CATEGORY

Engineering and Design Services

Engineering design is the process of planning to use resources optimally to meet desired needs by keeping in mind a variety of realistic constraints, such as economic factors, safety, reliability, aesthetics, ethics and environmental impact

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Engineering and Design Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

New Global Board Member for Meinhardt Group

February 16, 2023US Army Corps awarded engineering contract to Tetra Tech

February 15, 2023WSP acquires BG Consulting Engineers

February 01, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Engineering and Design Services

Schedule a DemoEngineering and Design Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoEngineering and Design Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Engineering and Design Services category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Engineering and Design Services category for the current quarter is 68.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

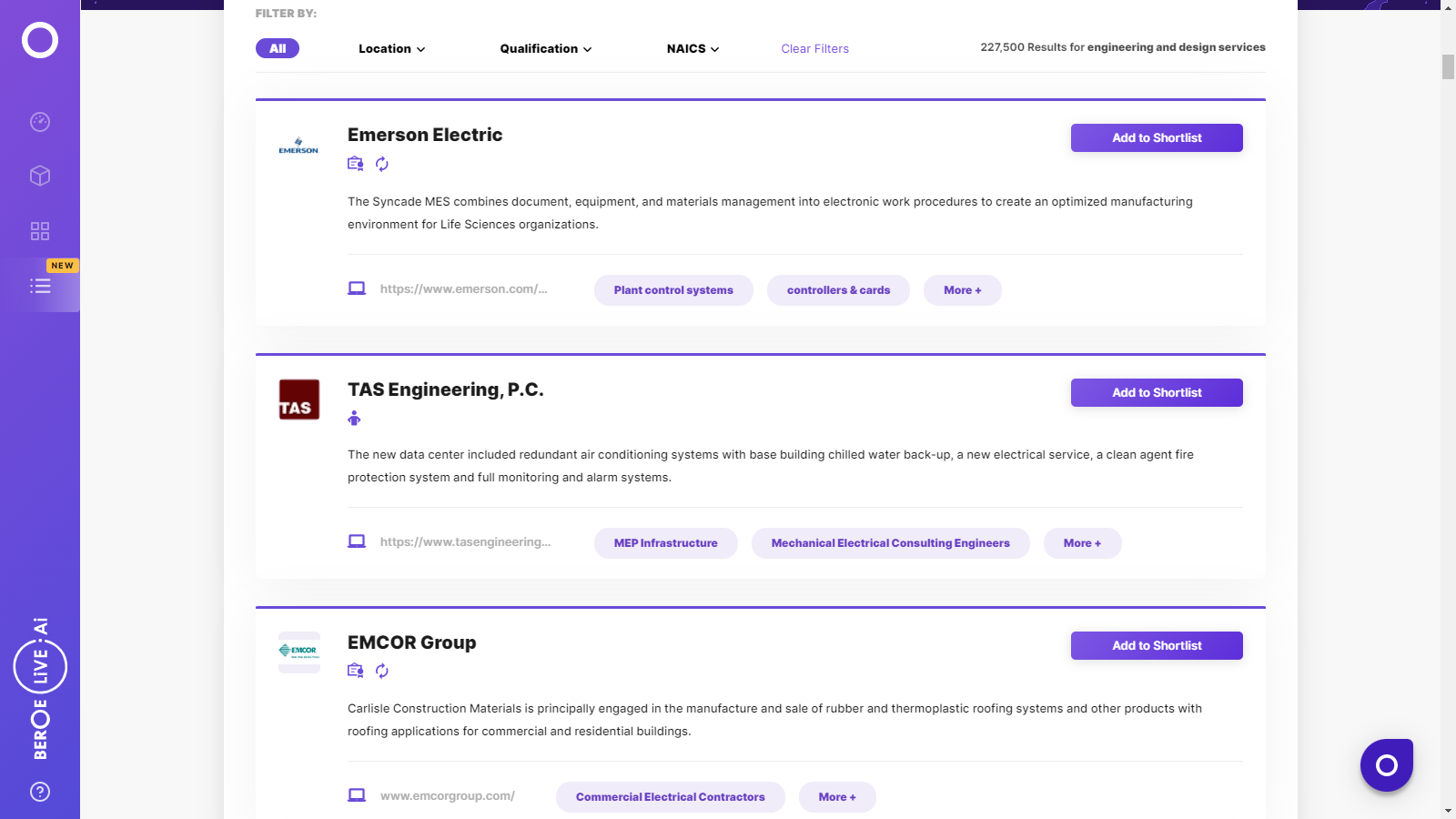

Engineering and Design Services Suppliers

Find the right-fit engineering and design services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the Engineering and Design Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoEngineering and Design Services market frequently asked questions

The engineering services market size is forecasted to grow at a CAGR of 4'5 percent to reach $1,209 billion by 2020. The global engineering services market is driven by growing investment in transport, industrial, and commercial infrastructure sectors in the emerging economies.

Owing to the low-cost talent pool in the APAC region as compared to the players in the EU and US markets, this region has become a favorable destination for the engineering services outsourcing industry. Furthermore, global players are also looking forward to increasing their regional presence in the APAC region through mergers and acquisitions, like the acquisition of Coffey by Tetra Tech and Aurecon's merger with AUP.

The factors driving the ED services market growth are the need for quicker and less expensive modular designs, industry consolidation/ strategic M&As, sustainable design leading to the rise of niche segments, increasing urbanization, and the use of design tools and techniques to avoid project delays and cost escalations.

The constraints that the ED services market is facing are a slow investment in projects due to political deadlocks and corruption, poor technology adoption, project execution.

The major technology-related engineering industry trends include 3D Laser Scanning, BIM 4D/5D, Augmented Reality, Reprographics, 3D Printing, and Construction Robotics.

Engineering and Design Services market report transcript

Engineering Services Industry Outlook & Drivers - Global Market Outlook

-

The global engineering and design market is expected to reach USD 1.13 trillion in 2023 from USD 1.07 trillion in 2022 with a growth of 6.1 percent and it is forecasted to grow up to USD 1.32 trillion in 2026 at the CAGR of 5.34 percent

-

Engineering and Design service market is growing in most of the countries with increase in construction activity especially in USA, APAC and Middle East region despite the inflationary pressure and unfavourable economic situation

-

APAC region has the major market share with 48 percent followed by Europe with 24 percent and North America with 18 percent. The developing nations are investing huge amount on infrastructure development which will be a major driving factor for engineering and design services

Market Outlook

-

The global Engineering and Design services industry is expected to reach USD 1136 billion in 2023 and forecasted to go up to USD 1328 in 2026 billion with a CAGR of 5.34 percent

-

The industry is majorly occupied by APAC region with 48 percent followed by Europe with 24 percent and North America with 18 percent

-

The demand for Engineering and Design services industry is majorly driven from the investment from various government for the development of infrastructure in their country. The increasing global population demands for increase in residential construction also have significant contribution to the industry

-

The global economic condition and anticipation of recession across most of the region hinders the investors to proceed with construction activity, this could affect the engineering and design industry significantly

Engineering Design Services Market: Drivers and Constraints

Drivers

-

Modular Design: Buyers in mature markets demand quicker and less expensive construction, which in turn, stresses the need for modular designs

-

Industry Consolidation/M&A: The demand for intelligent design, and to solve complex construction, has resulted in the expansion of service portfolios by strategic M&As

-

Sustainable Design: Sustainable design is of high demand in the market, currently, leading to the rise of niche segments, such as lighting and energy design

-

Urbanization: With levels of urbanization to reach 50 percent in APAC and Africa, between 2020 and 2035, respectively, there will be increased consumption of products and services, encouraging various industries to develop their facilities and offices in these economies

-

Project Design Time: Increased design complexity and fast-paced projects lead to delays and cost escalations, thus encouraging the use of design tools and techniques

Constraints

-

Project Funding: Public investments in infrastructure projects remain slow, due to political deadlocks, biased politics, and corruption, thereby delaying the projects as a whole

-

Recruiting & Retaining Staff: Skilled workers have left the industry, due to economic downturn and Corona Virus pandemic. There is an insufficient number of skilled younger workers

-

Project Execution: In case of ED firm + GC, the GC may face difficulties in taking cost and time advantages in the construction phase

Industry Best Practices : Engineering Design Services

-

Financial assessment and insurance liability, of the contractor

-

Early on involvement of construction firm to enable innovation in design and construction process

-

Right construction professional allocated for the respective job

-

Hiring contract employees to increase flexibility for non-strategic roles

-

Centralized sourcing of design and construction management services for spend control

Supply Trends and Insights : Engineering Design Services

Regional Supplier

-

Regional Perspective : Top suppliers in the regions includes global players and regional firms. Especially in engineering construction market, top 10 firms hold more than 70 percent of the market share. Housing construction sector is predominantly held by regional construction firms with high market share. Due to the pandemic, majority of the firms suffered net losses in the quarter, heavy competition will be prevalent among the top suppliers especially in the infrastructure segment and top clientele for suppliers could get discounts or lower, as contractors will try to secure more contract awards and keep their market share

Trends

New Technology Adoption:

-

Suppliers are expected to increase use of technologies like BIM, laser scanning, drones, 3D printing, modularization, prefabrication techniques and other digital technologies for remote working and collaborations

Sustainability Solutions:

-

Top suppliers are investing in sustainable construction practices to reduce the overall carbon footprint, as the world slowly moves towards reducing carbon reducing green practices

Engagement Trends

Most Adopted Model Globally:

-

Integrated project delivery, EPCM, EPC

-

EPC: Single point of contact and risk borne by EPC service provider

-

EPCM: Owner have more control over the entire process and quick scale of resources

-

Integrated project delivery: Parallel execution of design and execution phases, fast track components of the projects

Why You Should Buy This Report

- The report on the engineering and design services market offers a detailed analysis of the regional market outlook as well as the drivers and constraints for the Americas, Europe, and APAC markets.

- Porter’s Five Forces analysis of emerging and developed markets.

- Supplier profiles and SWOT analysis of major players in the global and regional engineering services market such as Fluor Corporation, Hatch Group, and Bechtel Corporation.

- Furthermore, the report provides insights on ways to market engineering services, top engineering industry trends, best procurement practices, KPIs, and end-use industry outlook.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now