CATEGORY

Civil Construction Services

Civil works are generally the execution part of the construction process. The scope of civil works includes the construction of structual components of buildings/facilities and pre construction works including excavation, foundation etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Civil Construction Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

UK Budget finances road, regeneration, and nuclear projects also address labour shortages

March 16, 2023Chinese construction company CSCEC added to the list of International Sponsors of the War

April 03, 2023Prevailing UK economic conditions set a blockade to new high-sized infra projects in London and other areas across the country

October 19, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Civil Construction Services

Schedule a DemoCivil Construction Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCivil Construction Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Civil Construction Services category is 8.60%

Payment Terms

(in days)

The industry average payment terms in Civil Construction Services category for the current quarter is 63.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Civil Construction Services Suppliers

Find the right-fit civil construction services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Civil Construction Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCivil Construction Services market report transcript

Global Civil Construction Services Industry Outlook

-

The global construction market is anticipated to expand by 3-4 percent in 2023 over the previous year, to reach $15.71 trillion. High inflationary pressures and the direct effects of weak global economies are affecting the construction sector

-

In majority of the nations, construction activities progressively picked up from the last quarter of 2022 after couple of non preforming months, especially in APAC, USA and Middle Eastern regions

-

Nearly half of the global construction market share has been captured by APAC and the Middle East combinedly; during the next five years, economic expansion are anticipated in these regions, which drives the construction market further

-

Construction output in North American and European markets were increased by 8% and 4% Y-o-Y respectively, which could marginally slow down in this 2023, due to prevailing uncertainties amid fears over recession in economies

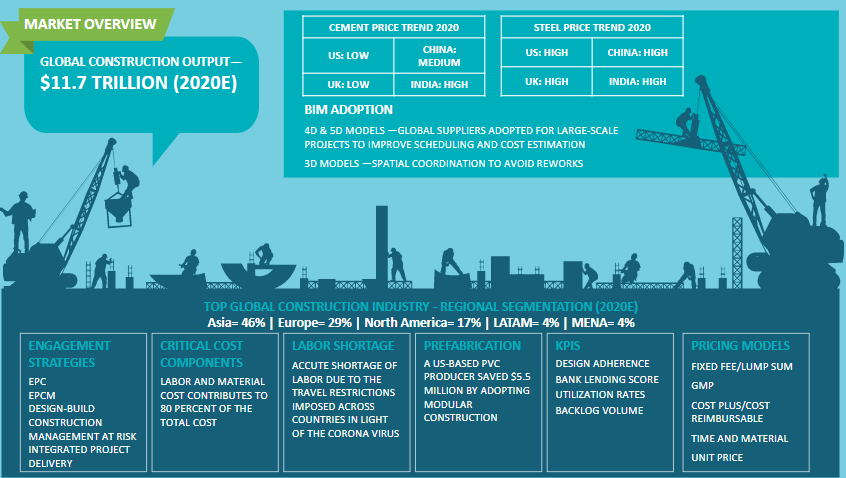

Global Construction-Industry Overview

-

The global construction industry is expected to reach USD 18.69 trillion by 2026 from an estimated market size of USD 15.71 trillion in 2023 with a CAGR of 5.9 percent.

-

Nearly half of the market is made up by the APAC and Middle Eastern areas combined, which also have the strongest growth potential. Additionally, Europe commands a market share of close to 25%, surpassing Northern America’s 18%

-

The construction market has witnessed a good growth despite a series of challenges in 2022, and it is anticipated that this trend will persist in 2023

Developed Regions

-

North America: After a subpar market performance in 2021, the North American construction output has been increased by almost 8 percent in 2022, and this growth could continue in the subsequent years. The CHIPS and Science Act of 2022, along with the Infrastructure Investment and Jobs Act, will greatly enhance the construction activities in the USA

-

Europe: Conflicting circumstances and several obstacles limited the market growth at 3% in 2022. In the medium to long term, energy shortages, excessive inflation, and other uncertainties may endure

Developing Regions

-

APAC: APAC leads the global market, with a projected CAGR of over 7%. With a longer perspective, both China and India are concentrating on enhancing their infrastructural capacities. Concerning economic circumstances exist in Sri Lanka and Pakistan.

-

LATAM: Aggregating to the lowest portion, this region could expand modestly at a CAGR of about 2%

Global Construction: Drivers and Constraints

Drivers

Expanding Industrial and Commercial Activities

- Ever-increasing retail consumption volumes necessitate the construction and expansion of much more production facilities, which in turn mandates the inclusion of commercial establishments in the value chain

Emerging Economies

-

Countries with faster economic growth in APAC and MEA are luring FDI into the construction projects to fulfill rising demand

-

The countries in Asia like India, China have major impact on the construction industry

Infrastructure Demand

-

Both emerging and developed countries place a high priority on improving and expanding the amount of money spent on new and upgrading the existing infrastructure

-

The increased demand for construction has also incorporated cleaner and greener energy producing units

Constraints

Price Volatility

-

The price of crude oil is unbalanced which is a major factor for the volatile nature of the price of construction materials.

-

The supply demand gap will also affect the price of the construction materials

Payment Backlogs

-

Corporate profitability and cash reserves are in peril due to ambiguous macroeconomic conditions. This resulted in a deficit of project cash flow maintenance, which presents difficulties for contractors and delays completion of the projects

Lack of Construction Labors

-

Sourcing skilled labor still being a challenge across the geographies

-

According to estimates, more than 3,500 workers are needed for every $1 billion worth new construction

Global Construction—Design Technology

3D laser scanning

- 3D laser scanning can be used in reproducing dimensions and positions of the object digitally, further turning them into a point cloud image

- 3D laser scanning of building structures will support offsite design recommendations, which saves time and costs

- Big projects are handled by having multiple scans from different angles and linking them all together to get an image, which is then exported to CAD or BIM programs to get a 3D model or drawing

BIM

- BIM is now being incorporated at all levels on the construction projects

- The physical building is constructed digitally by creating a virtual model, which reduces the risk of mistakes or discrepancies and also for cost saving

- Delivers spatial coordination on construction projects

- Tracking and monitoring construction development in the cloud reduces errors and redundancy

- Assessing documents, work lists, punch lists, field reports electronically

- Handling electrical systems to peak performance

Other Design Software

-

Different technologies that are currently being used in the construction industry for engineering and design are DataCAD, ArchiCAD, CADKEY, ConSteel, REVIT, NavisWorks, StruCad and Nemetschek, Bentley Systems, Corel Draw and Atlantis in the 3D and BIM space

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now