CATEGORY

Construction Industry Asia Pacific

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Construction Industry Asia Pacific.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoThe World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

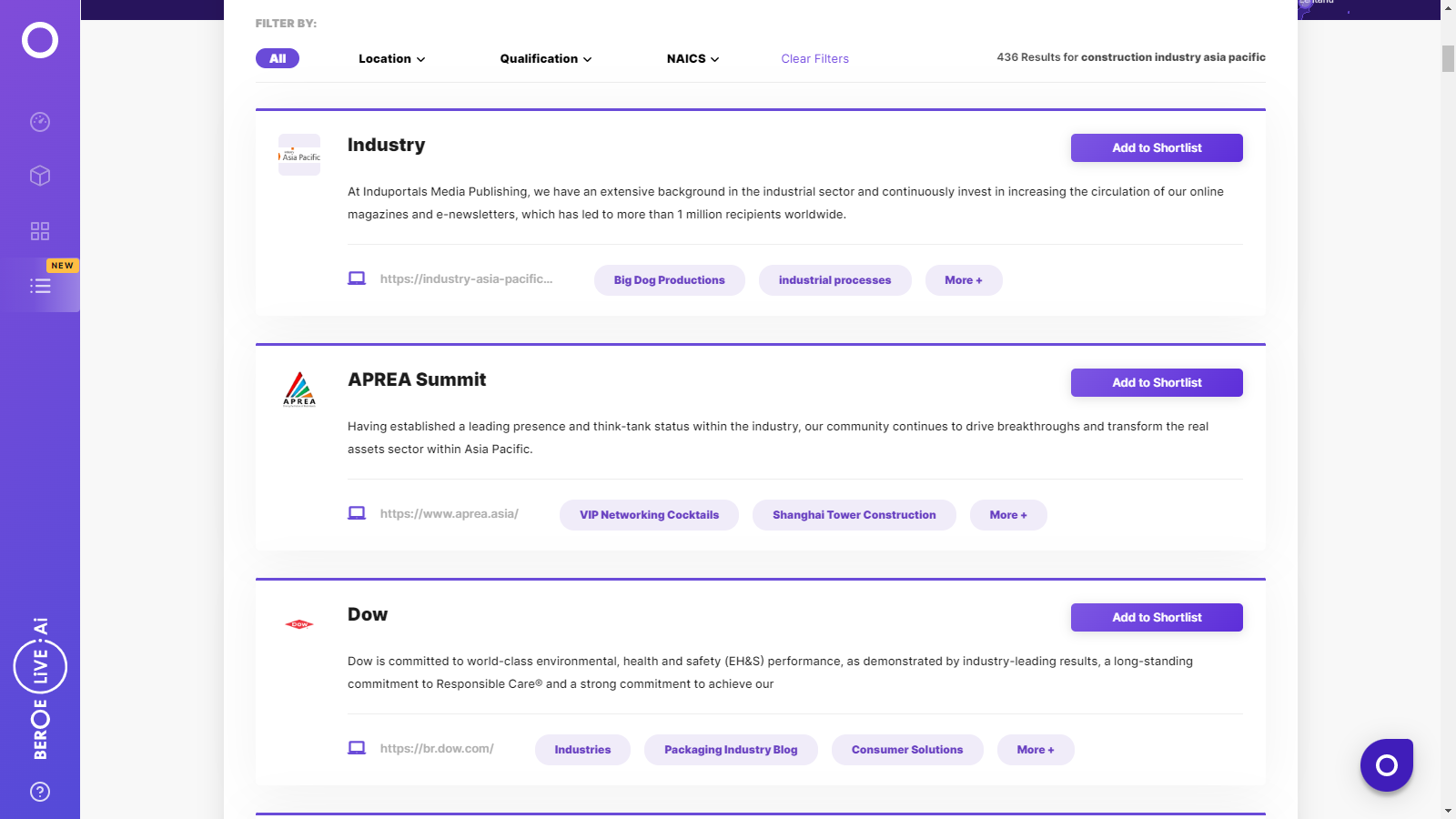

Construction Industry Asia Pacific Suppliers

Find the right-fit construction industry asia pacific supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Construction Industry Asia Pacific market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoConstruction Industry Asia Pacific market frequently asked questions

The construction industry in the APAC region has been growing at a CAGR of 4.09 percent from 2017 and will continue to do so until 2021 as per Beroe's forecasts. The APAC construction spending is expected to be almost half of the total global construction spend by 2020. The markets in regions like China, Japan, Indonesia, South Korea and Malaysia seem to have the highest potential for growth and profitability.

Construction Industry Asia Pacific market report transcript

Regional Market Outlook on Construction Industry

Economy

- Growing economy: According to IMF Forecast, the APAC region is predicted to grow at 3.3 percent in 2017, with the near-term outlook for the region being significantly clouded adding that medium-term growth-faced problems from a slowdown in efficiency growth in APAC economies, especially in China

- Domestic demand remains strong, with healthy labor markets, vigorous disposable income growth, and constant policy support. In addition, in most economies, real incomes are being boosted by continuous low inflation

Construction Market

- Market scenario: Investment in infrastructure development within APAC is expected to be the driving force for its ED industry, which is expected to grow at a CAGR of ~5–6 percent from 2017 to 2020. Indonesia and Japan experienced an increase in revenue from the construction industry, mainly due to large infrastructure investment by the government and increase in residential sector, along with an increase in projects for Tokyo Olympics in 2020, respectively

- Outlook: The construction market in APAC is expected to grow at a CAGR of 4.09 percent between 2017 and 2021. APAC construction spend is expected to be almost half of the total global construction spend by 2020, with China, Japan, Indonesia, South Korea, and Malaysia, expected to have the highest potential for market growth and profitability

Engineering and Construction Sector Profile: Japan

The Japanese construction industry is expected to witness a slow growth in the forecasted period (2016–2020), with investment in infrastructure, healthcare, education, and housing projects continuing to initiate growth.It has a strong project pipeline, with contractors having backlog until 2018 and beyond.

Construction Market Outlook (2015–2020)

- The engineering and design market spend is expected to be $67 billion in 2017, and it is expected to grow at a CAGR of 1.2 percent until 2019

- This increase is driven by a large number of infrastructure upgrade projects related to the 2020 Olympics; in addition, several reconstruction projects have entered the pipeline to compensate the recent natural calamities

- The investment in residential and infrastructure segments is driving the construction sector growth. These segments account for 33 percent and 28 percent of the construction activity, respectively

The Japanese construction industry has a strong project pipeline. Construction contractors have backlog until 2018 and beyond. Most of the construction projects are based on two major events:

- Preparation for Olympics

- Finishing off the rebuilding of several areas of the country

Share of Construction Spending by Sector (2016)

Key Insights

- In 2017, the construction demand is forecasted to reach around $130–132 billion, driven by the institutional and infrastructure projects

- In 2017, the average construction demand is projected to be around $145–148 billion annually, where most of the demand would be driven by building projects

- After 2012, the most driving factor for construction has been “Abenomics”, because of which, there was an increase in public work projects, which pushed the industry up

- Tokyo Olympics 2020 will result in infrastructure development, which includes railways and highways. Economic effect in the general construction sector is estimated to JPY 475 billion by the Tokyo metropolitan government

- Natural calamities, like tsunami and earthquake, have created the interest of new householders in solar power system, LED lightings, earthquake- resistant houses, all-electric houses, fireproof houses, and eco-friendly/energy saving houses, which resulted in the growth of the housing sector

Materials and Labor Outlook: Japan

In 2017, steel prices are expected to follow an upward trend, as the domestic demand for construction materials is improving.Construction labor wage growth has lagged behind labor productivity during the past 15 years and is expected to remain moderately sluggish, despite an increasingly tight labor market.

Construction Material Outlook

- Demand for construction materials is high, due to 2020 Tokyo Olympics and some renovation of aging buildings

- Japanese rebar prices are expected to remain almost stable, with 1–2 percent change in 2017 and 2018

- An upward trend in steel prices is expected to continue in 2017, as the domestic demand for construction materials is solid and inventory for steel is low

Construction Labor Outlook

- The total construction wage is expected to rise by 2.9 percent Y-o-Y in 2017, marginally decreasing from 3 percent Y-o-Y rise in 2016

- Structural factors are responsible for decline in wages. The increasing segment of lower waged, non-regular workers has dripped the average wages

- Base wages are rigid in the Japanese wage system, but these firms reduce bonus and payments, depending on short-term performance. Hence, declining the bargaining power of laborers

Economic Profile: Japan

In 2017, the Japanese economy is expected to grow by 1.6 percent, driven by fiscal stimulus, improved consumption, and better industrial production. The continued export momentum and the implementation of four supplementary budgets introduced since early 2016 will support the growth.

The USD–Japanese Yen (JP¥) is expected to increase to higher levels in 2017, but at a slower rate. Broadly, JP¥ is expected to be allowed to depreciate to support the economy, especially from the export market, which has been recovering from a weak state.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now