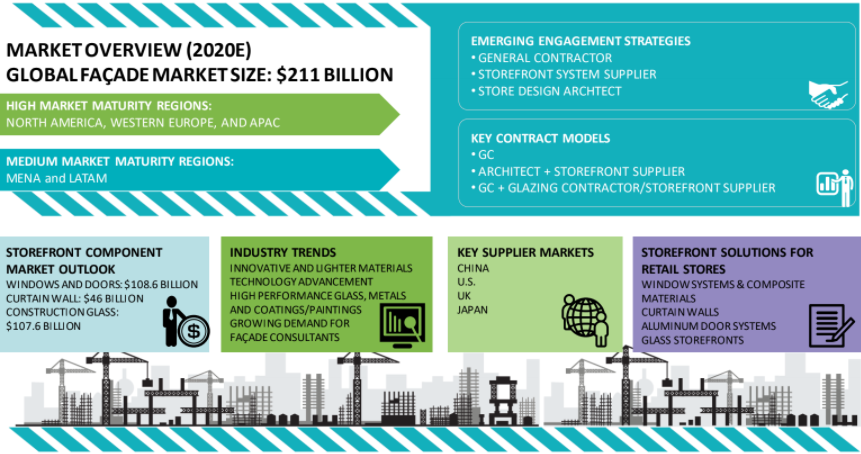

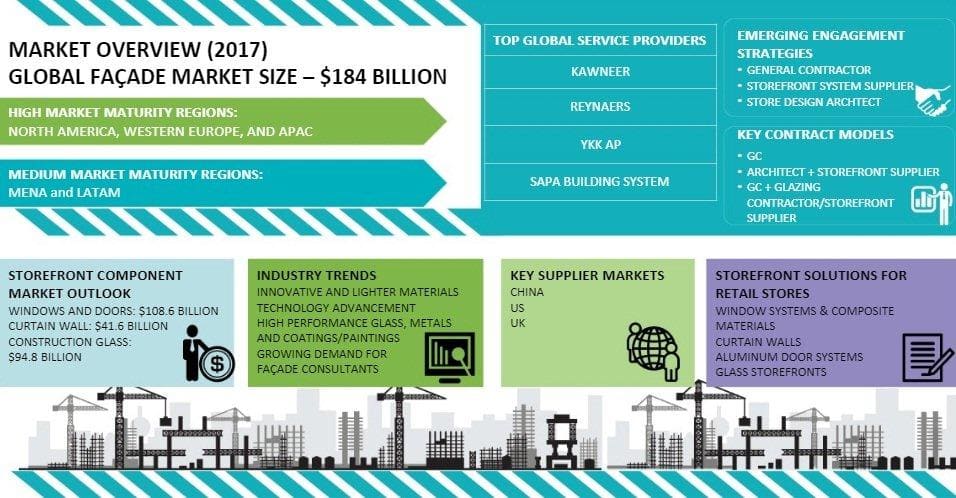

Market Overview - Storefront Systems

-

In 2023, the facade market has been estimated to be valued at $252 billion globally, and the curtain wall industry is valued at $52 billion. The façade market is anticipated to grow with a CAGR of 5–7 percent during the study period of 2022-26. The global market for windows and doors used in the overall construction is estimated to reach $114.7 billion in 2022. The curtain wall industry is expected to grow at 6-7.5 percent annually from 2022 to 2026. North America and Europe constitute to more than 50 percent of the market in 2022.

Market Overview - Glass Storefront Products

-

The global market for construction glass used in windows/storefronts is estimated at $121 billion in 2022. The global demand is expected to recover in 2023 and grow at a rate of 5–6 percent annually by 2026. APAC holds the largest share by more than 60 percent of the global construction glass market. About 80 percent of flat glass manufactured globally is used in the construction industry glass market.

Construction Glass Market Outlook

-

Emerging markets are the key drivers for construction glass utilization, slow growth is expected to continue till the end of 2023 with an anticipated growth range of 5-6 percent till 2026, owing to increasing demand and technological advancements in the industry. Construction glass is a translucent coating material utilized for glass doors, glass windows, and transparent walls

-

More than 60 percent of construction glass usage is contributed by the APAC region. Urbanization is a major driver for the demand for construction glass. Increasing commercial and industrial construction soon will provide a boost to the demand in the market

Flat glass Market Outlook

-

The flat glass market is valued at $128 billion in 2023 and is expected to grow at a rate of 4.7% to reach nearly $150 billion by 2026. Tempered and laminated glass constitute to the largest share in the flat glass market

-

Flat glass will probably see an increase in its international sales as a result of the increasing need for renewable energy around the world. This is due to the fact that solar panels, e-glass buildings, and photovoltaic modules all frequently use flat glass.

Market Overview - Commercial Glazing & Curtain Wall

Commercial Glazing Market:

-

The total market size for construction market glass is expected to reach $150 billion in 2025. Major growth is expected in APAC and North America in the next three years

-

Glazing industry in America and Europe is highly fragmented. In China and Japan, the industry is comparatively more consolidated, as supplier capability for high-end commercial systems remains low

Curtain Wall Market:

-

The global aluminium curtain wall market is expected to grow at a CAGR of 5-7 percent from 2022 to 2026

-

The global glass curtain wall market is expected to grow at a CAGR of 6-7 percent from 2022 to 2026

-

The commercial segment has dominated the market by 70% of the entire curtain wall market. The prevailing market conditions are not prevalent due to the stringent growth of retail stores

-

The curtain wall market in APAC is expected to reach $12.1 billion in 2022. Growth is mainly due to increasing energy costs and sustainability aspects

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now