CATEGORY

HVAC Maintenance Services

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like HVAC Maintenance Services .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Johnson Controls Hybrid energy acquisition: Aiming to reduce Greenhouse Gas emissions on long-term.

January 17, 2023Trane Technologies increases the HVAC product prices - Will other companies follow the suite?

September 14, 2022The impact of HFC ban. Will America face refrigerant shortage like Europe?

September 07, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on HVAC Maintenance Services

Schedule a DemoHVAC Maintenance Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in HVAC Maintenance Services category is 8.10%

Payment Terms

(in days)

The industry average payment terms in HVAC Maintenance Services category for the current quarter is 60.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

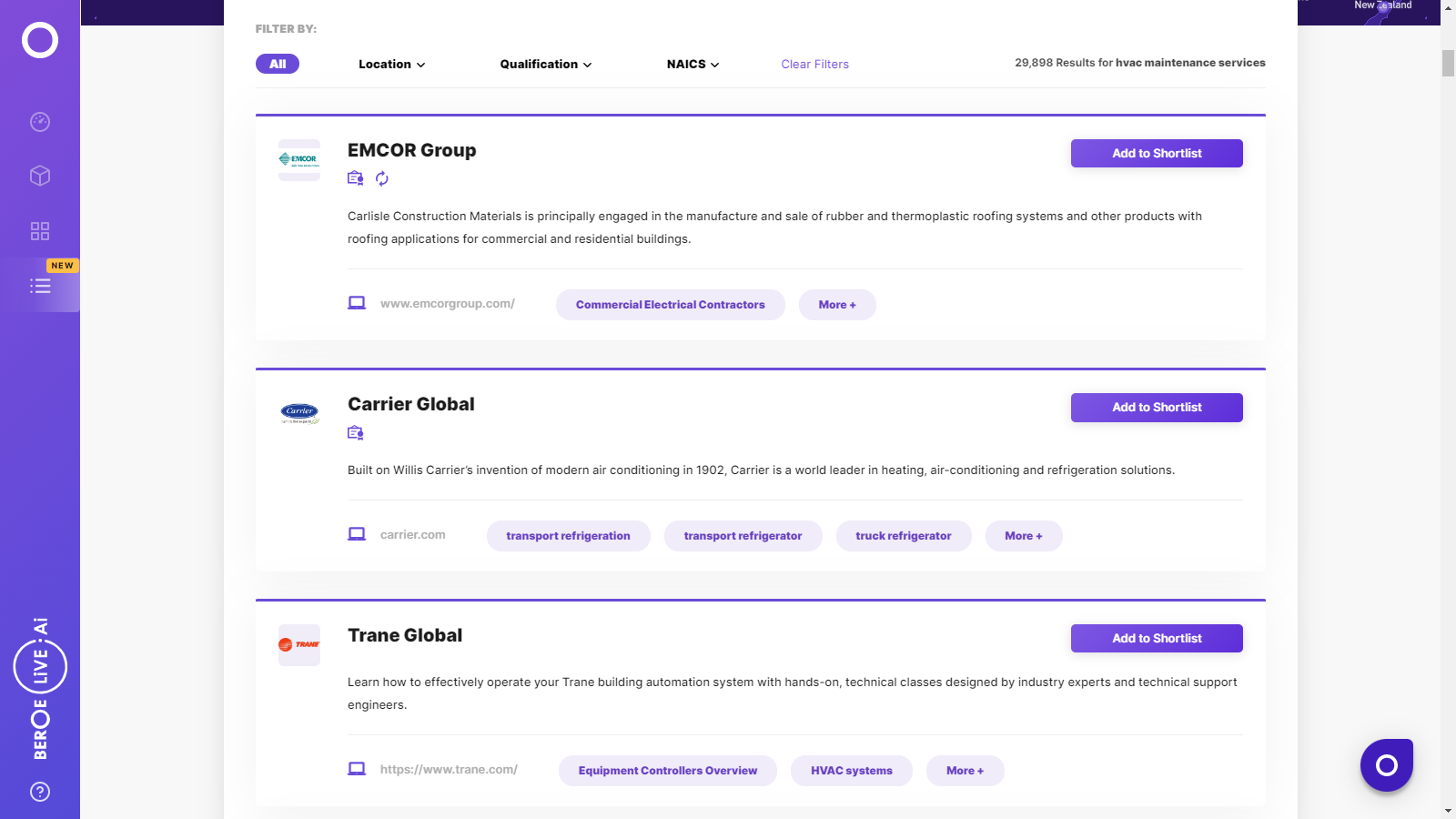

HVAC Maintenance Services Suppliers

Find the right-fit hvac maintenance services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Use the HVAC Maintenance Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoHVAC Maintenance Services market report transcript

HVAC Maintenance Services Global Market Outlook:

-

The global market for 2021 is estimated to be $64.9 billion, growing at a CAGR of 4.75-5.25 percent between 2022 and 2025

-

The market is expected to grow to $67.8 billion by 2022

-

Emerging regions including the US, the US market is highly matured, in terms of buyer as well as supplier maturity. There are multiple large global suppliers, who have a direct supply and support capability in the US

-

Industry has a high retention rate (Tier-1 players have an average client retentions rate of about 98 percent)

Global HVAC Market Overview

Key Trends Applicable

-

Intelligent HVAC Systems Using IoT and Data Analytics

-

Smart HVAC Designs

-

Green HVAC Units

Growth drivers for HVAC Maintenance Services

-

The construction market and its rate of growth has a direct impact on the sales of HVAC equipment and thus contributes directly to the market revenues through installation in both residential as well as commercial buildings

-

The demand for HVAC services, however, is majorly dictated by the demand from commercial spaces like Office, Healthcare and Public buildings, manufacturing and retail spaces

-

Government tax saving incentives and schemes, which allow an exemption of $1.80 per Sq.Ft for those buildings achieving savings of 50 percent or above by usage if efficient HVAC systems has also been a major reason for refurbishment and regular maintenance contracts in the HVAC space

-

Technology advances and new product offerings that guarantee cost savings through efficient energy have also aided in increasing the adoption rate for HVAC services

Porter's Analysis on HVAC Maintenance Services

Supplier Power

-

The AHU units can be very diverse and based on the buyers' demographics and requirements on-site

-

For Maintenance & Repair services, buyers normally go for preferred service providers either OEMs or authorized vendors

-

Availability of contracted skilled labour for industrial services are less than sufficient and the labour rates are also very high in developed regions

-

The risk in terms of availability of labour is borne by the suppliers

Barriers to New Entrants

-

HVAC related equipment and AHU in general are highly specialized equipment

-

High investment costs are a major deterrent for new players entering into the market

-

Suppliers need to have a full fledged infrastructure in place to not just deliver the AHU’s but also provide apt after sales support in terms of maintenance, service and retrofitting/upgradation of system continuously to keep them performing at the best even beyond their life time

Intensity of Rivalry

-

Highly competitive market as relationships are usually stretched over long periods of time

-

Supply base is majorly driven by local and regional suppliers. The industry has been witnessing regular M&A trend, which has helped the suppliers in increasing cross domain services and regional capabilities

Threat of Substitutes

-

Technology is changing very rapidly and the solutions for HVAC are changing rapidly

-

As energy and environmental regulations keep getting stringent the suppliers are focusing on improving their offerings and bringing in innovations to remain competitive

Buyer Power

-

Buyers do not have the volumes to have significant power in negotiations

-

AHU’s vary based on the specific requirements of the buyers and the functions

-

Backward integration or upgrading of existing system with new ones is a huge task especially when shifting across brands

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now