CATEGORY

Commissioning Services

Building commissioning (Cx) is the process of verifying (in new construction) all or some (depending on scope) of the subsystems for building envelopes, building security, controls, co-generation, , electrical, fire/life safety, interior systems (like laboratory units), mechanical (HVAC), plumbing, sustainable systems

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Commissioning Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCommissioning Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCommissioning Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Commissioning Services category is 8.10%

Payment Terms

(in days)

The industry average payment terms in Commissioning Services category for the current quarter is 59.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Commissioning Services Suppliers

Find the right-fit commissioning services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Commissioning Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCommissioning Services market report transcript

Global Commissioning Service: Industry Outlook

-

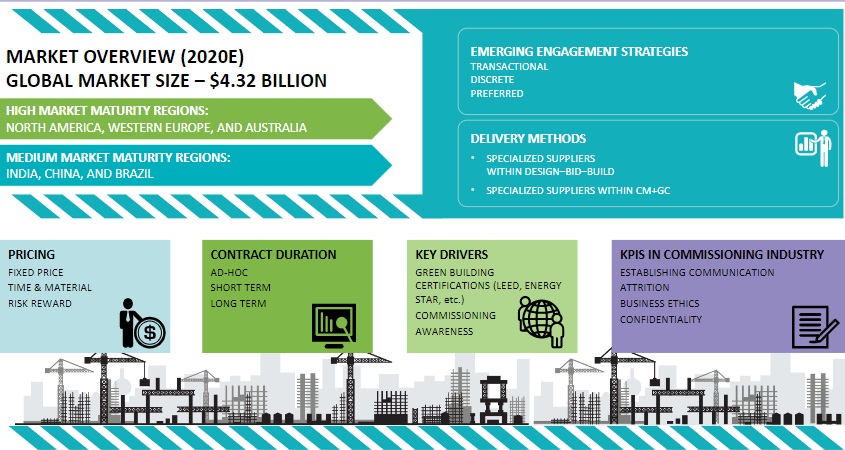

North America and Europe contribute to the major share of commissioning services, making up approx. 80 percent of this spend. Europe will register a strong growth with approx. 5.87 CAGR until 2024. Australia and Hong Kong have well-developed building commissioning market, due to the increasing adoption of green building certification

-

The global construction market is growing at a strong pace, driven by infrastructure, industrial & residential projects. Due to climate change issues and after the COP 26 summit, many countries are actively promoting green, sustainable, and energy-efficient construction & buildings. This has significantly increased the demand for commissioning services. Since first COVID-19, many global companies have adopted virtual process for onsite commissioning works. The demand for commissioning service is expected to increase strongly in 2022 and the forecast period

- The global commissioning industry is projected to grow from $4.6 billion in 2021 to $4.89 billion in 2024, growing at a CAGR of 5.8 percent. This increase is primarily driven by the greater emphasis green building initiatives & energy efficiency

- North America and Europe contribute to the largest share of commissioning services, making up approximately 77-80 percent of this spend

Developed Regions

-

North America: Being the largest spend region for these services, the demand for these services is expected to increase, due to energy-efficiency concerns

-

Western Europe: This region has a high focus on commissioning services, like North America, hence, the demand is increasing, especially due to green building initiatives and regulations set forth by the governments

Developing Regions

-

APAC: The percentage contribution of the APAC regions is slightly moderate from 17 percent in 2022. Northeast Asia, India, and Australia will be the driver for the market in the region

-

LATAM: This region is facing a slow growth rate, and the construction momentum in the region is one of the lowest in the globe, ridden with project delays and cancelations

Commissioning Services Outlook

-

Increasing adoption of LEED certification and energy star ratings are driving the demand for building commissioning in the US

-

Commissioning services in Canada are receiving a considerable boost on new buildings and retro-commissioning for the existing buildings

-

The increasing inclination of consumers toward Artificial Intelligence, BIM Technology, advanced technologies and energy efficiency is projected to fuel the growth of the global building optimization and the commissioning market

Drivers and Constraints

Commissioning research has been ongoing across the globe for some years, and mainstream awareness of commissioning of low-energy buildings has augmented due to the implementation of the new building codes and regulations.

Drivers

-

Green Building Certifications (LEED, ENERGY STAR, etc.): Green building certification standards have been the primary driver. Wider sustainability goals, building codes, and utility incentives also drive the market

-

Awareness towards commissioning services , the use of trained commissioning technicians (who are familiar with standards), the use of proper equipment and the availability of comprehensive documentation (which are all essential to achieving a good outcome) are the major drivers

-

Commissioning Awareness: Both official real-estate investors and property managers are gradually incorporating commissioning and green building processes into their standard functional procedures

-

Training Services: Training services for building commissioning will expand the commissioning workforce by 2022 and during the forecast period

Constraints

-

Commissioning Cost: Global awareness of commissioning is still low. Many building owners remain unconvinced of its benefits. Many geographies still have a shortage of qualified comm. Engineers

-

Whole building commissioning can add between 1% to 4% percent to the mechanical and electrical construction expenses of a project

-

Commissioning add to the maintenance cost of building, which may increase the cost of the occupiers. Long term contracts with commissioning service suppliers could aid in the cost rationalization. Commissioning offers benefits that often do not directly serve those who are responsible for paying the costs of commissioning

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now